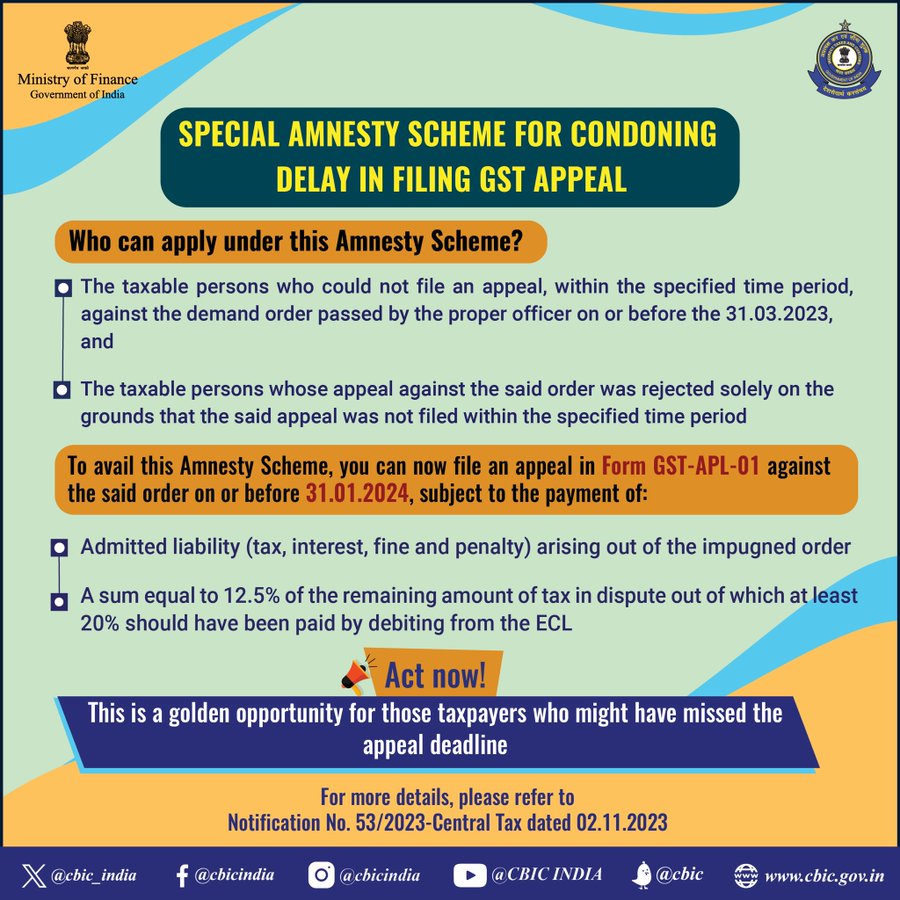

In a proactive move to alleviate the challenges faced by taxpayers dealing with Goods and Services Tax (GST) issues, the Central Board of Indirect Taxes and Customs (CBIC) has unveiled a groundbreaking amnesty scheme. This initiative allows specified GST taxpayers a window of opportunity to appeal against GST tax demand orders until January 31, 2024, presenting a lifeline for those in disagreement with such orders.

Understanding the Amnesty Scheme

The special amnesty scheme is designed to pardon delays in filing GST appeals, offering relief from the fines and penalties associated with late submissions. Individuals facing late fees for delayed filing of GSTR 3B, which amounts to ₹50 per day, or cases involving State Goods and Services Tax (SGST) and Central Goods and Services Tax (CGST) with tax liabilities incurring a ₹25 per day fine, can potentially find respite under this scheme.

Eligibility Criteria

The CBIC, in its notification titled ‘No. 53/2023- CENTRAL TAX,’ dated November 2, 2023, outlines the eligibility criteria for taxpayers to benefit from this amnesty scheme. Those eligible include individuals who were unable to appeal against a GST demand order issued by the GST proper officer on or before March 31, 2023, and cases where the earlier appeal was dismissed solely due to exceeding the appeal deadline.

The scheme covers GST demand orders issued on or before March 31, 2023, encompassing even those related to the financial year 2018-19.

How to File

To take advantage of the amnesty scheme, eligible individuals must file appeals against the GST tax demand order using GST Form APL-01. The CBIC emphasizes that "the appeal against the said order in FORM GST APL-01, as per subsection (1) of Section 107 of the said Act, should be submitted on or before the 31st day of January 2024."

This straightforward process aims to simplify the filing of appeals under the GST Amnesty Scheme, providing a strategic solution for those grappling with GST-related challenges.

CAclubindia

CAclubindia