In order to prevent the practice of receiving sum of money or the property without consideration or for inadequate consideration, section 56(2)(x) brings to tax any sum of money or the value of any property received by any person without consideration or the value of any property received for inadequate consideration.

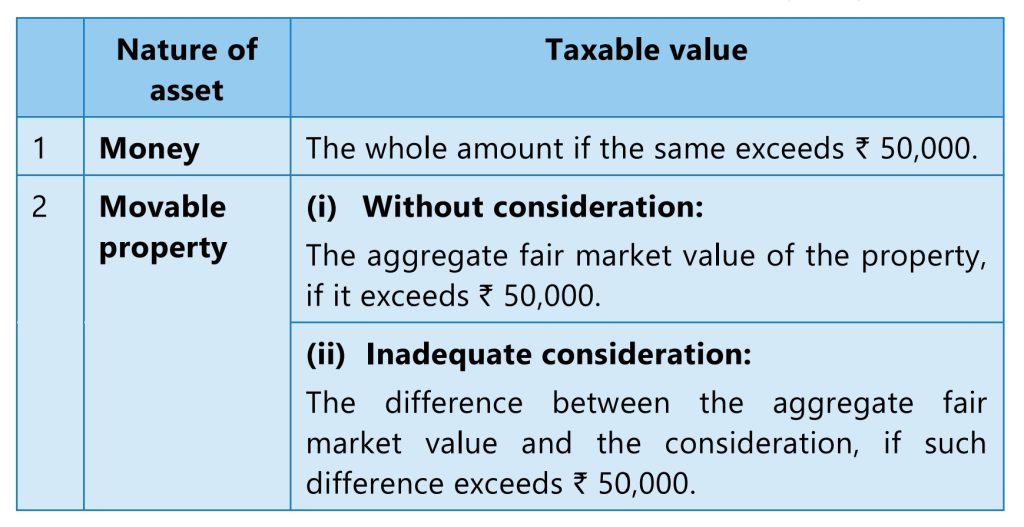

If any sum of money is received without consideration and the aggregate value of which exceeds Rs.50,000, the whole of the aggregate value of such sum is chargeable to tax.

Gift of an Immovable Property

If an immovable property is received without consideration, The stamp duty value of such property would be taxed as the income of the recipient if it exceeds Rs.50,000.

Taking into consideration the possible time gap between the date of agreement and the date of registration, the stamp duty value may be taken as on the date of agreement instead of the date of registration, if the date of the agreement fixing the amount of consideration for the transfer of the immovable property and the date of registration are not the same, provided whole or part of the consideration has been paid by way of an account payee cheque or an account payee bank draft or by use of electronic clearing system (ECS) through a bank account or through such prescribed electronic mode on or before the date of agreement.

The prescribed electronic modes notified are credit card, debit card, net banking, IMPS (Immediate payment Service), UPI (Unified Payment Interface), RTGS (Real Time Gross Settlement), NEFT (National Electronic Funds Transfer), and BHIM (Bharat Interface for Money) Aadhar Pay as other electronic modes of payment [CBDT Notification No. 8/2020 dated 29.01.2020].

Gifts Received for Inadequate Consideration

If consideration is less than the stamp duty value of the property and the difference between the stamp duty value and consideration is more than the higher of

- (i) Rs.50,000 and

- (ii) 10% of consideration,

the difference between the stamp duty value and the consideration shall be chargeable to tax in the hands of the assessee as “Income from other sources”.