Professional Resource News

ICAI further extends the last date for filing nomination for 15th ICAI Awards till 4th January 2022

13 December 2021 at 12:31Last date for filing nominations for 15th ICAI Awards has been extended till 4th January 2022.

ICAI announces empanelment of CA firms/LLPs for the year 2022-2023

10 December 2021 at 16:47Empanelment of Chartered Accountant firms/LLPs for the year 2022-2023

ICAI proposes amendments to IAS 1 - Presentation of Financial Statements

01 December 2021 at 08:48Non-current Liabilities with Covenants - Proposed amendments to IAS 1

Last date for filing nomination for 15th ICAI Awards extended till 10th December 2021

01 December 2021 at 08:47Last date for filing nomination for 15th ICAI Awards has been extended till 10th December, 2021

ICAI President highlights the importance of promoting financial inclusion through financial literacy

01 December 2021 at 08:46Professional and dexterous auditing is the key for any nation’s strong economy. Giving due value and honour to the institution of Comptroller and Auditor General of the country, the first ever Audit Diwas was celebrated on 16th of November this year

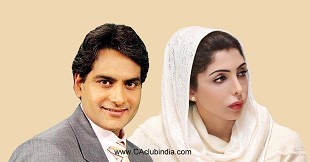

Sudhir Chaudhary dropped from ICAI UAE Event after Princess calls him an intolerant terrorist

24 November 2021 at 12:37No Toxic - Sudhir Chaudhary Dropped from ICAI Abu Dhabi Event

ICAI extends the last date for submission of MEF for 2021-22 to 25th November 2021

22 November 2021 at 08:28FURTHER EXTENSION OF LAST DATE FOR SUBMITTING MEF 2021-22 FROM NOVEMBER 20 TO NOVEMBER 25, 2021

NFRA seeks applications from CAs for engagement as Professionals in NFRA

20 November 2021 at 07:18National Financial Reporting Authority (NFRA) intends to engage eligible and interested persons as professionals purely on contractual basis, without any provision for regular employment under any circumstances.

ICAI Invites Nominations for 15th ICAI Awards

18 November 2021 at 08:40Nominations for 15th ICAI Awards are open for members in industry including part time COP holders. Last date - 30th November, 2021

ICAI extends the Multipurpose Empanelment Form for 2021-22 to 20th November 2021

10 November 2021 at 08:36The Institute of Chartered Accountants of India, on receiving various requests from members, has decided to extend the last date for submission of Online Multipurpose Empanelment Form along with the Declaration for 2021-22, to 20th November 2021.

Popular News

- ICAI Introduces UDIN Ceiling & Field-Level Validation for Section 44AB Tax Audits from 1st April 2026

- Draft Form 124 Proposes Mandatory Disclosure of Relationship With Landlord for HRA Claims

- ICAI: UDIN Validation Now Based on Five Parameters Including PAN

- MCA Launches Companies Compliance Facilitation Scheme 2026 with Major Relief on Late Filing Fees

- New Draft Form Introduced for Provisional Registration Under Income Tax Act, 2025

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia