Under the Ethics in Government Act and House Ethics rules, Representative Jasmine Crockett has filed the House Form 278e, disclosing the fair‑market value ranges of her real‑estate assets that contribute […]

GST Indexation Benefits after the Finance Act, 2024

In a recent circular 224/18/2024-GST [CBIC-20001/4/2024-GST] dated 11th July 2024, it has been clarified that upon payment of an amount equivalent to 20% of the disputed tax amount […]

Converting Company to LLP is a Smart Tax Move

Provisions of Section 45 of the Income-tax Act, 1961 (‘the Act’) provides for charging of Capital Gains Tax on account of transfer of capital asset in the previous […]

Section 2(15): Tax Challenges for Charitable Organizations

Under the amended section 2(15) of the Income-tax Act, 1961 (“the Act”), charitable institutions with the purpose of ‘advancement of any other object of general public utility’ are […]

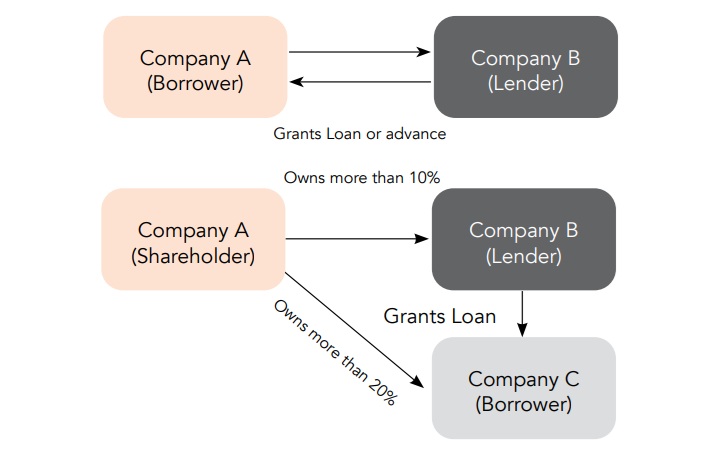

Deemed Dividend: International Tax and Transfer Pricing

Section 2(22)(e) of the Income Tax Act, 1961 deals with the taxation of certain loan transactions as “deemed dividends”. It targets closely held companies (where the public is […]