TCS on car purchase is a provision under the Income Tax Act where dealer or sellers are requires to collect a percentage of the sale price as tax from buyers at the time of the sale.

It helps in ensuring that tax is collected at the source of the transaction by making it easier for the tax authorities to track large transactions.

Rule of TCS on the car purchase

When you bought a car which costs above 10 lakh rupees, you need to pay 1% Tax Collected at Source (TCS).

TCS is deducted by the dealer and deposited to the government against your pan card number.

After deducting the TCS, dealer or seller will issue the TCS certificate to the buyer.

The certificate will include all basic details such as the seller’s TAN number and buyer’s PAN number.

Time limit To deposit TCS

It is mandatory for the dealer who deducts TCS to deposit with the government within 30 days of the sale.

What if buyer doesn’t have PAN?

The TCS rate will be 10% if the buyer does not provide PAN to the seller.

How to check TCS credit in income tax portal?

You can checkout online on quarterly basis via 26AS.

26AS is a consolidated Annual Information Statement for a particular Financial Year (FY).

Steps to check 26AS

- Visit the official e-filing website and log in using your credentials.

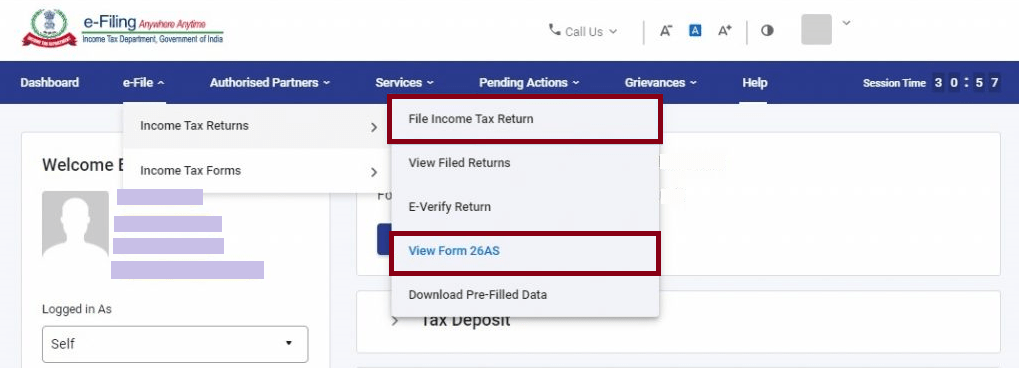

- Go to the ‘e-file’ menu. Click on ‘Income Tax Returns’ and select ‘View Form 26AS’ from the drop-down menu.

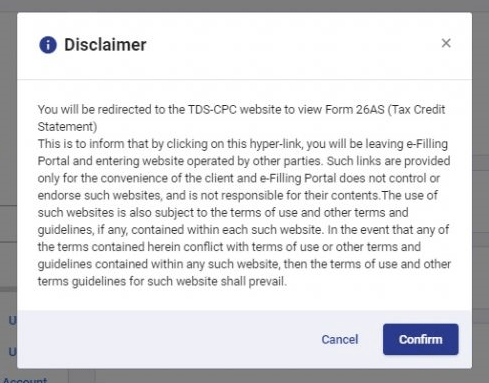

- Click ‘Confirm’ on the disclaimer to be redirected to the TRACES website.

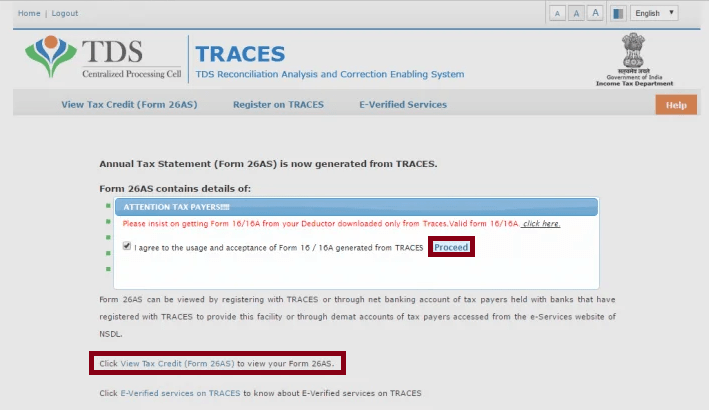

- On the TRACES (TDS-CPC) website, select the box on the screen. Click on ‘Proceed’. Click on the link at the bottom of the page: ‘View Tax Credit (Form 26AS)’.

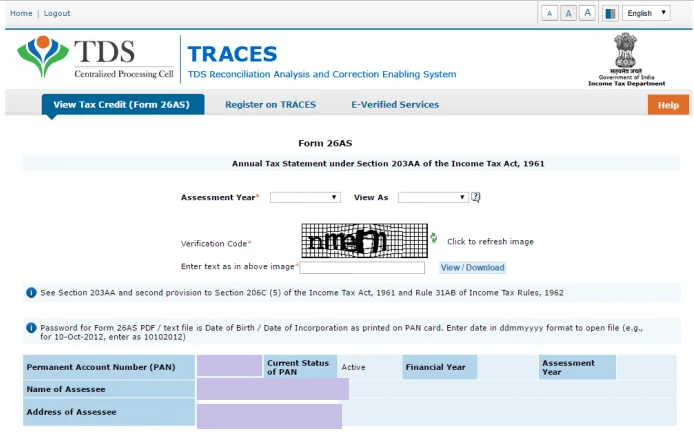

- Select the Assessment Year you want to view. Choose the format (HTML to view online, or PDF to download). Enter the ‘Verification Code’. Click on the ‘View/Download’ button.

- After downloading, open the file to view your Form 26AS.

Is TCS Refund on Car Purchase Possible?

Yes, buyer can claim the benefit of TCS refund while filling his ITR in two cases.

Case 1

If your total income is less than 5 Lakh rupees in a year after all deduction then you can get full refund.

Case 2

If your total income is more than 5 Lakh rupees in a year after all deduction then your TCS is adjusted over net tax liability.

From the two cases we got to know that if your tax liability is less than TCS then you will get refund little bit or else its fully set off against tax liability.

What is the higher TCS rate?

The higher TCS rate will be the highest of:

- Two times the standard TCS rate mentioned in the Income Tax Act.

- 5% TCS.

When the Higher TCS Rate is charged?

According to Section 206CCA, a higher TCS rate is applicable when the buyer:

- has not filed ITR for the last two financial years before the relevant year when TCS is collected.

- time limit to file ITR has expired.

- total TCS and TDS was more than ₹50,000 in each of these two financial years.

Click here to know how long will it take for ITR refund.

FAQs

Yes, you can claim a refund of TCS from the government if you are not liable to pay income tax.

Yes, TCS is applicable on sale of second-hand car.

A fee of Rs 200 per day is charged for late filing.

A penalty between Rs 10,000 and Rs 1,00,000 can be levied for incorrect filing.