Tax on YouTube income is levied in two categories:

- GST – Applicable if income exceeds ₹20 lakh from services.

- Income Tax – Taxed as business/professional income under slab rates.

Taxability Under GST

When YouTubers are considered as supplier of services?

YouTubers are to be considered as supplier of services when a creator post video’s and content on their channel with monetization and providing a platform for advertising.

Is GST Registration Mandatory?

Yes, GST Registration becomes mandatory for the Youtuber if the total turnover exceeds Rs.20 Lakh in the Financial Year.

GST on Income from YouTube and Blogging

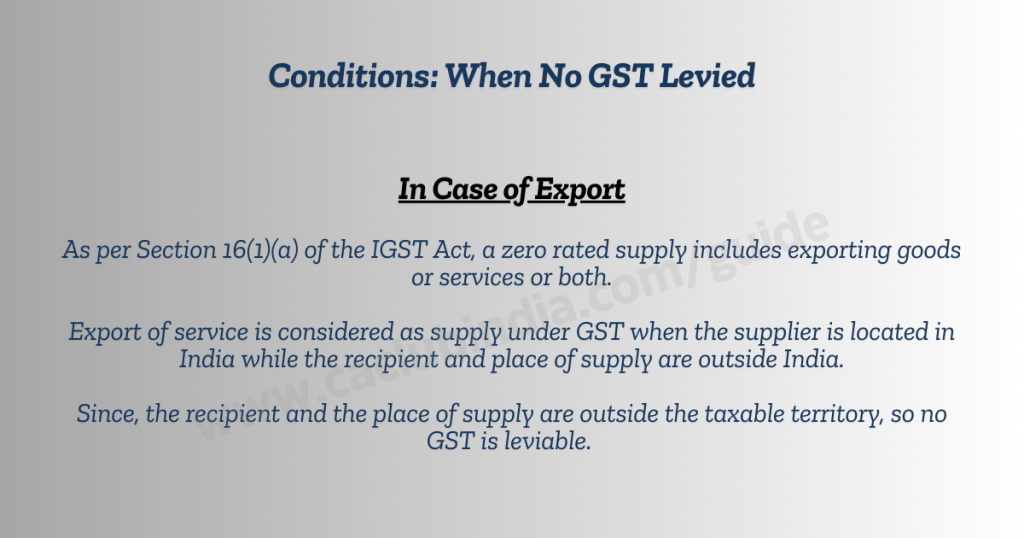

Zero-Rated Services for Ad Revenue

YouTubers and bloggers providing services to platforms like Google AdSense or YouTube (outside India) fall under export of services, which is zero-rated under GST. They have two options:

- Export with LUT/Bond – They can export services without paying GST by filing Letter of Undertaking (LUT) in Form RFD-11.

- Pay GST and Claim Refund – They can pay GST at 18% and later claim a refund of the tax paid.

GST on Paid Promotions (App Promotion, Brand Deals, etc.)

If a YouTuber promotes an app, brand, or any product, it is considered a supply of service, which attracts 18% GST.

GST Compliances Required for YouTuber

GSTR-1 and GSTR-3B are required to be filled just like other taxpayers.

Must have GST invoice for all the services rendered.

Invoice must mention the invoice date, the value of services offered and the GST rates.

Taxability Under Income Tax

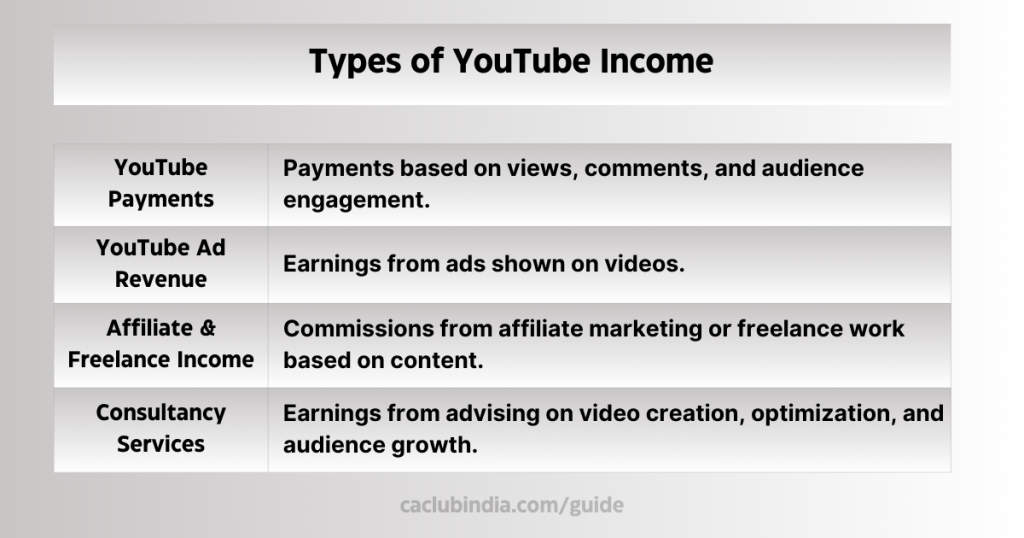

Income earned by Youtuber is classified mainly into two categories:

- Income from Other Source.

- Income from Business or Profession.

Which ITR Form to Choose for Filling?

ITR-3 Form

This form is applicable to individuals and Hindu Undivided Families (HUFs) who earn income from Business or profession (requiring maintenance of books of accounts)

Individuals and HUFs filing ITR-3 can choose between the Old Tax Regime (with deductions) or the New Tax Regime (without major deductions).

ITR-4 Form

This form is applicable to Profession u/s 44ADA (Presumptive Taxation for Professionals) whose gross receipts up to ₹75 lakh (w.e.f. AY 2024-25). Minimum 50% of gross receipts treated as income

FAQs

Yes, income earned from YouTube (AdSense revenue, sponsorships, promotions, etc.) is taxable under Income Tax Act, 1961.

Yes, expenses like video equipment, internet, rent, and travel can be deducted from taxable income.

If payments received from Indian sponsors then TDS is applicable.