Section 92E applies to international and specified domestic transactions between Associated Enterprises (AEs), with at least one party being a non-resident.

Transactions Covered Under Section 92E

- Buying, selling, or leasing tangible/intangible property.

- Cost-sharing agreements between Associated Enterprises.

- Lending/borrowing money.

- Transactions impacting income, profits, or losses.

Purpose of Form 3CEB

Form 3CEB is required to be filed by taxpayers engaged in any international transaction or certain specified transactions with an associated enterprise.

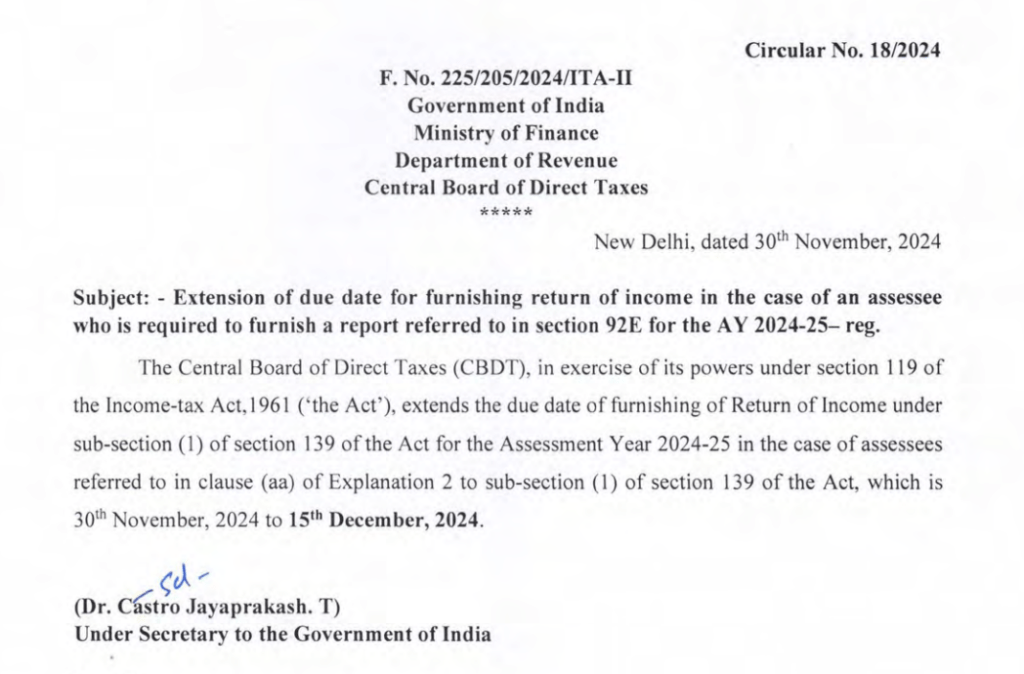

Filing Deadline

Original Due Date: 30th November 2024

Extended Date: 15th December 2024

The CBDT has extended the due date for filing income tax returns for AY 2024-25 from 30th November 2024, to 15th December 2024.

Is it compulsory to file Form 3CEB?

Yes, its compulsory.

As per section 92E read with Rule 10E, an assessee who has entered into an international transaction or specified domestic transaction, during the previous year with an associated enterprise is required to file form 3CEB and any income arising from an international transaction shall be computed having regard to the arm’s length price.

As per Rule 10E, every assessee who has entered into international transaction or specified domestic transaction during the previous year shall obtain a report from Chartered Accountant in Form 3CEB.

The Form has to be uploaded by CA using DSC.

What are the prerequisites for filing of Form 3CEB?

- Taxpayer and CA are registered on the e-Filing portal with valid user ID and password

- Status of PAN of taxpayer and CA is active

- Taxpayer has assigned CA for form 3CEB

- CA and Taxpayer have a valid and active Digital Signature Certificate.

Penalty for Non-Compliance

If fails to furnish the report within the deadline a penalty will be levied amounting to Rs. 1,00,000.