The first weeks of the new year saw several fast-moving wildfires sweep through 63 square miles of the Los Angeles area, destroying over 14,000 structures, including homes, businesses, and schools.

At least 27 people lost their lives, and economic losses are estimated at $275 billion. Insurers in California are now facing tens of billions of dollars in claims, with loss estimates ranging from $30 billion to $50 billion, the largest fire-related catastrophe globally in history.

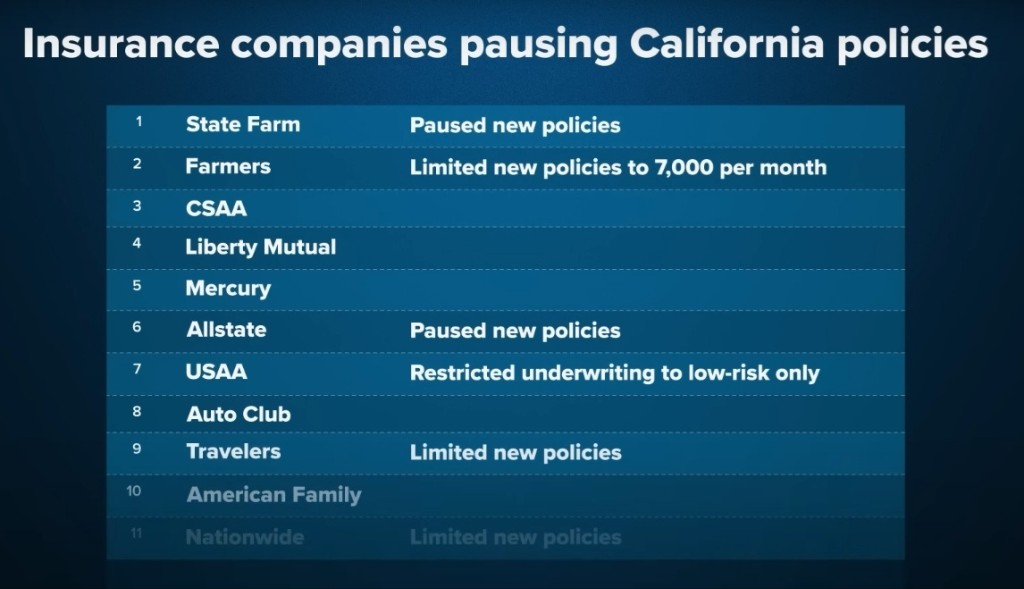

The Shrinking Insurance Market

The insurance industry has often been compared to a “canary in the coal mine” for the climate crisis, and many now say that canary is barely hanging on.

This issue is not confined to California. 44% of all U.S. homes are in areas facing severe climate risks, including flooding, wildfires, extreme heat, and hurricanes.

Regulatory Challenges and Rising Costs

Part of the issue in California is its regulatory framework. Proposition 103, passed in 1988, mandates that the state’s Department of Insurance approve property insurance rates and roll them back by 20%.

This has suppressed insurance rates below what many companies say is necessary to cover wildfire risks. Until recently, insurers in California were also prohibited from using risk modeling in their rate calculations, limiting their ability to set rates based on the latest data.

In addition to rising risks, costs have surged. Over the past five years, construction labor costs have increased by 35.1%, while construction material costs have risen by 37.3%.

The Future of Home Insurance

Despite the financial strain, experts believe insurers have the reserves needed to cover these claims. “Insurance companies are required by regulation to have adequate reserves.

This will impact their earnings, but it’s not a capital event,” one analyst said. Reinsurance, essentially insurance for insurance companies, also plays a crucial role in covering major losses, spreading risk across a global market.

However, homeowners across the country should brace for higher premiums. “A catastrophe of this size will drive up insurance costs nationwide, not just in California,” an industry expert warned. “It’s not going to bankrupt the industry, but it will affect pricing and availability. Insurers will have to reassess their risk appetite.”