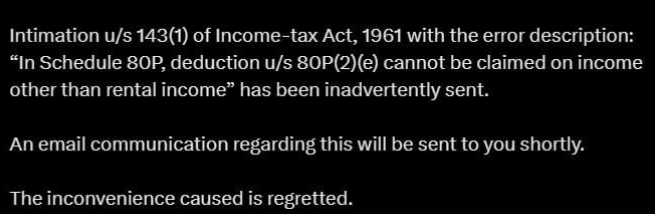

The Income Tax Department has clarified that the error in the 80P deduction notices was sent inadvertently. The department has assured taxpayers that an email communication addressing this issue will be sent out shortly. In the meantime, taxpayers are urged not to panic and to wait for further instructions from the department.

The error in the notices was due to a technical glitch in the department's system. The glitch caused the notices to be sent to taxpayers who had claimed deductions under Section 80P, even though they were not eligible for such deductions.

The department has said that it is taking steps to rectify the error and that the affected taxpayers will not be penalized. The department has also said that it will be issuing refunds to taxpayers who have already paid taxes based on the erroneous notices.

The email communication from the department is expected to be sent out in the next few days. The communication will provide more details about the error and the steps that the department is taking to rectify it.

In the meantime, taxpayers who have received the erroneous notices are advised to not take any action. They should wait for further instructions from the department.

Here are some additional things to keep in mind

- The error only affects taxpayers who have filed their income tax returns for the assessment year 2023-2024.

- The error does not affect taxpayers who have claimed deductions under Section 80P for other assessment years.

- Taxpayers who have any questions about the error can contact the Income Tax Department helpline.

CAclubindia

CAclubindia