Section 194B of the Income Tax Act requires tax deducted at source (TDS) on earnings from lotteries, crossword puzzles, and games. Until April 1, 2025, TDS will be deducted 30% for winnings over ₹10,000. After that date, TDS will apply to all winning amounts. The person responsible for the deduction is required to provide a TDS certificate and submit a TDS return. Winners can claim this TDS as a credit while filing their tax returns.

| Beginning April 1, 2025, Section 194B of the Income Tax Act will be significantly revised regarding Tax Deducted at Source (TDS) on winnings from lotteries, crossword puzzles, card games, and various other gambling activities. Presently, TDS applies when total winnings exceed ₹10,000 within a financial year. The new amendment suggests that TDS will be deducted on any individual transaction that exceeds ₹10,000, thereby removing the requirement to consider the annual cumulative total. |

In Summary

Current Rule

TDS is deducted if the total winnings from lotteries, crossword puzzles, etc., exceed ₹10,000 in a financial year.

New Rule (Effective April 1, 2025)

TDS will be deducted on each individual transaction exceeding ₹10,000.

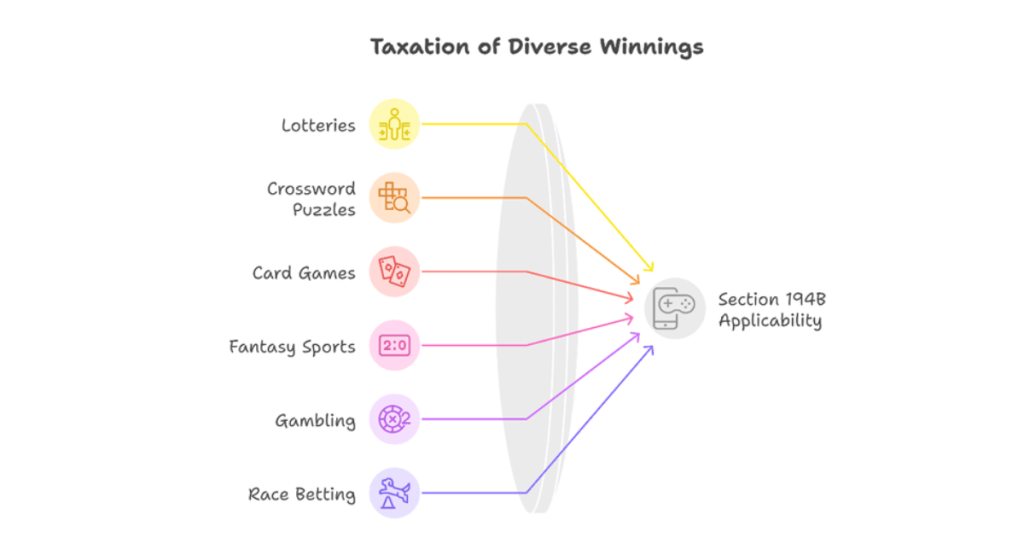

Applicability of Section 194B

Section 194B of the Income Tax Act, 1961, applies to the following types of winnings:

- Lotteries

- Crossword puzzles

- Card games

- Fantasy sports

- Gambling

- Race betting

- TV shows

- Other games of any sort

Rate of TDS u/s 194B

Under Section 194B, TDS at 30% is deducted on winnings from lotteries, puzzles, and games, effective on any amount from 1st April 2025.

When should TDS be deducted Under Section 194B?

TDS under Section 194B must be withheld at the moment winnings from lotteries, puzzles, and games are paid out.

Penalty for non-compliance under Section 194B

- Failure to Deduct TDS: If the person responsible for paying the winnings fails to deduct TDS, they may be liable to pay interest at the rate of 1% per month or part thereof on the amount of TDS that was not deducted, from the date on which it was deductible to the date on which it is deducted.

- Failure to Deposit TDS: If TDS is deducted but not deposited with the government, the person responsible may be liable to pay interest at the rate of 1.5% per month or part thereof on the amount of TDS that was not deposited, from the date on which it was deducted to the date on which it is paid.

- Penalty for Late Filing of TDS Returns: If the TDS return is not filed on time, a penalty of ₹200 per day of default may be imposed, subject to a maximum of the amount of TDS deductible.

- Penalty for Non-filing of TDS Returns: If the TDS return is not filed at all, a penalty ranging from ₹10,000 to ₹1,00,000 may be imposed.

- Prosecution: In cases of willful non-compliance or failure to pay TDS, the person responsible may face prosecution, which can lead to imprisonment ranging from 3 months to 7 years, along with a fine.

Example to Illustrate How Section 194B of the Income Tax Act Works

Rahul wins ₹15,000 from a lottery on 15th May 2024. The lottery organizer is responsible for paying out the winnings.

Before 1st April 2025

The winnings exceed the threshold of ₹10,000.

| TDS Amount = ₹15,000 * 30% = ₹4,500 Net Amount = ₹15,000 – ₹4,500 = ₹10,500 |

The lottery organizer must issue a TDS certificate (Form 16A) to Rahul within 15 days from the due date for furnishing the statement of TDS.

The lottery organizer must file a TDS return (Form 26Q) quarterly, detailing the TDS deducted and deposited.

From 1st April 2025

The threshold of ₹10,000 is removed, so TDS applies to any amount of winnings.

| TDS Amount = ₹5,000 * 30% = ₹1,500 Net Amount = ₹5,000 – ₹1,500 = ₹3,500 |

The same rules apply for issuing the TDS certificate and filing the TDS return as mentioned above.

This update is designed to streamline the TDS process by concentrating on individual transactions instead of total amounts over the financial year. It is crucial for those involved in lotteries, gambling, or related activities to be informed about this change to accurately comprehend their tax responsibilities.

Conclusion

Participants in these activities should remain vigilant and informed about their tax deductions, ensuring that they keep track of their winnings and any applicable TDS. By understanding these updates, individuals can avoid potential non-compliance and ensure they meet their tax obligations accurately.