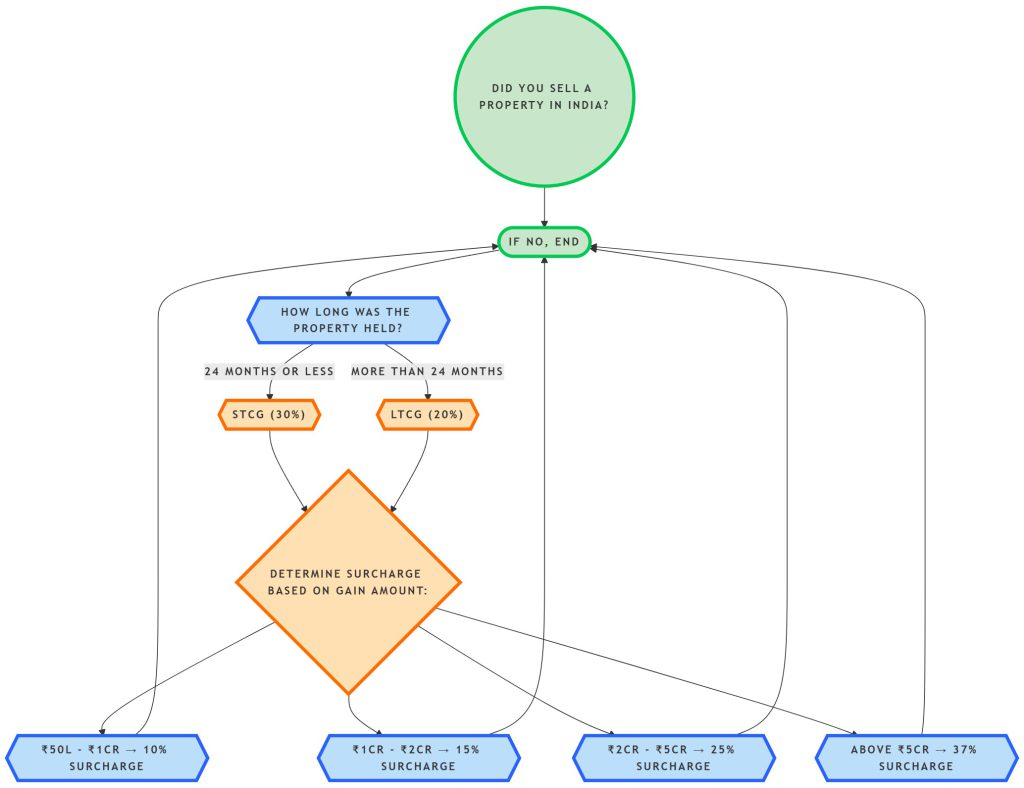

When an individual sells property in India, taxation depends on the holding period. If the property is held for more than 24 months, it qualifies as a long-term capital gain (LTCG) and is taxed at 20% along with applicable surcharge and cess. If held for 24 months or less, it is considered a short-term capital gain (STCG) and is taxed at 30% with applicable surcharge and cess.

Surcharge rates vary based on income:

- 10% for gains between ₹50 lakhs and ₹1 crore.

- 15% for gains between ₹1 crore and ₹2 crores.

- 25% for gains between ₹2 crores and ₹5 crores.

- 37% for gains exceeding ₹5 crores. Additionally, a 4% education cess is applicable.

Exemptions from Capital Gains Tax

There are three sections under which one can claim exemptions on LTCG:

- Section 54: If the sale proceeds from a house property are reinvested in another house property within two years (or before one year of sale) or if construction is completed within three years, the gain is exempt.

- Section 54F: If an NRI sells any asset (other than a house) and reinvests the net sale consideration in a house property, they are eligible for exemption.

- Section 54EC: NRIs can invest up to ₹50 lakhs in capital gain bonds (such as REC and NHAI bonds) within six months of sale. These bonds have a 5.5% interest rate and a five-year lock-in period.

The interest earned from these bonds is taxable as income from other sources.

Tax Deducted at Source (TDS) on Property Transactions

If an NRI is selling property in India, the buyer must deduct TDS at the time of payment:

- For long-term capital gains: 20% TDS plus applicable surcharge and cess.

- For short-term capital gains: 30% TDS plus applicable surcharge and cess.

This ensures the government collects tax before the transaction is completed. However, NRIs can apply for a lower or nil TDS rate using Form 13, which must be submitted to the Income Tax Department’s International Taxation Division. This process takes 45–60 days, so NRIs should plan in advance.

Stamp Duty and Registration Charges

Typically, the buyer bears stamp duty and registration charges. However, both parties can mutually agree to share these costs.

In cases of property exchange, stamp duty is applicable only on the higher-valued property. The agreed value in the transaction document is considered for capital gains tax computation.

Implications of Selling Below Guidance Value

Property transactions must adhere to the government’s guidance value. If a property is registered for a lower amount, it gets flagged for undervaluation.

The District Registrar may inspect and approve a lower registration value. However, under Section 50C of the Income Tax Act, if the registered value is more than 10% below the guidance value, the difference is considered deemed capital gain for the seller and deemed gift for the buyer, attracting respective taxes.

A notable exception is when banks auction properties—here, the auction price is accepted without undervaluation implications.

Cash Transactions in Property Deals

Cash transactions over ₹20,000 in property deals are strictly prohibited. Payments must be made via banking channels such as RTGS, NEFT, DD, or cheques. If a seller receives cash, they face a 100% penalty under Section 271D of the Income Tax Act.