In a bid to bolster transparency and streamline reporting mechanisms, the Goods and Services Tax Network (GSTN) has introduced a significant enhancement to the GST Return form GSTR-1. This latest update focuses on enriching the reporting process for taxpayers who generate e-invoices, presenting them with a more comprehensive overview of their outward supplies.

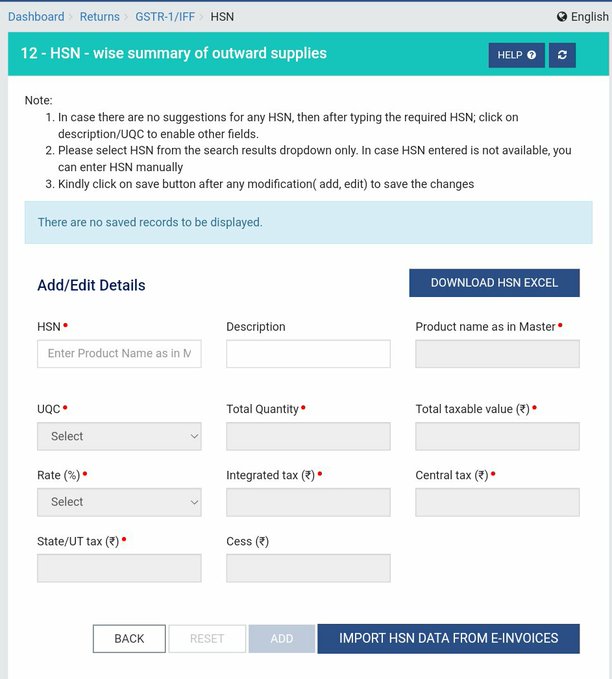

The pivotal alteration resides within "Table 12 - HSN wise summary of outward supplies," where GSTN has incorporated a new feature to empower taxpayers with detailed insights into their supply transactions categorized by Harmonized System of Nomenclature (HSN) codes. This augmentation is poised to revolutionize the way businesses document and analyze their outward supplies, fostering greater accuracy and efficiency in compliance efforts.

By leveraging this newly introduced option in Table 12, taxpayers can delve deeper into the composition of their outward supplies, dissecting them based on specific HSN codes. This granular level of reporting not only enhances transparency but also equips businesses with invaluable data-driven insights to optimize their operations and strategic decision-making processes.

Furthermore, this enhancement holds particular significance for taxpayers who utilize e-invoicing systems. The integration of detailed reporting capabilities within Table 12 aligns seamlessly with the overarching objectives of e-invoicing, which aims to digitize and standardize invoicing processes while facilitating seamless tax compliance.

In essence, the introduction of this new feature underscores GSTN's unwavering commitment to fostering a conducive environment for tax compliance and transparency. By empowering taxpayers with enhanced reporting functionalities, GSTN endeavors to simplify the compliance landscape and empower businesses with the tools they need to thrive in the dynamic realm of indirect taxation.

As businesses navigate the complexities of GST compliance, the revamped Table 12 serves as a beacon of efficiency and innovation, paving the way for more informed decision-making and streamlined reporting processes. With this latest enhancement, taxpayers can harness the power of data to unlock new avenues for growth and success in an ever-evolving regulatory landscape.

Note:

- In case there are no suggestions for any HSN, then after typing the required HSN; click on description/UQC to enable other fields.

- Please select HSN from the search results dropdown only. In case the HSN entered is not available, you can enter the HSN manually.

- Kindly click on the save button after any modification (Add, Edit) to save the changes.

CAclubindia

CAclubindia