Income Tax News

CBDT notifies Faceless Jurisdiction of Income Tax Authorities Scheme, 2022

31 March 2022 at 09:05Faceless Jurisdiction of Income Tax Authorities Scheme, 2022

CBDT amends Income-tax Rules, 1962 for prescribing fees u/s 234H of IT Act, 1961

31 March 2022 at 09:05Amendment to the provisions of Income-tax Rules, 1962 for prescribing fees under section 234H of the Income-tax Act, 1961

CBDT notifies e-Assessment of Income Escaping Assessment Scheme, 2022

31 March 2022 at 09:05e-Assessment of Income Escaping Assessment Scheme, 2022

IT Department conducts searches on a popular chain of educational institutes in Maharashtra

25 March 2022 at 08:36The Income Tax Department carried out a search and seizure operation on 14.03.2022 on a popular chain of educational institutes, running several schools and colleges at multiple locations in India and abroad.

CBDT issues refunds to more than 2.26 crore taxpayers from 1st April 2021 to 20th March 2022

24 March 2022 at 12:31CBDT issues refunds of over Rs. 1,93,720 crore to more than 2.26 crore taxpayers from 1st April 2021 to 20th March 2022.

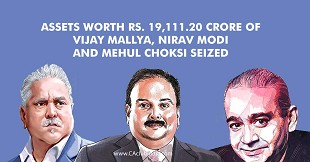

Assets worth Rs 19,111.20 crore of Vijay Mallya, Nirav Modi and Mehul Choksi seized

23 March 2022 at 08:57Cases pertaining to Vijay Mallya, Nirav Modi and Mehul Choksi who have defrauded Public Sector banks by siphoning off the funds through their companies which resulted in total loss of Rs. 22,585.83 crore to the public sector banks.

IT Department conducts searches in a prominent Real Estate Group of North India

22 March 2022 at 16:36Income Tax Department conducts searches in a prominent Real Estate Group of North India

IT Department conducts searches on a Pune & Thane based unicorn start-up group

21 March 2022 at 08:39Income Tax Department conducted a Search & Seizure operation on a Pune & Thane based unicorn start-up group, primarily engaged in the business of wholesale and retail of construction material

CBDT condones delay in filing of Form 10-IC for AY 2020-21

18 March 2022 at 07:50Condonation of delay under section 119(2)(b) of the Income-tax Act, 1961 in filing of Form 10-IC for Assessment Year 2020-21

CBDT provides relaxation from the requirement of electronic filing of application in Form No.3CF

18 March 2022 at 07:50Relaxation from the requirement of electronic filing of application in Form No.3CF for seeking approval under section 35(1)(ii)/(iia)/(iii) of the Income-tax Act,1961 (the Act)

Popular News

- CBDT to Replace Forms 3CA, 3CB & 3CD with Consolidated Form 26

- Income Tax Rules, 2026 Notified: Rule-Wise Comparison with Old IT Rules, 1962

- Draft Income Tax Rules, 2026 Released: Major Changes in Capital Gains, Perquisites and Non-Resident Taxation

- CBDT Proposes New Form 130 for TDS on Salary, Pension and Interest Income Under IT Act

- Draft Income Tax Forms 2026 Released: Category-wise Table of 190 Draft Forms Explained

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia