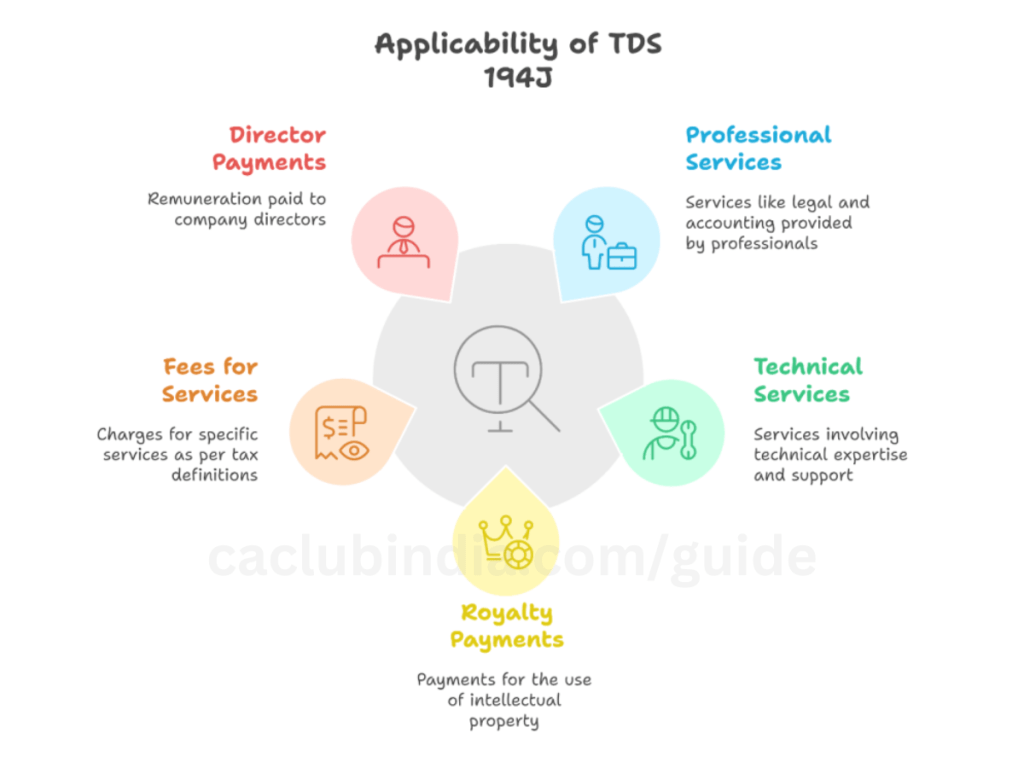

Section 194J of the Income Tax Act in India relates to Tax Deducted at Source (TDS) on payments for professional and technical services. This section requires tax deduction from payments made for certain professional services, technical services, royalties, and fees paid to directors.

Applicability

Rate of TDS

- 2% in case of fees for technical services (not being professional services) or royalty-like consideration for the sale, distribution or exhibition of cinematographic films and

- 10% in other cases

(In case of a payee engaged only in the business of operation of a call centre, the tax shall be deducted at source at 2%)

Time of Deduction

The deduction is to be made at the time of credit of such sum to the account of the payee or at the time of payment thereof in cash or by issue of a cheque or draft or by any other mode, whichever is earlier.

Where such sum is credited to any account, whether called suspense account or by any other name, in the books of accounts of the person liable to pay such sum, such crediting shall be deemed to be the credit of such sum to the account of the payee and tax has to be deducted accordingly.

Threshold Limit

| Nature of payment | TDS Rate | Current Threshold | Proposed Threshold |

| Technical Services | 2% | ₹30,000 | ₹50,000 |

| Professional Services | 10% | ₹30,000 | ₹50,000 |

| Royalty in the nature of consideration for sale, distribution or exhibition of cinematographic films | 2% | ₹30,000 | ₹50,000 |

| Other royalty | 10% | ₹30,000 | ₹50,000 |

| Non-compete fees | 10% | ₹30,000 | ₹50,000 |

Revised Limit

Starting from FY 2025-26, the TDS threshold has been raised to ₹50,000 for professional and technical services. This indicates that if the total payment made to a resident for such services within a financial year is ₹50,000 or less, there is no requirement to deduct TDS.

Non-Applicability of TDS u/s 194J

- An individual or a Hindu undivided family is not liable to deduct tax at source.

- However, an individual or HUF, whose total sales, gross receipts or turnover from business or profession carried by him exceeds Rs. 1 crore in case of business or Rs. 50 lakhs in case of profession in the financial year immediately preceding the financial year in which the fees for professional services or fees for technical services is credited or paid is required to deduct tax on such fees.

- Further, an individual or HUF, shall not be liable to deduct income-tax on the sum payable by way of fees for professional services, in case such sum is credited or paid exclusively for personal purposes.

Conclusion

The rise in the TDS limit under Section 194J starting from FY 2025-26 is a positive development for small professionals and businesses, as it lessens the compliance burden and enhances cash flow. Nevertheless, it’s important to remain informed about any additional Income Tax Act amendments and ensure accurate documentation and reporting of all transactions.

FAQs

No, the increased limit of ₹50,000 applies specifically to:

1. Professional services,

2. Technical services.

For other payments like royalties or fees for technical services, the existing limits and rates may still apply unless otherwise specified.

No, the increased TDS limit of ₹50,000 applies only to resident payees. For non-residents, the TDS rates and limits are governed by the Income Tax Act and DTAA provisions.

The increase in the TDS limit aims to:

1. Reduce compliance burden for small professionals and businesses,

2. Improve cash flow for payees by reducing the need for TDS deductions on smaller payments,

3. Simplify the TDS process for small transactions