This article analyses the amendments made by the Finance (No.2) Act, 2024 with respect to the provisions contained in Chapter XVII-B and XVII-BB of the Income-tax Act, 1961 relating to TDS and TCS.

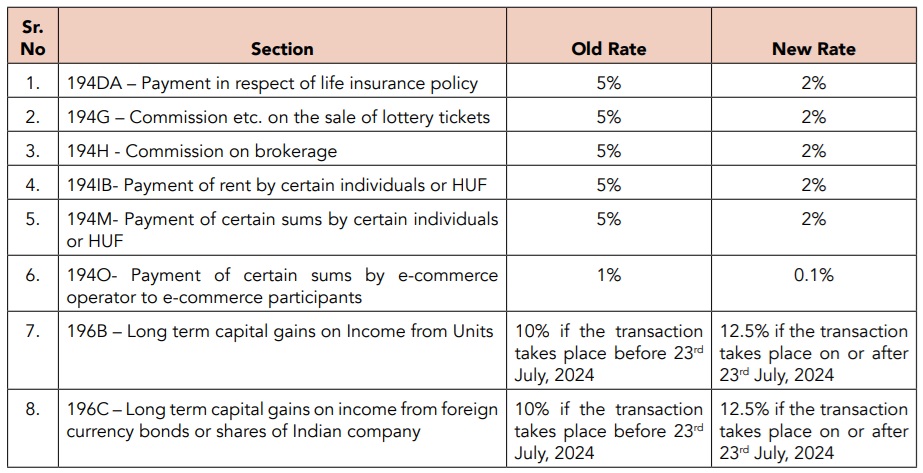

Summary of the rates of tax deducted at source under Chapter XVII-B

| Sr. No | Section | Old Rate | New Rate |

|---|---|---|---|

| 1 | 194DA – Payment in respect of life insurance policy | 5% | 2% |

| 2 | 194G – Commission etc. on the sale of lottery tickets | 5% | 2% |

| 3 | 194H – Commission on brokerage | 5% | 2% |

| 4 | 194IB – Payment of rent by certain individuals or HUF | 5% | 2% |

| 5 | 194M – Payment of certain sums by certain individuals/HUF | 5% | 2% |

| 6 | 194O – Payment by e‑commerce operator to participants | 1% | 0.1% |

| 7 | 196B – Long term capital gains on income from units | 10% before 23 Jul 2024 | 12.5% on or after 23 Jul 2024 |

| 8 | 196C – Long term capital gains on foreign currency bonds | 10% before 23 Jul 2024 | 12.5% on or after 23 Jul 2024 |

TDS on Salary [Section 192]

Section 192(2B) enables a taxpayer to furnish details of income under other heads and TDS thereon to his employer to be considered while deducting tax at source under section 192.

However, there is no provision to consider tax collected at source in the case of the employees for the purpose of tax deduction under section 192.

Therefore, to reduce the compliance burden in the hands of employees for claiming a refund from TCS and to avoid cash flow issues faced by them, it is suggested to allow the credit of TCS to be taken into account.

Also, section 192(2B) permits taking into account income under other heads and TDS thereon for the purpose of tax deduction under Section 192 (1), subject to fulfillment of certain conditions.

The scope of section 192(2B) has been expanded by substituting it w.e.f. 01.10.2024 to permit consideration of TDS and TCS for deducting tax under section 192(1). This is a benevolent provision providing clarity on an issue, which was hitherto silent.

Interest on Securities [Section 193]

Section 193 provides for a deduction of income tax at source on interest payable on securities to resident assessee. However, interest payable on any security of the Central Government/State Government has been excluded for this purpose.

Tax would, however, be deductible on interest payable on 8% Savings (Taxable) Bonds, 2003 or 7.75% Savings (Taxable) Bonds, 2018, if such interest payable during the fi nancial year is more than Rs.10,000.

The Finance (No.2) Act, 2024 has now provided that, in addition to the above, w.e.f. 01.10.2024, TDS under section 193 would also be attracted on interest payable on Floating Rate Savings Bonds, 2020 (Taxable), and any other notified security of the Central Government/ State Government, if the interest payable on such securities during the fi nancial year is more than Rs.10,000.

Payment on transfer of immovable property [Section 194-IA]

Section 194-IA(1) requires tax deduction by a person, being a transferee, responsible for paying to a resident transferor any amount as consideration for transfer of immovable property (except agricultural land).

The rate of TDS is 1% of the consideration or the stamp duty value, whichever is higher, and tax is to be deducted at the time of credit or payment, whichever is earlier, of such amount to the transferor.

However, no tax deduction is required if both the consideration for the transfer of an immovable property and the stamp duty value of such property are less than Rs.50 lakh.

Some taxpayers have, however, interpreted that the consideration being paid or credited indicates each individual payment and not the total consideration paid for the immovable property.

Therefore, a proviso has been inserted w.e.f. 01.10.2024 to clarify the requirement for TDS in cases where there is more than one transferor or transferee of any immovable property.

In such cases, the consideration would be the aggregate sum of the amounts paid or payable by all such transferees to the transferor or all such transferors for transfer of the immovable property.

Repurchase of units by Mutual Fund or Unit Trust of India [Section 194F]

Section 194F requires tax deduction @ 20% by the person responsible for paying the amount referred to in section 80CCB(2), which relates to investment made under the Equity Linked Savings Scheme.

The said section has been omitted w.e.f. 01.10.2024 because now most of the schemes of section 80CCB have been redeemed or withdrawn.

Commission/Remuneration on the sale of lottery tickets [Section 194G]

Section 194G requires tax deduction at source @ 5% by a person who is responsible for paying an amount exceeding Rs. 15,000 in the nature of commission/remuneration/prize of lottery tickets to a person stocking, distributing, purchasing or selling such tickets, at the time of credit of income to the payee’s account or at the time of payment, whichever is earlier.

The rate has been reduced from 5% to 2% w.e.f. 01.10.2024.

Payment of certain sums by certain individuals or Hindu undivided family [Section 194M]

Section 194M(1) requires an individual or HUF (other than those required to deduct under sections 194C/194H/194J) paying any amount for work (including supply of labour), commission, brokerage or fees for professional services during the year to deduct tax @ 5% at credit or payment, whichever is earlier. The rate has been lowered from 5% to 2% w.e.f. 01.10.2024.

Payments to partners of firms [Section 194T]

A new section 194T requires firms to deduct tax @ 10% on salary, remuneration, interest, bonus or commission paid to partners at credit or payment, whichever is earlier, w.e.f. 01.04.2025.

No deduction is required if aggregate payments to a partner in the year do not exceed Rs. 20,000.