Section 2(22)(e) of the Income Tax Act, 1961 deals with the taxation of certain loan transactions as “deemed dividends”.

It targets closely held companies (where the public is not substantially interested) that provide loans or advances to certain shareholders or concerns linked to such shareholders.

These payments, to the extent of the company’s accumulated profits, are treated as income in the form of dividends, even if no formal dividend is declared.

Key Conditions for Taxability of Deemed Dividend

For this section to apply, three conditions must be met:

- The lender must be a private company (or a company in which the public is not substantially interested).

- The loan must be given to either a shareholder holding at least 10% voting power or a concern in which such a shareholder has substantial interest (20% or more).

- The loan must be given out of accumulated profits.

Two Key Scenarios Explained

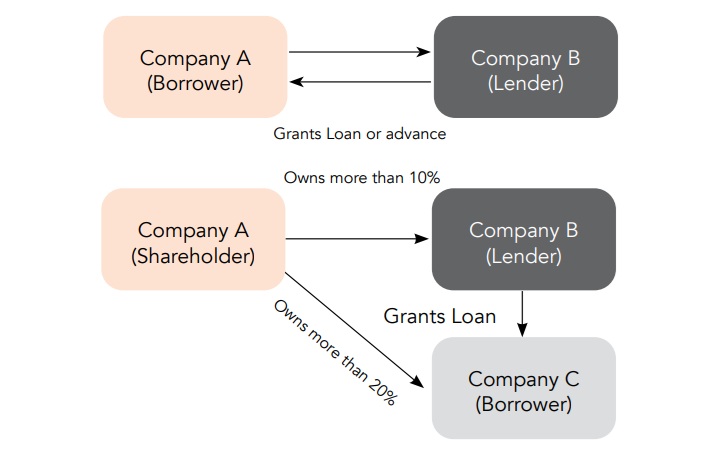

Scenario A: If the company directly gives a loan to a shareholder owning more than 10%, the deemed dividend is taxable in the hands of the shareholder.

Scenario B: If the loan is given to a company or concern in which such a shareholder holds at least 20%, the taxability becomes complex—whether it lies with the shareholder or the borrowing concern.

Who Should Be Taxed: Shareholder or Borrower?

There are two main views:

View 1: CBDT Circular No. 495 (1987) supports taxation in the hands of the borrower (i.e., the concern receiving the loan).

View 2: Supported by case law, including Bhaumik Colour Pvt. Ltd., Universal Medicare, Ankitech Pvt. Ltd., and Madhur Housing, the courts have held that deemed dividend is taxable only in the hands of the shareholder who holds a substantial stake in both entities, not in the hands of the borrower.

The recent decision by the Ahmedabad Tribunal in Aaryavart Infrastructure also affirms this interpretation, favoring taxation in the hands of the shareholder.

Treatment under International Tax and Tax Treaties

The OECD Model Tax Convention defines “dividends” as income from shares or similar rights, but not from debt claims like loans or advances. Section 2(22)(e), being about loans, may not qualify as “dividends” under tax treaties.

There are two views again:

View 1: Since Indian law treats deemed dividend as income, it should fall under the “dividend” article of tax treaties.

View 2 (preferred): Since deemed dividend arises from loans, not direct shareholding income, it doesn’t match the treaty definition of dividend. It is better classified under “Other Income” unless effectively connected with a PE.

Indian courts have noted distinctions between “payment” and “distribution”—Section 2(22)(e) uses “payment” unlike other clauses which use “distribution,” reinforcing that such transactions are not traditional dividends.

Transfer Pricing Implications

In cases where the loan is extended to a foreign entity with a common Indian shareholder, key considerations under transfer pricing (TP) arise:

Reporting Nature: The transaction should be reported in Form 3CEB as a loan (as per Section 92B), not as dividend. Though Section 2(22)(e) deems it to be dividend, TP focuses on the actual nature of the transaction.

Deeming Fiction Limits: Courts have consistently held that legal fictions like Section 2(22)(e) should not extend beyond their specific purpose. So, TP provisions should recognize the loan as debt, not dividend.

Secondary Adjustments and Potential Overlap

Under Section 92CE, if excess money from a transfer pricing adjustment is not repatriated, it’s treated as a deemed loan. There’s a theoretical risk of such a loan being treated as deemed dividend under Section 2(22)(e).

However, applying one fiction (TP) to another (deemed dividend) may not be legally sound. Courts have stressed that each fiction must be interpreted within its intended scope.

Conclusion

Deemed dividend under Section 2(22)(e) remains a complex and litigated area of tax law, especially in cross-border situations.

Indian jurisprudence and international tax principles suggest that such loans should be taxed in the hands of shareholders, not recipient concerns. Moreover, international tax treaties may not treat these as dividends at all, potentially classifying them under “Other Income”.

With growing foreign investment and India’s economic rise, clarity on these provisions is crucial. Consistent and precise interpretation of these laws will play a key role in building investor confidence and ensuring proper tax compliance.