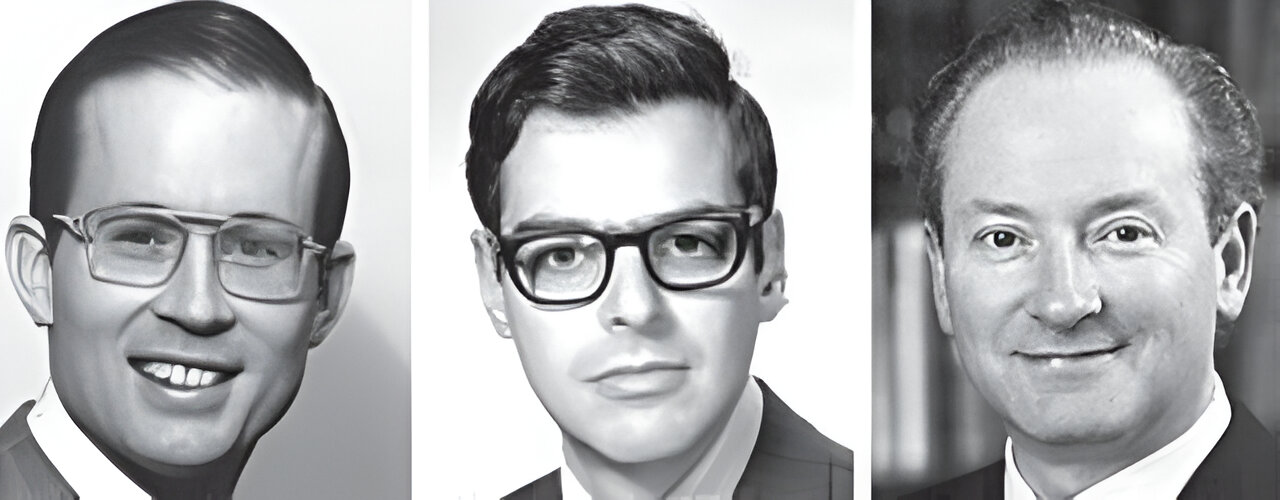

We’re now gonna talk about probably the most famous formula in all of finance, and that’s the Black-Scholes Formula. Sometimes it’s called the Black-Scholes-Merton Formula, and it’s named after these gentlemen.

The person to the left is Fischer Black. The one in the middle is Myron Scholes. They really laid the foundation for what led to the Black-Scholes Model and the Black-Scholes Formula, and that’s why it has their name.

The one on the right is Bob Merton, who really took what Black-Scholes did and took it to another level to get to our modern interpretations of the Black-Scholes Model and the Black-Scholes Formula.

All three of these gentlemen would have won the Nobel Prize in Economics, except for the unfortunate fact that Fischer Black passed away before the award was given. Myron Scholes and Bob Merton did get the Nobel Prize for their work.

Why the Black-Scholes Formula Matters

The reason why this is such a big deal, why it is Nobel Prize-worthy, is that people have been trading stock options for a very long time. They had been trading them, buying them, and selling them.

It was already a major part of financial markets, but there was no really good way of mathematically valuing an option. People had a sense of what mattered, especially options traders, but there was no analytical framework.

That’s what the Black-Scholes Formula gave us. Before diving into the formula, let’s build some intuition for what we would care about when pricing a stock option.

You would care about the stock price and the exercise price. You would also care about how much higher or lower the stock price is relative to the exercise price.

You would care about the risk-free interest rate since it keeps showing up when discounting values to today. You would also think about how much time remains before exercising the option.

Finally, you would care about the stock’s volatility. We measure volatility as the standard deviation of log returns for that security.

Understanding Volatility in Options Pricing

At first, volatility might seem complicated, but let’s break it down. Imagine two stocks—one that moves steadily and another that jumps all over the place.

The second stock, which fluctuates more, is considered more volatile. Volatility is simply how much the stock’s returns deviate from their average value.

A higher volatility means a higher standard deviation of log returns. Options tend to be more valuable when the underlying stock has higher volatility.

