Securities Transaction Tax (STT) was introduced in the year 2004 Union Budget and came into effect from 1st Oct 2004.

SST is governed by Securities Transaction Act which has specifically listed down various taxable securities transactions.

Here taxable securities include equity, derivatives, unit of equity oriented mutual fund.

Unlisted shares sold via an offer for sale during an Initial Public Offering (IPO) and later listed on stock exchanges are subject to Securities Transaction Tax (STT).

Important Update

Impact on Transaction Value

STT is an additional tax added to the transaction value which increases the overall transaction cost i.e., the effective cost of buying or selling shares increases due to this additional charge.

Purpose

The purpose is to mitigate tax evasion as the same is taxed at source.

Scope of securities liable for STT

- Shares, scrips, stocks, bonds, debentures, debenture stock or other marketable securities of a like nature in or of any incorporated company or other body corporates.

- Derivatives.

- Units or any other instrument issued by any collective investment scheme to the investors in such schemes.

- Government securities of equity nature.

- Equity-oriented units of mutual funds.

- Rights or interest in securities.

- Securitised debt instruments.

Note –

- These securities must be traded on recognized stock exchanges for STT to apply.

- Off-market transactions do not attract STT.

STT Charges

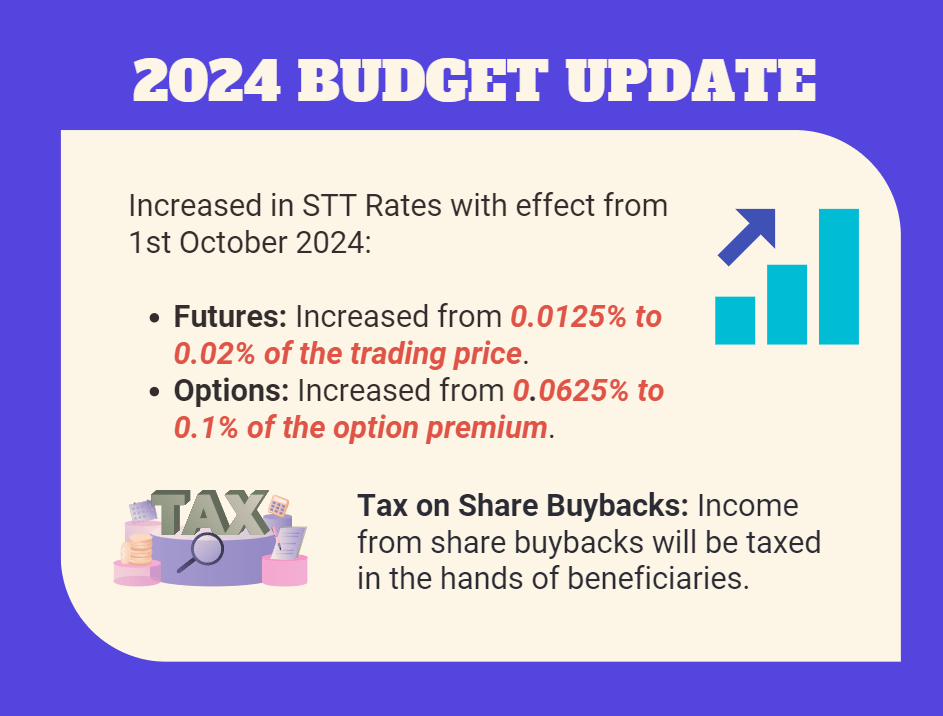

| Order Type | From 1st April 2023 | From 1st Oct 2024 |

| Equity intraday | 0.025% | – |

| Equity delivery | 0.1% | – |

| Options | 0.0625% | 0.01% |

| Futures | 0.0125% | 0.02% |

Capital Gain Tax

The tax has been classified into two:

Short Term Capital Gain (STCG)

It applies if shares like mutual fund, units of UTI etc has been sold within 12 months.

In this case the rate of tax is 15% till 22nd July 2024.

The tax rate on such securities has increased to 20% from 23rd July, 2024.

Long Term Capital Gain (LTCG)

It applies if the shares has been sold after 12 month of owning it.

In this case the rate of tax is 10% till 22nd July 2024.

The tax rate on such securities has been increased to 12.5% from 23rd July, 2024.

Long Term Capital Gains Tax With No Indexation – Click Here

Impact on Traders and Investors

The increase rate in STT will impact traders engaged in high-frequency trading.

Higher transaction costs may lead to a more disciplined trading approach among retail investors.

By raising the cost of trades, the government aims to promote more cautious participation in the derivatives market and to and ensure that tax rates are aligned with the increasing value of transactions in the derivatives market.

FAQs

The STT on Futures has increased to 0.02% and on Options to 0.1%.

The new STT rates will be applicable from 1st October 2024.

Yes, off-market transactions are exempt from STT.