For the Financial Year (FY) 2024-25 (Assessment Year AY 2025-26), the key due dates for filing ROC (Registrar of Companies) returns in India are typically determined based on the company’s Annual General Meeting (AGM) date.

To avoid heavy penalties, companies and LLPs must strictly adhere to compliance deadlines. Neglecting annual ROC filings can lead to severe consequences, making it essential for businesses to prioritise timely regulatory submissions.

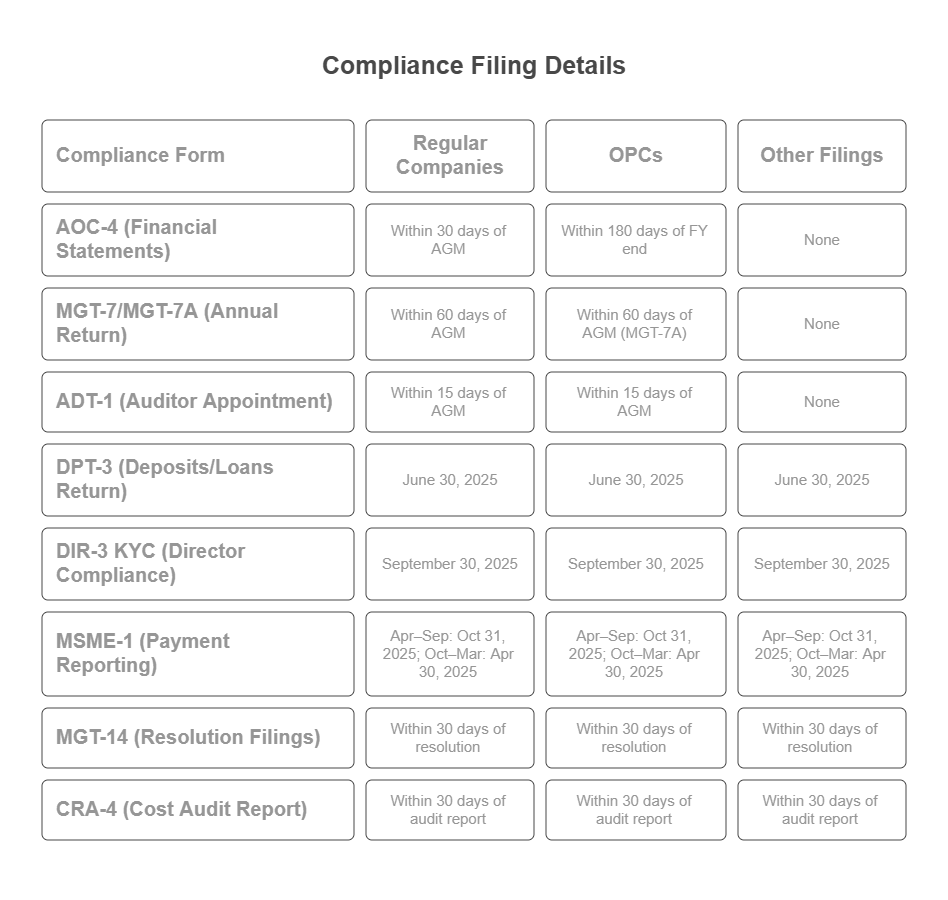

Below are the key forms and their corresponding due dates for FY 2024-25, considering a financial year ending on March 31, 2025, and an Annual General Meeting (AGM) held by September 30, 2025 (the standard deadline for AGMs)

Key ROC Annual Compliance Deadlines for FY 2024-25 (AY 2025-26)

Form AOC-4 (Financial Statements Filing)

Regular Companies: Due within 30 days of AGM

- (AGM by Sep 30, 2025 → Deadline: Oct 30, 2025)

OPCs: Due within 180 days of FY end

- (FY ends Mar 31, 2025 → Deadline: Sep 27, 2025)

Form MGT-7/MGT-7A (Annual Return)

Due within 60 days of AGM

- (AGM by Sep 30, 2025 → Deadline: Nov 29, 2025)

- (MGT-7A for OPCs/Small Companies)

Other Critical Filings:

Form ADT-1 (Auditor Appointment)

Due within 15 days of AGM

- (AGM on Sep 30, 2025 → Deadline: Oct 15, 2025)

Form DPT-3 (Deposits/Loans Return)

Annual Filing Deadline: June 30, 2025

- (Covers outstanding loans/deposits as of Mar 31, 2025)

DIR-3 KYC (Director Compliance)

Mandatory for all active DINs: September 30, 2025

MSME-1 (Half-Yearly Payment Reporting)

- Apr–Sep 2025: Due by Oct 31, 2025

- Oct 2024–Mar 2025: Due by Apr 30, 2025

Form MGT-14 (Resolution Filings)

- Continuous compliance: Within 30 days of passing resolutions

Form CRA-4 (Cost Audit Report)

- Due within 30 days of receiving the audit report

- (For cost-audit mandated companies)

Key Compliance Reminders for FY 2024-25 Filings:

AGM Deadline

- All companies (except OPCs) must conduct their AGM within 6 months of FY closure

- For FY ending March 31, 2025: September 30, 2025 is the absolute deadline

MCA Portal Transition

- The MCA V3 portal became operational from June 1, 2025

- Most annual filings (including AOC-4 and MGT-7/7A) are now processed through V3

- Note: Possible brief service interruption in July 2025 for final system upgrades

Late Filing Consequences

Critical Advisory

- Compliance deadlines may be subject to MCA notifications

- Always verify final dates on the official MCA website before filing

- Last-minute extensions, if any, will be communicated through MCA circulars

FAQs

Every registered company/LLP under the Companies Act, 2013 must file ROC forms detailing business activities within prescribed due dates or else they will have to pay a penalty.

Yes, by applying to the ROC with a valid reason for delay.

All companies except One Person Companies (OPCs) must hold an AGM within 6 months of financial year end.