Statutory Audit Meaning

A statutory audit is a compulsory audit of the financial records of a business conducted by an external entity. This audit is made compulsory under the law or statute that governs a company’s ethics and principles.

It is done by checking bank accounts, transactions, ledgers, financial statement, booking records and various critical documents which are submitted for government records and tax purpose.

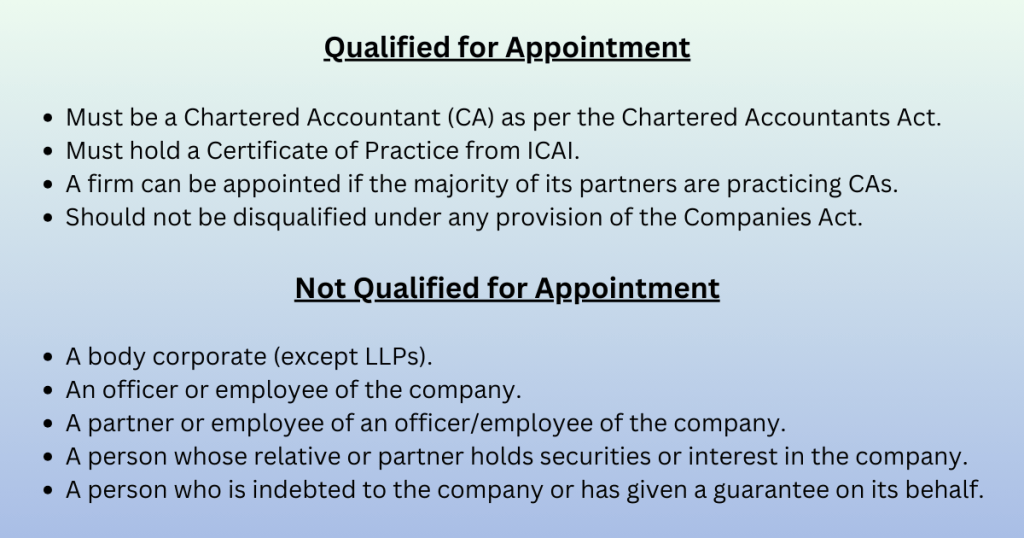

Who Qualifies for Statutory Audit Appointment and Who Doesn’t?

Difference Between Internal Audit and Statutory Audit

| Internal Audit | Statutory Audit |

| The nature and scope of internal audit are fixed by the management. | The nature and scope of statutory audit are fixed by the Law. |

| It is not Compulsory | It is made compulsory by Statute. |

| The internal auditor and his staff are appointed by the management and their duties and remuneration are fixed by them. | The statutory auditor is appointed by the shareholders. His rights, duties and liabilities are laid down by the Companies Act, 2013. |

| Internal auditor is an employee of the company. | Statutory auditor is an independent person. |

| Internal auditor need not be a Chartered Accountant. | Statutory auditor must be a Chartered Accountant. |

| Internal auditor can be removed at any time by the management. | Statutory auditor can only be removed by the shareholder and that too after undergoing the procedure laid down by the Companies Act. |

| The auditor is not required to attend the shareholders meetings. | The law gives a right to the statutory auditor to attend the annual general meeting. |

Audit Process

Internal Control verification

- To review processing pattern of company / firm from purchase order placed by company to actual delivery to its customer.

- If there is too much reversal of accounting entries, the companies’ internal controls in bookkeeping are weak, higher chances of accounting error.

Statutory compliances

GST Compliance

Input tax credit

- To verify eligibility, invoice type (B2B/B2C).

- To ensure that the invoice against which ITC claimed have been paid within 180 days from the date of invoice.

- If Non–GST invoice received, then check the number and volume of invoices received from the same vendor during the year.

- To reconcile monthly balance in E-ledger with books.

Output tax Liability

- To check invoice series from the new financial year have started from new series.

- To Check whether the nature of tax levied is as per destination of goods.

- To verify HSN/SAC-wise recording for ICFR compliance.

- To confirm RCM tax payment where applicable.

- To match E-way bills with invoices.

- To monitor credit notes and their impact on GST returns.

- To ensure correct treatment of zero-rated supplies under LUT.

Input Tax Credit

- Check whether invoice received in B2C or B2B.

- Check whether expenses are eligible for input tax credit.

- Ensure that the invoice against which ITC claimed have been paid within 180 days from the date of invoice (aging clause).

- If Non–GST invoice received, then check the number and volume of invoices received from the same vendor during the year, If volume is high then confirm the applicability of GST on vendor.

- Reconcile monthly balance in E-ledger with books.

Tax Deducted at Source Compliances

- Tax Deducted at Source Checklist

- To Ensure Form 26AS matches with Form 16A

- To verify tax payable according to returns, challans or advances given to vendors.

- To review Dividend Distribution Tax, if the business offers dividends to the shareholders.

- Encashment of Gratuity, Leaves, Bonus, ESIC, and Provident Fund.

ROC Compliances

ROC compliances are necessary to know the default status of the company.

- Form ADT–1: Appointment of Auditor.

- Form AOC–4: Filling of statement of accounts.

- Form MGT–7: Filling of Annual Returns.

- Form MGT–14: Filling of resolution and agreement to ROC

- Form CRA–4: Filling of cost auditor report, if applicable)

- INC–22: Director KYC

- DPT–3 and MSME compliance form.

This audit process ensures compliance, accuracy, and risk mitigation in financial reporting.