General Rule for ITC

Every registered persons can claim ITC on goods or services used for business purposes which are credited to their electronic ledger.

Conditions for ITC

- Must have a tax invoice or prescribed document.

- Invoice details must be furnished by the supplier in the statement of outward supplies and such details have been communicated to the recipient

- Recipient must receive the goods/services.

- Deemed receipt if goods/services are delivered on their direction.

- ITC should not be restricted in the communication under Section 38.

- Tax charged must be paid to the government.

- The return under Section 39 must be filed.

Points To Remember

If payment made to the supplier is delayed beyond 180 days, ITC must be reversed with interest. ITC can be reclaimed on subsequent payment.

Time Limit To Claim ITC

ITC can be claimed until November 30 of the following financial year or the filing of the annual return, whichever is earlier.

Special Provisions for Past Years

For FY 2017-18 to 2020-21, ITC can be claimed in returns filed until November 30, 2021.

ITC for Revoked Registrations

If registration is revoked, ITC on invoices not restricted earlier can be claimed in returns filed:

- By November 30 of the following financial year or annual return filing date, whichever is earlier.

- Within 30 days from the revocation order for invoices during the cancellation period.

Application for Rectification of ITC Demand Orders

If ITC was disallowed, and demand orders were raised for FY 2017-18 to 2020-21 under Section 16(4), rectification is now allowed under sections 16(5) or 16(6).

Taxpayers with demand orders for wrong ITC availment due to violations of Section 16(4) can apply for rectification under new Sections 16(5) or 16(6).

As per Notification No. 22/2024 – CT dated 08.10.2024, taxpayers can rectify orders issued u/s 73/74 of the CGST Act.

Process for Filing Application for Rectification of Orders

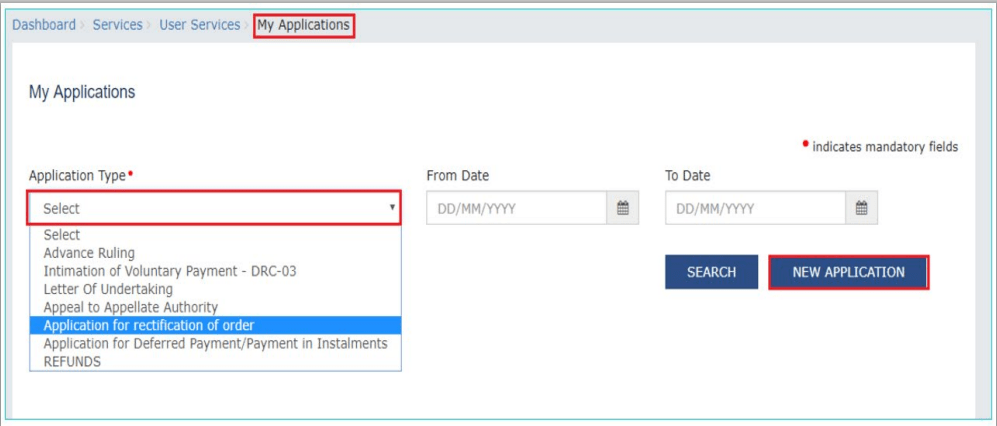

- Taxpayers can apply online by logging in and navigating to: Services > User Services > My Applications.

- Select “Application for rectification of order” in the Application Type field and click the NEW APPLICATION button.

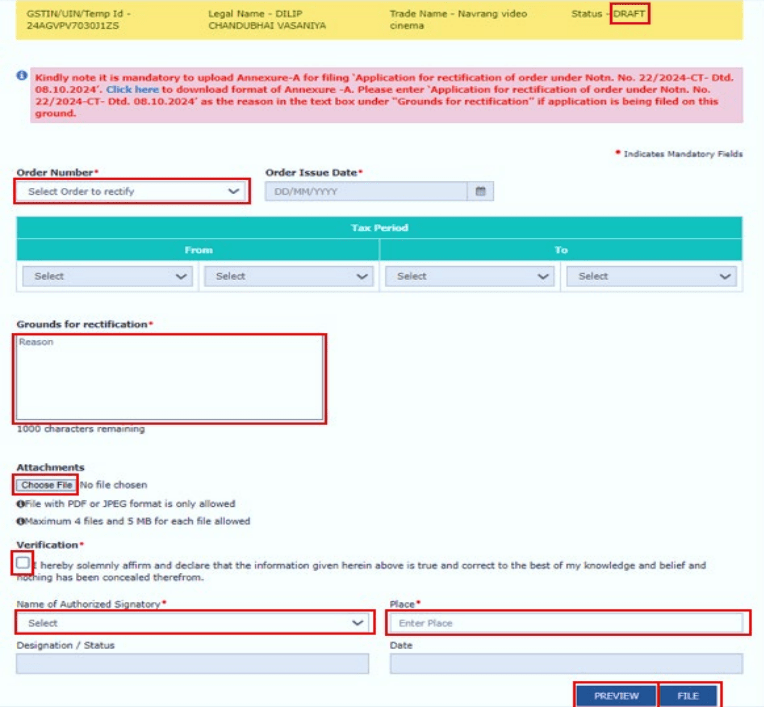

- Enter details in the displayed fields as mentioned in the following steps:

- Based on your selection, latest Order Issue Date and Tax Period fields will get auto-populated.

- In Grounds for rectification field, enter the reason, “Application of rectification of order under Notification No. 22/2024-Central tax dated 08.10.2024”.

- Click Choose File to upload details in Annexure A as notified vide Notification No. 22/2024, dated 8th October 2024, in support of your application. This would be a mandatory step.

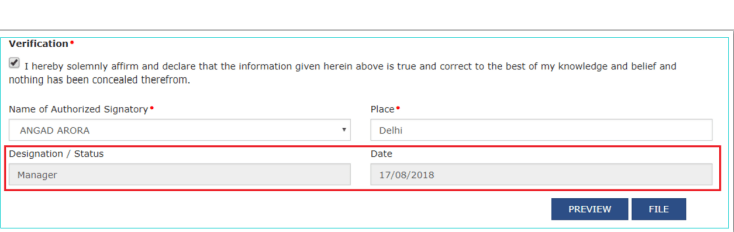

- Enter Verification details. Select the declaration check-box and select the name of the authorized signatory.

- Based on your selection, the fields Designation/Status and Date (current date) displayed below will get auto-populated. Enter the name of the place where you are filing this application.

- Complete the filing process by clicking on PREVIEW and FILE.

Click Here for GST Amnesty Scheme: Waiver of Interest & Penalties.