Section 194Q, introduced via the Finance Act 2021 and effective from 1st July 2021, mandates Tax Deducted at Source on the purchase of goods exceeding a specified threshold.

This provision aims to enhance tax compliance, track high-value transactions, and widen the tax net.

Applicability

This section applies to buyers meeting specific criteria:

- Buyers with turnover exceeding Rs 10 crores in the previous financial year.

- Buyers responsible for making payments to resident sellers.

- Total purchases over Rs 50 lakh in a financial year attract TDS under this section.

Major Relief for Sellers from FY 2025-26

Rate of TDS

The buyer is liable to deduct TDS at the rate of 0.1% on the amount exceeding Rs 50 lakh from a seller.

For Example

If a buyer purchases goods worth Rs 60 lakh, then TDS is applicable only on Rs 10 lakh at 0.1%.

Calculation

A buyer with a turnover of ₹12 crore, purchases goods worth ₹70 lakh from a resident seller in FY 2024-25.

Working:

| Threshold: | ₹50 lakh. |

| Taxable Amount: | ₹70 lakh – ₹50 lakh = ₹20 lakh. |

| TDS Amount: | ₹20 lakh × 0.1% = ₹2,000. |

Time of Deduction

TDS is to be deducted –

- at the time of crediting to the seller’s account or

- at the time of making payments thereof any any mode, whichever is earlier.

Due Date To Deposit TDS

TDS must be deposited by the 7th of the following month. For March deductions, the due date is April 30.

Key Points

- Deduct TDS on payment or credit.

- This section doesn’t apply to non-resident sellers.

- Failure to comply may lead to a disallowance of expenditure, up to 30%. Further demand can be also raised u/s 201(1) of the Income Tax Act for non deposit of TDS and penalty can also be levied on the same u/s 221 of the Act.

- Applies to purchases of both revenue and capital goods.

Non-furnishing of PAN

If a seller doesn’t provide a PAN, TDS is deducted at 5%, higher than the standard rate of 0.1%.

GST Consideration

TDS is computed on amounts excluding GST.

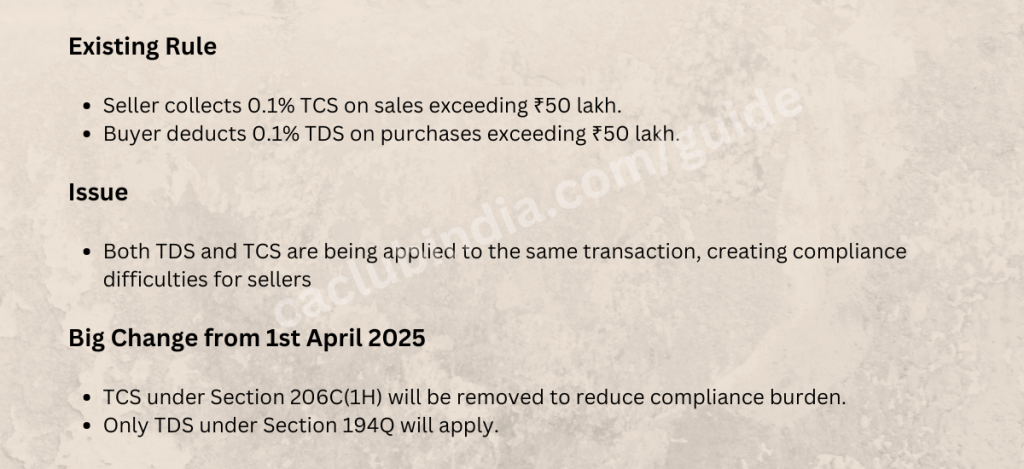

TDS u/s 194Q Vs TCS u/s 206(1H)

| Particulars | Section 194Q | Section 206(1H) |

| Who is Responsible? | Buyer | Seller |

| Applicable | Turnover of the buyer must exceed Rs. 10 cr during the previous year (excluding GST) Aggregate purchase of goods exceeding Rs. 50 Lakh in previous year (including GST) | Turnover of the seller must exceed 10cr during the previous year (excluding GST) Sale consideration received exceeds Rs. 50 Lakh in previous year (including GST) |

| Effective From | 1st July 2021 | 1st October 2020 (w.e.f 1 April 2025, TCS u/s 206C(1H) will be removed). |

| When | At the time of payment or credit | At the time of receipt |

| Quarterly Statement | Form 26Q | Form 27EQ |

Conclusion

Section 194Q simplifies TDS deductions on purchases exceeding Rs 50 lakh. Buyers deduct 0.1% TDS on qualifying purchases from resident sellers when PAN details are available.

FAQs

No, the obligation to deduct tax under this provision arises only when the payment is made to a resident seller.

Yes, section 194Q is applicable to the purchase of capital goods or revenue goods.

The Debit Note increases the purchase value and the same should be considered for the calculation.