CAclubindia News

ICAI Signs MoU with CAG to Boost Capacity of PSU Audit Officers

22 April 2025 at 08:30ICAI and CAG Join Hands to Strengthen Capacity of PSUs Audit Officers

UAE-Based NRI Gets Rs 2.84 Crore GST Notice for Fake Firm, Alleges PAN Misuse

22 April 2025 at 08:29In a shocking case of identity theft and alleged GST fraud, a 48-year-old NRI employed in an aviation consultancy firm in the UAE has filed a police complaint after receiving a GST demand notice of Rs 2.84 crore from the Income Tax Department

GST Fraud of Over Rs 100 Crore Busted: Commerce Graduate Arrested

21 April 2025 at 08:35In a major crackdown on tax evasion, the CGST department has unearthed a massive GST fraud of over Rs 100 crore, operated through a network of fake companies from a single shop located in a Faridabad mall.

Form 10AB Filing Activated: Charitable Trusts Can Now Seek Section 12A Relief

21 April 2025 at 08:26In a significant relief to charitable and religious institutions, the Income Tax Department has now enabled the filing of condonation requests through Form 10AB on the e-filing portal.

MCA Notifies Election Tribunal for ICAI Council Poll Disputes Held in Dec 2024

21 April 2025 at 08:25The Ministry of Corporate Affairs (MCA) has officially constituted an Election Tribunal to resolve disputes arising from the Council elections of the Institute of Chartered Accountants of India (ICAI) held in December 2024.

Income Tax Dept Clarifies Tax Exemption Rules for DPIIT-Recognised Startups

21 April 2025 at 08:25In a significant clarification aimed at fostering ease of doing business, the Income Tax Department on Friday reiterated that DPIIT-recognised startups are eligible for multiple tax exemptions

ICAI Suspends Two CAs for Professional Misconduct in Separate Disciplinary Cases

19 April 2025 at 08:03ICAI suspends CA Praveen Murarka and CA Subhash Chander Sharma for professional misconduct, reinforcing its commitment to ethical standards and disciplinary action within the profession.

Income Tax Dept Probes Startups on Foreign Funds from Singapore

19 April 2025 at 07:22In a significant move that could impact India's thriving startup ecosystem, the Income Tax Department has issued show cause notices to multiple startups regarding foreign investments routed through Singapore over the past five years.

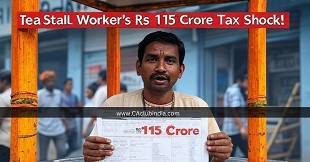

Tea Stall Worker in Gujarat Shocked After Receiving Rs 115 Crore Income Tax Notice

19 April 2025 at 07:22As the financial year nears its end and salaried professionals across India gear up for tax filings, an unusual and baffling incident has emerged from Gujarat. ..

No GST on UPI Payments Over Rs 2000, Says Government Amid Viral Rumors

19 April 2025 at 07:22Claims that Government is considering levying Goods and Services Tax (GST) on UPI transactions over ₹2,000 are completely false, misleading, and without any basisThe claims that the Government is considering levying Goods and Services Tax (GST) on UP

Popular News

- ED Arrests Two CAs in Rs 641 Crore Cyber Fraud and Money Laundering Case Under PMLA

- New Draft Form Introduced for Provisional Registration Under Income Tax Act, 2025

- New Accountant Certification Format for Slump Sale Capital Gains Under IT Act 2025

- MCA Launches Companies Compliance Facilitation Scheme 2026 with Major Relief on Late Filing Fees

- TDS on Property, Rent & Virtual Digital Assets: Draft Form 141 Brings Detailed Reporting Norms

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani

CAclubindia

CAclubindia