TDS on Metal Scrap refers means that a businesses must withhold amount while making payments to suppliers for the purchase of metal scrap.

For example

When a business buys metal scrap amounting Rs 50,000, it will deduct 2% TDS i,e., Rs 1,000 and pay Rs 49,000 to the supplier. The deducted amount will then to be deposited with the government.

Introduction

The introduction of TDS under GST Act has been a significant step towards improved tax collection, reduction in tax evasion, simplifying process and improving tax compliance in India.

Applicability

TDS is applicable on GST payable by a registered person to the government where the total taxable value of goods or services exceeds a specified threshold.

The registered person shall deduct certain amount of the GST and directly remit it to the government.

However, the Input Tax Credit (ITC) can be claimed by the supplier on the TDS deducted by the payer.

Section 51 of the CGST Act, 2017, a department or establishment of the Central Government or State Government or local authority or Governmental agencies or such persons or category of persons as may be notified by the Government are required to deduct tax at the rate of one per cent where the total value of such supply exceeds two lakh and fifty thousand rupees.

Official Notification

As per Notification No. 50/2018 – Central Tax dated 13th September, 2018-

“the Central Government hereby appoints the 1st day of October, 2018, as the date on which the provisions of section 51 of the said Act shall come into force with respect to persons specified under clauses (a), (b) and (c) of sub-section (1) of section 51 of the said Act and the persons specified below under clause (d) of sub-section (1) of section 51 of the said Act, namely:-

(a) an authority or a board or any other body, –

(i) set up by an Act of Parliament or a State Legislature; or

(ii) established by any Government, with fifty-one per cent. or more participation by way of equity or control, to carry out any function;

(b) Society established by the Central Government or the State Government or a Local Authority under the Societies Registration Act, 1860 (21 of 1860);

(c) public sector undertakings.”

A further amendment has been made to the above notification through Notification No. 25/2024 – Central Tax dated 09th October, 2024 that another clause shall be inserted after clause (c) of the above said notification as follows-

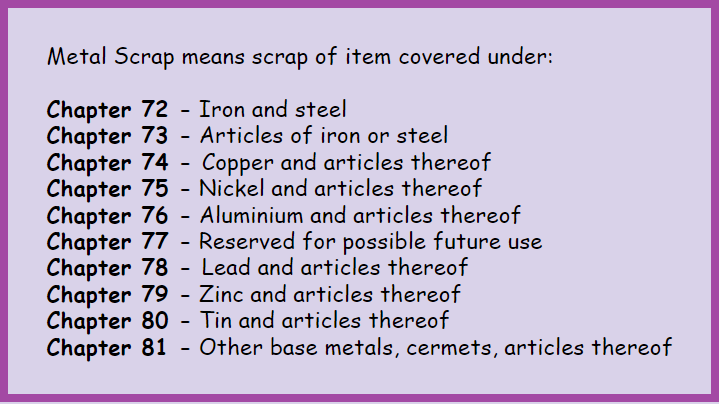

“(d) any registered person receiving supplies of metal scrap falling under Chapters 72 to 81 in the First Schedule to the Customs Tariff Act, 1975 (51 of 1975), from other registered person”

Explanation

In simple words, Notification No. 25/2024 – Central Tax, was introduced to impose TDS under GST for metal scrap transactions in case of Business-to-Business (B2B) transactions.

Effective date

The above notification shall come into force with effect from the 10th day of October, 2024.