If you own a stock outright, you have to deal with its ups and downs. But with an option, you can ignore the wild swings and exercise only when it benefits you.

This intuition tells us that the more volatile an asset, the more valuable an option on that asset is. Now, let’s actually look at the Black-Scholes Formula.

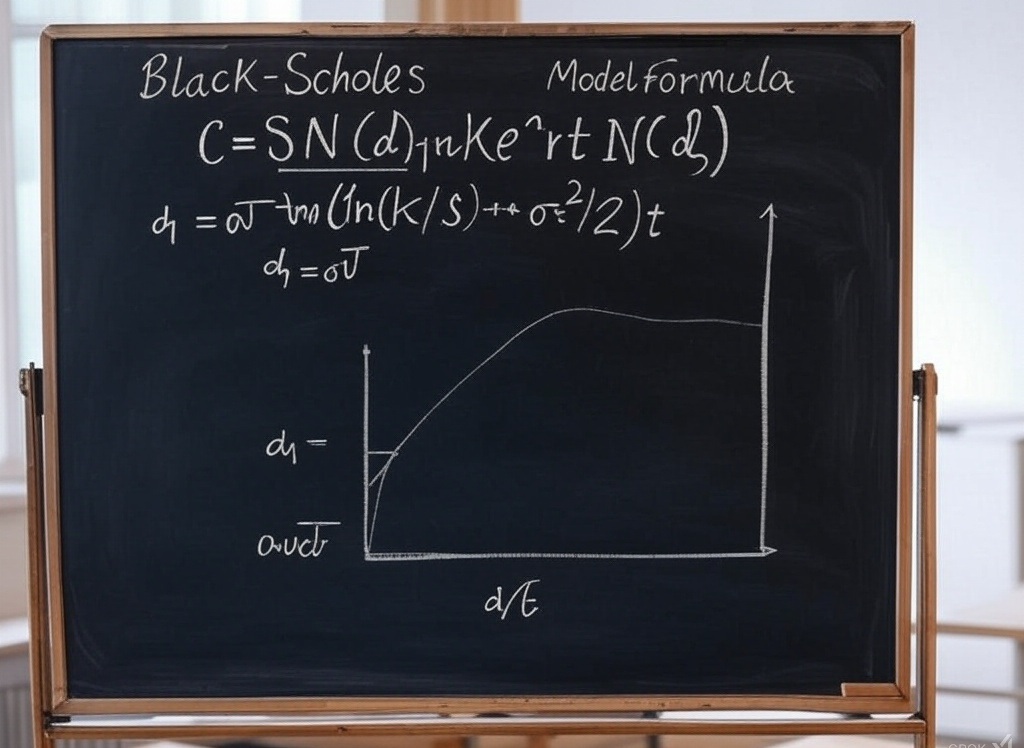

Breaking Down the Black-Scholes Formula

The formula we’re looking at applies to a European call option. A similar approach works for a European put option.

A European call option is mathematically simpler than an American call option. It can only be exercised at expiration, whereas an American option can be exercised at any time.

Now, let’s dissect the formula. The first term involves the current stock price, multiplied by a function that takes an input. The second term discounts the exercise price back to today.

The function used here, N, is the cumulative distribution function of a standard normal distribution. This simply gives the probability that a random variable is less than or equal to a certain value.

The first term represents the stock price weighted by the probability of exercising the option. The second term represents the discounted exercise price, also weighted by probability.

If the stock price is much higher than the exercise price, the option’s value should be high. Similarly, the more likely we are to exercise the option, the more valuable it becomes.

Volatility plays a key role in the formula. A higher volatility increases the value of a call option because it raises the probability that the stock price will exceed the exercise price.

We see this in the formula, where volatility appears in the terms D1 and D2. A higher sigma makes D1 go up and D2 go down, increasing the call option’s value.

If volatility were lower, the value of the call option would decrease. This confirms our earlier intuition that higher volatility leads to a higher option price.