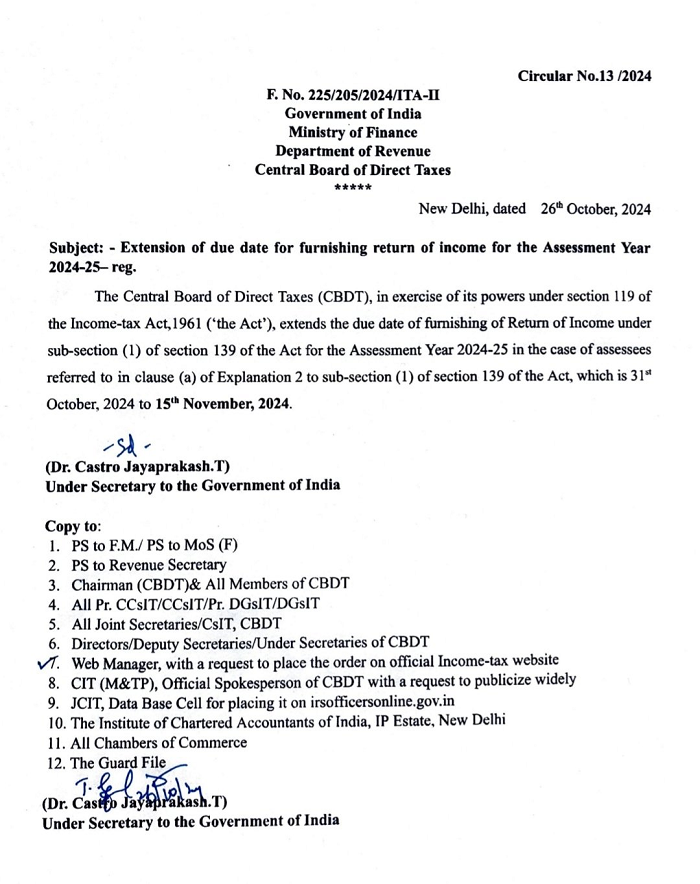

On October 26, 2024, the Central Board of Direct Taxes (CBDT) announced an extension for filing the Return of Income for the Assessment Year (AY) 2024-25. This significant update is aimed at providing relief to taxpayers and ensuring compliance with the income tax regulations.

Key Highlights of Circular No. 13/2024

- Extension of Due Date: The deadline for filing the Return of Income under section 139(1) of the Income Tax Act has been moved from October 31, 2024, to November 15, 2024. This applies specifically to assessees mentioned in clause (a) of Explanation 2 to sub-section (1) of section 139.

- Reason for Extension: The CBDT has exercised its powers under section 119 of the Income Tax Act, indicating the need to accommodate taxpayers in fulfilling their filing obligations. The extension is particularly relevant given the challenges faced by individuals and businesses during the filing period.

Official copy of the Circular has been mentioned below

Implications for Taxpayers

Taxpayers now have an additional 15 days to gather their financial documents and ensure accurate reporting of their income. This extension is expected to enhance compliance and reduce the likelihood of errors in filings, thereby potentially decreasing the volume of disputes and penalties associated with late submissions.

Conclusion

The extension of the due date for filing the Return of Income for AY 2024-25 reflects the CBDT's proactive approach in accommodating taxpayers. As the new deadline approaches, taxpayers should take advantage of this additional time to ensure thorough and accurate filings.

CAclubindia

CAclubindia