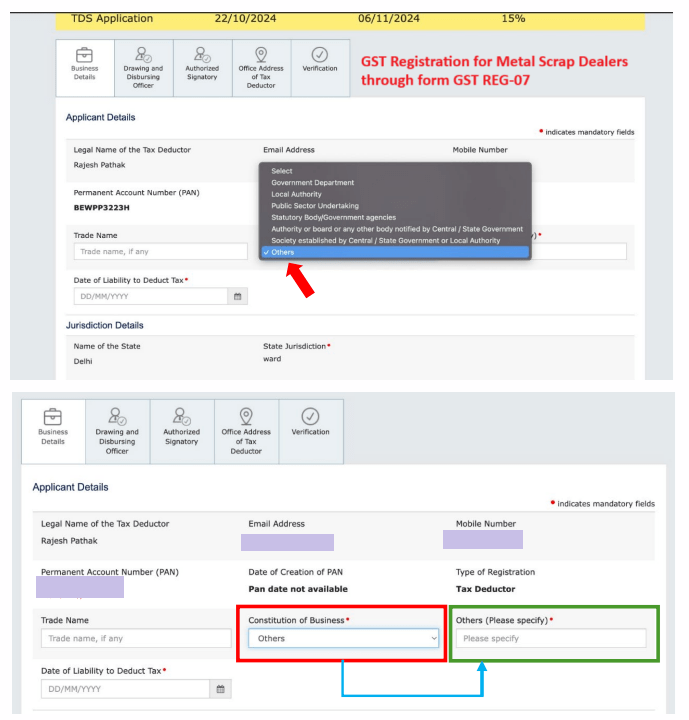

Separate registration

Form REG-07 has been introduced for TDS deduction registration.

TDS Rates

Businesses are required to deduct 2% from registered suppliers.

Intra State : CGST – 1% & SGST – 1%

Inter State : IGST 2%

Monthly Updates

Form GSTR-7 shall be filed on the 10th of subsequent month and the form contains details such as TDS deducted, amount paid to supplier, GSTIN details and other relevant information.

Key Points on Reporting TDS for Metal Scrap Supplies

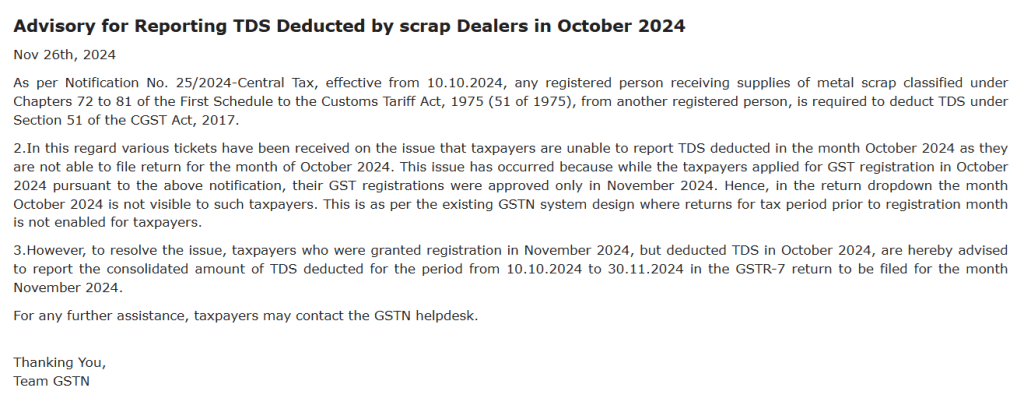

Issue with October 2024 Return

Taxpayers who applied for GST registration in October 2024 cannot file returns for October due to system limitations.

This issue has occurred because the taxpayers applied for GST registration in October 2024 pursuant to the above notification, their GST registrations were approved only in November 2024. Hence, in the return dropdown the month October 2024 is not visible to such taxpayers.

This is as per the existing GSTN system design where returns for tax period prior to registration month is not enabled for taxpayers.

Resolution

Report TDS deducted for 10.10.2024 to 30.11.2024 in GSTR-7 for November 2024.

Advisory for Reporting TDS Deducted by scrap Dealers in October 2024

Registration Process for Metal Scrap Buyers

As per the advisory issued on October 13, 2024, the GST portal has been updated to help metal scrap buyers register using Form GST REG-07.

Taxpayers in this category must select “Others” in Part B of Table 2 under the “Constitution of Business” section and then enter “Metal Scrap Dealers” in the text box.

This step is mandatory for those selecting “Others” in Table 2.

After this, fill the remaining details and submit the form on the GST portal to complete registration as per Notification No. 25/2024 – Central Tax, issued on October 9, 2024.

FAQs

Businesses which are involved in B2B transactions including the purchase of metal scrap from registered suppliers are required to deduct TDS.

TDS on metal scrap does not apply to unregistered suppliers or individual sellers.

The TDS mechanism will help the government to track metal scrap transactions and improve tax compliance.