Section 194P was introduced in Budget 2021 to provide conditional relief to senior citizen above the age of 75 years from filling the IT Return.

Conditions for Exemption

The key conditions for exemption:

Age Requirement

He/she should be 75 years or older.

Resident Status

The Senior citizen must be a resident of India during the financial year.

Income Source

The income should include only pension income and interest income. Interest income from accounts maintained in the same bank where the pension is credited.

Specified Bank

The bank must be a specified bank notified by the central government. Such banks will be responsible for the TDS deduction of senior citizens after considering the deductions under Chapter VI-A and rebate under 87A.

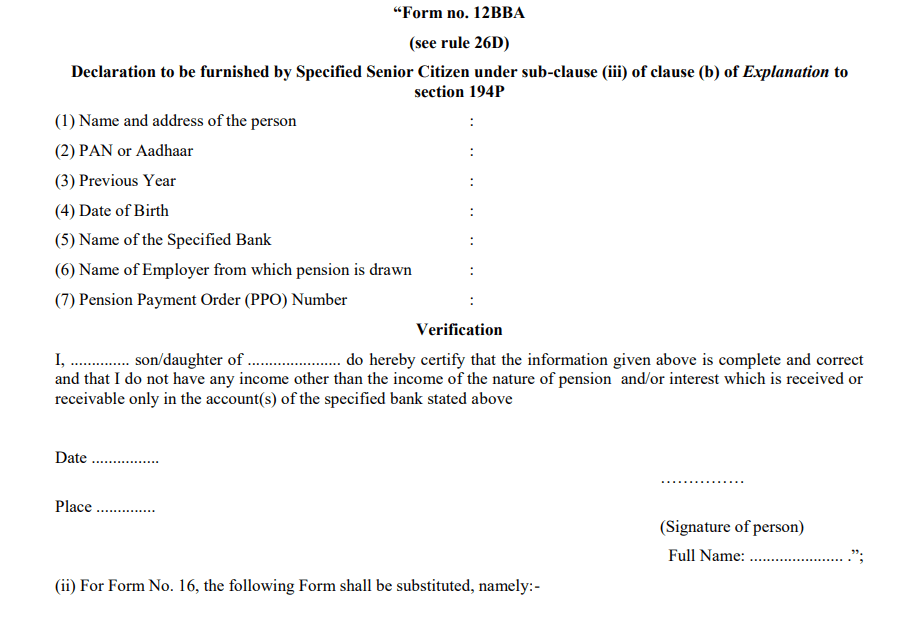

Declaration to Bank

The senior citizen must submit a declaration in Form 12BBA to the specified bank, providing details of income and deductions under applicable sections (like Section 80C, 80D, etc.).

Once the specified bank deducts tax for senior citizens above 75 years of age, there will be no requirement to furnish income tax returns by senior citizens

How to File the Declaration?

Form No. 12BBA to be furnished in paper form and it should contain the following details:

- Total income of senior citizen

- Deductions available under section 80C and 80U

- Rebate available u/s 87A

- Confirmation from the senior citizen of having only pension and interest income

Declaration Form Format

FAQs

Senior citizens who are:

a. 75 years or above,

b. Residents of India,

Earning income solely from a pension and interest from the same bank where the pension is credited, qualify for this exemption.

Section 194P came into effect from April 1, 2021.