Others News

Digital Payment Transactions Surge With Over 18,000 Crore Transactions in 2024-25

12 March 2025 at 08:57RBI, NPCI Launch Awareness Campaigns and AI-Based Solutions to Prevent Financial Cybercrimes

RBI to Issue New Rs 100 and Rs 200 Banknotes Bearing Governor Sanjay Malhotra's Signature

12 March 2025 at 08:54The Reserve Bank of India will shortly issue ₹100 and ₹200 denomination Banknotes in Mahatma Gandhi (New) Series bearing the signature of Shri Sanjay Malhotra, Governor.

RBI to Inject Rs 1 Lakh Crore via OMO, Announces $10 Billion Forex Swap to Manage Liquidity

06 March 2025 at 08:41On a review of current and evolving liquidity conditions, the Reserve Bank has decided to conduct operations to inject liquidity into the banking system

49th Civil Accounts Day: FM Highlights PFMS's Role in Digital Governance

03 March 2025 at 08:43The Civil Accounts Day 2025 was celebrated in New Delhi today to mark the 49th foundation day of Indian Civil Accounts Service (ICAS) with the Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman, presiding over as Chief Guest.

RBI: 98.18% of Rs 2000 Notes Returned, Rs 6,471 Crore Still Circulating

03 March 2025 at 08:42The Reserve Bank of India (RBI) has provided an update on the withdrawal of ₹2000 denomination banknotes, revealing that as of February 28, 2025, only ₹6,471 crore worth of these notes remain in circulation.

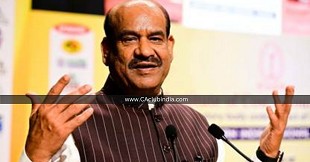

Lok Sabha Speaker Highlights Legal & Financial Reforms at ICAI Symposium on Viksit Bharat 2047

03 March 2025 at 08:41Lok Sabha Speaker Shri Om Birla stressed that the recent initiatives in simplification and transparency in financial laws have provided an enabling environment for investment in India.

RBI: Tax Cuts and Moderating Inflation to Boost Household Consumption

22 February 2025 at 09:00The Reserve Bank of India (RBI), in its latest bulletin released on February 19, 2025, highlighted that the tax relief measures announced in the Union Budget 2025-26 and easing inflation are set to strengthen household consumption and investments.

DRI Busts Seven Fake Currency Modules Across Four States, Nine Arrested

22 February 2025 at 08:58In its drive against facilities engaged in the printing of Fake Indian Currency Notes (FICN), DRI busts seven more modules in Maharashtra (4), Haryana (1), Bihar (1) and Andhra Pradesh (1); nine arrested

RBI Launches 'RBIDATA' App for Seamless Access to Economic and Financial Data

21 February 2025 at 08:46Reserve Bank of India launched RBIDATA, a Mobile App, that offers macroeconomic and financial statistics relating to the Indian economy in a user-friendly and visually engaging format.

FM Sitharaman Expects Durable Consumption Recovery

10 February 2025 at 08:49Finance Minister Nirmala Sitharaman on Saturday expressed optimism about a durable recovery in consumption, driven by fiscal and monetary policy measures.

Popular News

- CBDT to Replace Forms 3CA, 3CB & 3CD with Consolidated Form 26

- Income Tax Rules, 2026 Notified: Rule-Wise Comparison with Old IT Rules, 1962

- Draft Income Tax Rules, 2026 Released: Major Changes in Capital Gains, Perquisites and Non-Resident Taxation

- CBDT Proposes New Form 130 for TDS on Salary, Pension and Interest Income Under IT Act

- Draft Income Tax Forms 2026 Released: Category-wise Table of 190 Draft Forms Explained

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia