Professional Resource News

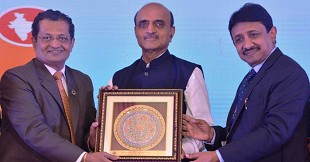

ICAI honours Stellar CAs at 15th Annual Awards Ceremony

12 February 2022 at 10:07The Institute of Chartered Accountants of India (ICAI) conducted Leadership Summit, 2022 & 15th ICAI Awards on February 2, 2022 at New Delhi to recognise the stellar performances of Chartered Accountants across the sectors.

ICAI releases guidelines for conducting Distance / Remote / Online Peer Review

10 February 2022 at 08:48The Peer Review Board after due deliberation at its recently held meeting has decided to adopt conducting of distance/ remote/ online Peer Review

ICAI celebrated its 72nd Annual Function

07 February 2022 at 08:57ICAI celebrated its 72nd Annual Function on February 4, 2022.

ICAI President's Message - February 2022

01 February 2022 at 15:06My Dear Professional Colleagues,As the completion of the Council Year 2021-22 approaches, we look back at this incredible journey of the Council Year. It has been a great honour and privilege to fortify the legacy of my alma mater as the 69th Preside

ICAI Virtual International Conference 2022 | Accountants Creating a Digital and Sustainable Economy

21 January 2022 at 10:26The Institute of Chartered Accountants of India (ICAI) is organizing Virtual International Conference 2022 on the theme "Accountants Creating a Digital and Sustainable Economy"

ICSI elects New President and Vice President for the year 2022

20 January 2022 at 08:43CS Devendra V. Deshpande elected as the President and CS Manish Gupta as the Vice President of ICSI for the year 2022 w.e.f. 19th January, 2022.

ICAI requests to give comments on the ED of ICAI Valuation Standard-304 by 27th January, 2022

18 January 2022 at 11:13Request to give comments on the Exposure Draft of ICAI Valuation Standard-304 "Valuation of Assets in the Extractive Industries" by 27th January 2022

ICAI invites Expression of Interest for Empanelment as Resource Person/ Subject Matter Expert in the Social Sector

17 January 2022 at 08:38ICAI is pleased to invite expression of interest for empanelment as Resource Person/Subject Matter Expert for developing

ICAI extends last date for complying with mandatory CPE hours requirements for the Calendar Year 2021 to 28th February 2022

16 January 2022 at 07:38Extension of last date for complying with the mandatory CPE hours’ requirements for the Calendar Year 2021 either in physical/offline mode or in virtual mode through VCM/DLH - from 31st December, 2021 to 28th February, 2022

ICAI seeks for issuance of NFRA Consultation Paper on Statutory Audit and Auditing Standards for MSMCs

15 January 2022 at 08:13ICAI concerns are: (i) Returning of "Revision of Existing Accounting Standards: Approach Paper (2020) prepared by ICAI" by NFRA and(ii) Issuance of NFRA Consultation Paper on "Statutory Audit and Auditing Standards for Micro, Small and Medium Companies

Popular News

- CBDT to Replace Forms 3CA, 3CB & 3CD with Consolidated Form 26

- Income Tax Rules, 2026 Notified: Rule-Wise Comparison with Old IT Rules, 1962

- Draft Income Tax Rules, 2026 Released: Major Changes in Capital Gains, Perquisites and Non-Resident Taxation

- CBDT Proposes New Form 130 for TDS on Salary, Pension and Interest Income Under IT Act

- Draft Income Tax Forms 2026 Released: Category-wise Table of 190 Draft Forms Explained

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia