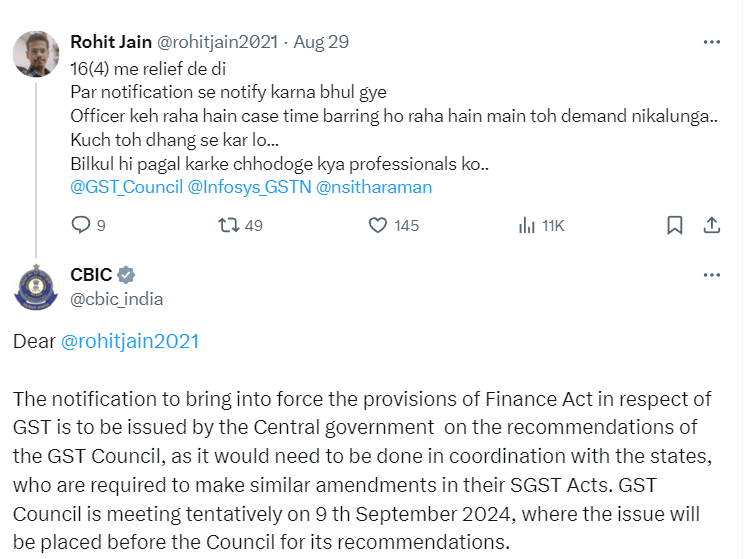

The Central Board of Indirect Taxes and Customs (CBIC) has announced that the provisions of the Finance (No.2) Act, 2024, related to Goods and Services Tax (GST) will not come into effect until after the 54th GST Council Meeting. The key provisions awaiting implementation include the GST Amnesty Scheme and the relief under Section 16(4).

CBIC has emphasized that the notification to enforce these provisions will be issued by the Central Government based on the GST Council's recommendations. This approach ensures proper coordination with the states, which must also amend their respective State GST (SGST) Acts to align with the changes. The 54th GST Council Meeting, tentatively scheduled for September 9, 2024, will address this issue and provide the necessary recommendations.

This clarification aims to provide clarity to businesses and taxpayers awaiting the implementation of these crucial GST reforms. Stakeholders are advised to stay updated on the developments from the upcoming GST Council Meeting for further details.

CAclubindia

CAclubindia