It is a common practice in business to transfer goods transferred amongst different units of same entity, for instance, distribution of samples manufactured in a factory to different branches or transfer of goods from factory to depot/showroom for sale therefrom, from one warehouse to another warehouse, from one branch to another branch where the demand of the goods is higher.

Since the transfer is within the same business, the transferor unit would not charge any amount to the transferee unit. Similarly, it is also possible that one branch supplies services to another branch of the same entity without consideration. These transactions are termed as self-supplies. Under GST, these transactions though undertaken without consideration, will also qualify as supply.

Examples

Raghubir Fabrics transfers 1000 shirts from his factory located in Lucknow to his retail showroom in Delhi so that the same can be sold from there. The factory and retail showroom of Raghubir Fabrics are registered in the States where they are located. Although no consideration is charged, supply of goods from factory to retail showroom constitutes supply

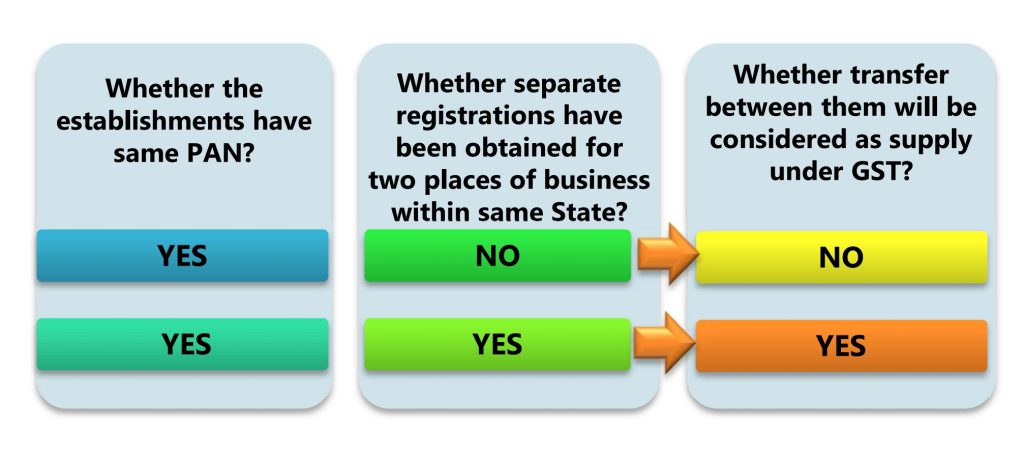

However, transfer between two units of a legal entity under single registration (apparently within same State) will not be considered as supply. This can be understood with the help of the following example.

Raghubir Fabrics transfers 1000 shirts from his factory located in Lucknow to his retail showroom in Kanpur so that the same can be sold from there.

It has taken one registration in the State of Uttar Pradesh declaring Lucknow factory as its principal place of business and Kanpur showroom as its additional place of business.

Since no consideration is charged, supply of goods from factory to retail showroom in same State under single registration does not constitute supply.

However, in the above example, if Raghubir Fabrics obtains separate registrations for Lucknow factory and Kanpur showroom, stock transfer between the Lucknow factory and Kanpur showroom will constitute supply. The concept arising from the above discussion is summarised in below diagram (assuming a case where there are two places of business in a State).