The Central Board of Indirect Taxes and Customs, via their official Twitter handle, has released "Misconceptions Vs. Reality" under Rule 86B. Read the misconceptions about the 1% payment of tax liability in cash in GST under Rule 86B below:

Misconceptions vs Reality!

Reality for Misconception 1

Facts about 1% payment of tax liability in cash in GST under Rule 86B.

Reality for Misconception 2

Facts about 1% payment of tax liability in cash in GST under Rule 86B.

Reality for Misconception 3

Facts about 1% payment of tax liability in cash in GST under Rule 86B.

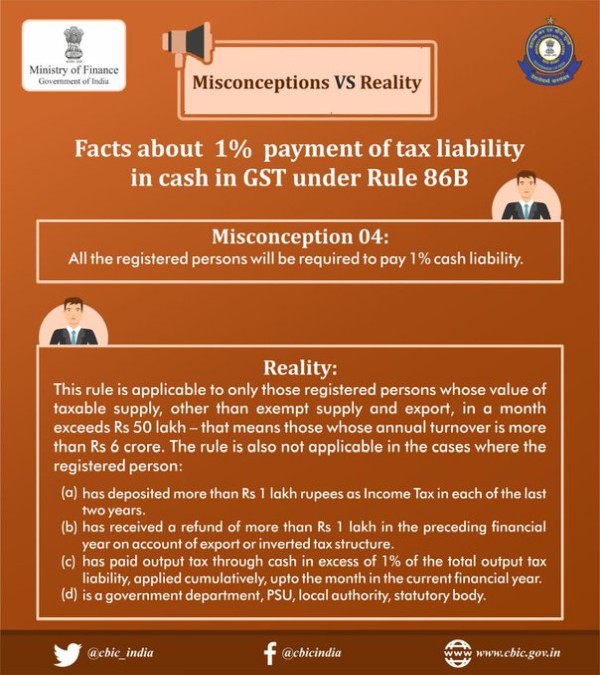

Reality for Misconception 4

Facts about 1% payment of tax liability in cash in GST under Rule 86B.

Reality for Misconception 5

Facts about 1% payment of tax liability in cash in GST under Rule 86B.

CAclubindia

CAclubindia