Specifying Forms, returns, statements, reports, orders, by whatever name called, prescribed in Appendix-ll to be furnished electronically under sub-rule (1) and sub-rule (2) of Rule 131 of the Income-tax Rules, 1962

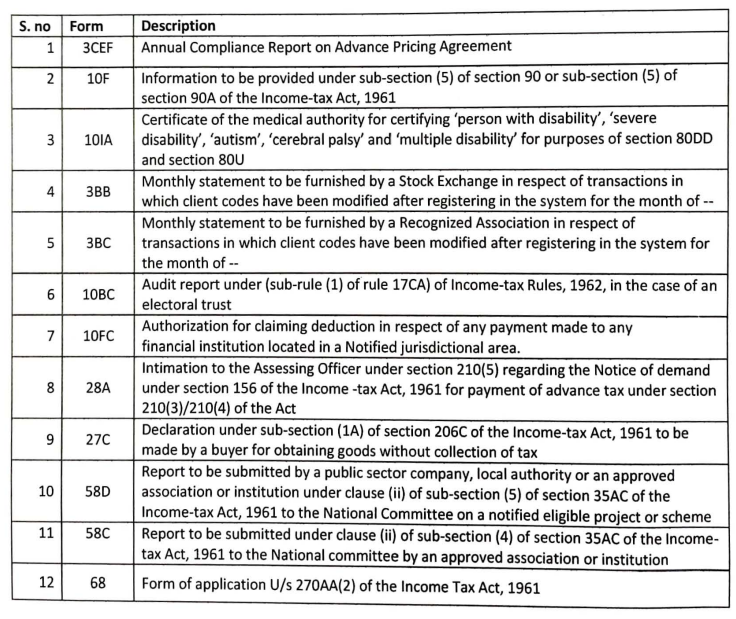

In exercise of the powers conferred under sub-rule (1) and sub-rule (2) of Rule 131 of the Income tax Rules, 1962 (‘the Rules’), the Director General of Income Tax (Systems), with the approval of the Board, hereby specifies that the following Forms, returns, statements, reports, orders, by whatever name called, shall be furnished electronically and shall be verified in the manner prescribed under sub-rule (1) of Rule 131:

2. This notification shall come into effect immediately.

OGIT (Systems), CBDT

Copy to:

- PPS to the Chairman and Members, CBDT, North Block, New Delhi.

- All Pr. Chief Commissioners/ Director Generals of Income Tax-with a request to circulate amongst all officers in their regions/ charges

- Js(TPLJ-I &1/Media coordinator and Official Spokesperson of CBDT.

- DITIT)/DIT(Audit)/0IT(Vig)/ADG(System)1,2,3,4,5/CIT(TBA), CIT(CPC)-8Bangalore, CIT(CPC-TDS)

Ghaziabad - ADG(PR.PP&OL) with a request for advertisement campaign for the Notification.

- TPL and ITA Divisions of CBDT

- The Institute of Chartered Accountants of India, IP Estate, New Delhi.

- Web Manager, “incometaxindia.gov.in” for hosting on the website’.

- Database cell for uploading on www.irsofficersonline.gov.in and DG System’s Corner.

- ITBA publisher for uploading on ITBA website

CAclubindia

CAclubindia