Revised income tax return is a corrected version of your original tax return.

Filing a Revised Income Tax Return (ITR) is essential if you’ve made errors or omissions in your original filing. As per the current rules under the Income Tax Act of India, the due date to revise your ITR for the Assessment Year 2025-26 (Financial Year 2024-25) is 31st December 2025.

What is a Revised ITR?

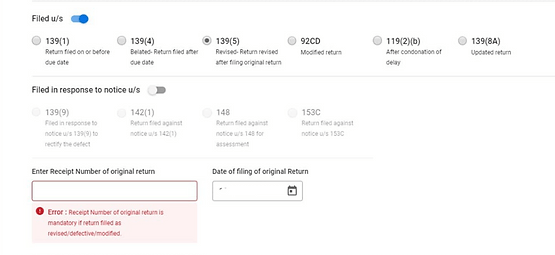

A Revised Income Tax Return allows taxpayers to rectify errors or omissions in their originally filed income tax return. The provision for revising an ITR is covered under Section 139(5) of the Income Tax Act, 1961.

Errors that can be corrected include:

- Misreporting of income

- Missing deductions under Section 80C to 80U

- Incorrect tax payment details

- Inaccurate personal details like PAN, Aadhaar, or bank account information

- Errors in declaring investments, exemptions, or TDS (Tax Deducted at Source)

Eligibility for Filing a Revised ITR

You can revise your return if:

- You filed the original return on or before the due date (for AY 2025–26, the due date was 31st July 2025 for most taxpayers).

- You filed a belated return (after the due date, but before 31st December 2025).

What is Belated income tax return?

Belated income tax return is a tax return filed after the original due date specified by the Income Tax Department.

A taxpayer can revise and refile their income tax return even if it was submitted late as a belated return.

Key Deadlines

- The revised ITR for FY 2024–25 must be filed on or before 31st December 2025.

- After this date, rectifications or corrections are not permitted, except via an appeal or rectification request to the Income Tax Department.

Changing Tax Regime While Filing Revised ITR

- If you file original ITR before 31st July 2025 having no Income from Business and Profession. Then, you can switch tax regime before 31st December 2025.

- If you file original ITR in New Tax Regime after 31st July 2025 with having no Income from Business and Profession. Then, you cannot opt for old tax regime.

Guide to Filing a Revised Income Tax Return

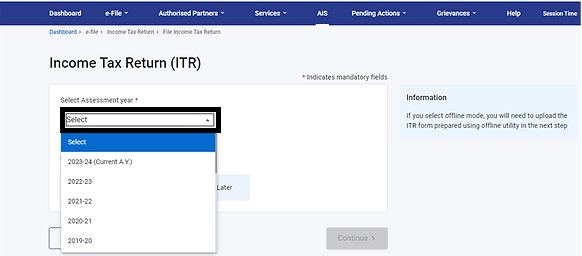

- Visit the official Income Tax e-Filing portal and log in using your credentials.

- On the dashboard, select the Relevant assessment year for which you want to file a revised return.

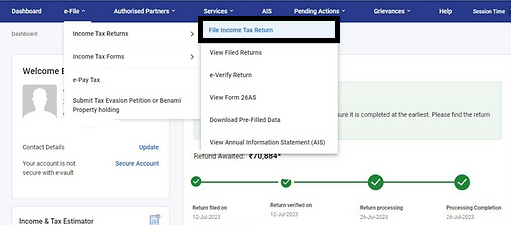

- Under the ‘e-File’ tab, select ‘Income Tax Return’ and choose the option for filing a revised return.

- Provide details such as the acknowledgment number and filing date of the original return.

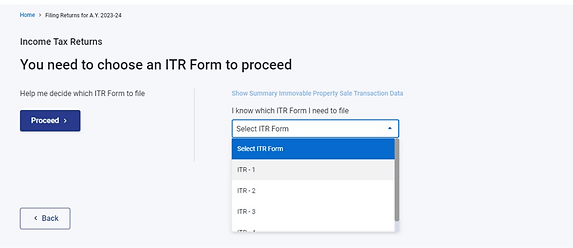

- Choose the same ITR form that was used for filing the original return, based on your income sources.

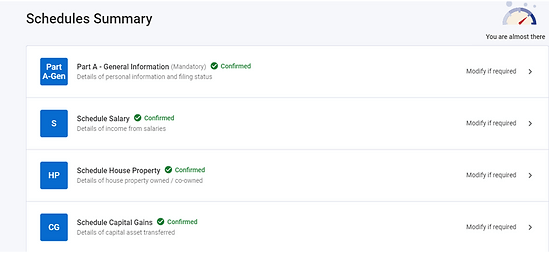

- In the revised return form, correct any errors or update information related to income, deductions, etc.

- If changes require supporting documents, upload them along with the revised return.

- Carefully review all details in the revised return form for accuracy before submitting.

- After submission, a new acknowledgment number for the revised return will be generated. Keep this for future reference.

- E-verify the revised return using methods like Aadhaar OTP or EVC, or send a signed physical copy (ITR-V) to the CPC.

- Check the processing status of your revised return on the e-filing portal regularly.

Practical Examples

Case 1: Missed Reporting of Income

- Original ITR: Reported salary income but forgot to include interest earned from a fixed deposit (FD).

- Revised ITR: Add FD interest under Income from Other Sources, recalculate tax, and pay any additional tax with applicable interest.

Case 2: Wrong Deduction Claimed

- Original ITR: Claimed a deduction of Rs.2,00,000 under Section 80C, while the maximum allowable is Rs.1,50,000.

- Revised ITR: Correct the deduction, resulting in additional tax payable.

Case 3: TDS Credit Not Claimed

- Original ITR: Missed claiming TDS credit of Rs.10,000 shown in Form 26AS.

- Revised ITR: Claim the TDS and adjust the tax refund accordingly.

What Happens After Filing a Revised ITR?

- The Income Tax Department processes your revised return as a fresh submission.

- Once processed, you’ll receive an intimation under Section 143(1), detailing any refund or tax payable after the revision.

Consequences of Failing to Revise by 31st December 2025

- Irrevocable Errors: Uncorrected mistakes can’t be fixed after the deadline unless appealed.

- Penalties: Misreporting or underreporting income may attract penalties under Section 270A.

- Loss of Refund: If the revised ITR is not filed on time, you risk losing refunds due to unclaimed deductions or TDS.

Common Mistakes to Avoid

- Not Verifying the ITR: An unverified return (original or revised) is considered invalid.

- Revising Incorrectly: Ensure all errors are corrected. Multiple revisions are allowed, but repeated mistakes may attract scrutiny.

- Overlooking Form 26AS: Reconcile your income and TDS with Form 26AS to avoid mismatches.

- Filing a Belated Revised Return: Revising after the due date invalidates the revision.

Key Tips

- Keep Proofs: Maintain documents like salary slips, rent receipts, and investment proofs for deductions and exemptions.

- Check TDS Credit: Verify TDS details in Form 26AS or Annual Information Statement (AIS).

- Consult an Expert: If your case involves complex errors or high-value transactions, consult a tax consultant or CA.

Essential Tips for Completing ITR 1 Form Correctly Click here

FAQs

There is no penalties or charges for filling revised income tax return.

31st December 2024 for FY 2023-24 (AY 2024-25)

Yes, a belated return can be revised. However, the last date to file a revised return or a belated return is 31st December of the relevant assessment year.

If the ITR e-filing form has to be changed, a revised return can be filed. You can file a revised tax return as many times as you want, as there is no limit to the number of times you file the return.