Reverse Charge Mechanism means the liability to pay tax is on the recipient (Purchaser) of supply of goods or services instead of the supplier of such goods or services.

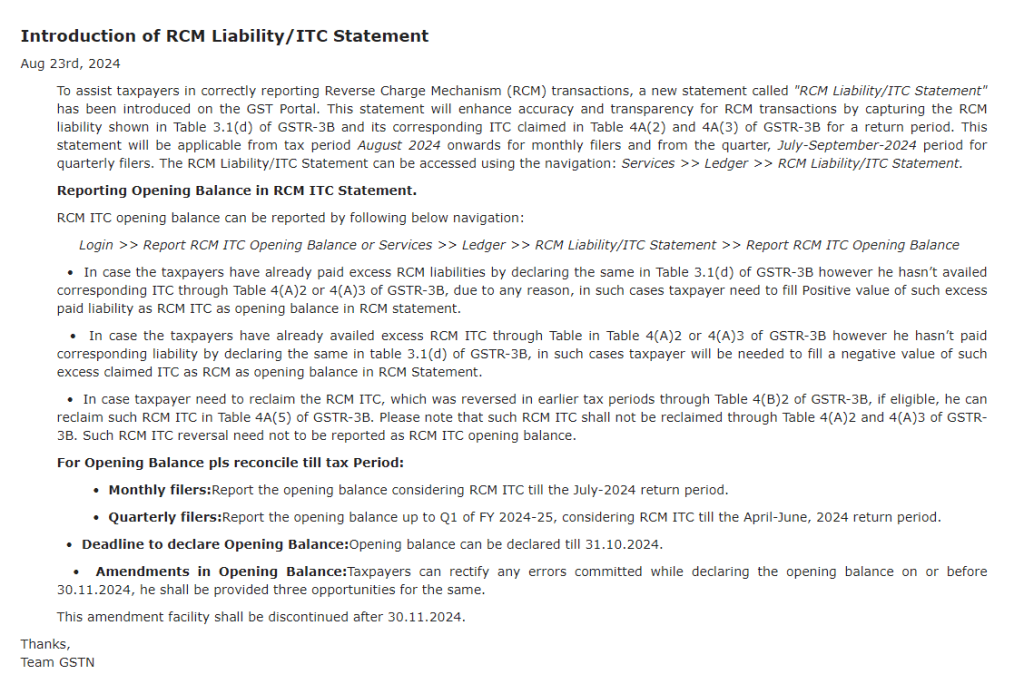

Purpose of the new “RCM Liability/ITC Statement” on the GST Portal

A new statement “RCM Liability/ITC Statement” has been introduced on the GST Portal to help taxpayers accurately report RCM transactions.

It matches the RCM liability in GSTR-3B with the claimed ITC for a given return period.

This statement is effective from August 2024 for monthly filers and the July-September 2024 quarter for quarterly filers.

To access it, go to: Services >> Ledger >> RCM Liability/ITC Statement.

Types of Reverse Charge Mechanism

There are two types of Reverse Charge scenarios provided in law:

1. On the nature of supply or supplier

Notified goods or services for RCM

As per the provision of section Sec 9(3) of CGST/SGST (UTGST) Act 2017 and Sec 5(3) of IGST Act 2017,

- the Government may, on the recommendation of the Council, by notification ,

- specify categories of supply of goods or services or both,

- the tax on which shall be paid on reverse charge basis by the recipient of such goods or services.

Notified Goods Under Reverse Charge

| Goods | Supplier | Taxable Person |

| Cashew nuts, not shelled or peeled | Agriculturist | Any registered person |

| Bidi wrapper leaves | Agriculturist | Any registered person |

| Tobacco leaves | Agriculturist | Any registered person |

| Silk yarn | Any person who manufactures silk yarn from raw silk or silk worm cocoons for supply of silk yarn | Any registered person |

| Supply of lottery | State Government, Union Territory or any local authority | Lottery distributor or selling agent |

| Cement | An unregistered supplier | Promoter/Builder |

Notified Services Under Reverse Charge

| Services | Supplier | Taxable Person |

| Transport of Goods by Road | Goods Transport Agency | Registered Person |

| Legal Service | Legal Firm/advocate | Registered Person |

| Sponsorship Services | Individual / Business | Corporate or Partnership Firms |

| Services of an Insurance Agent | Insurance Agent | Insurance Company |

| Recovery Agent Services | Recovery Agent | Banking Company |

| Taxi services through an e-commerce operator | Tax Driver | E-Commerce Operator |

Note : The person who pays GST on reverse charge is recipient of supply (should be registered taxpayers).

2. Taxable supplies by any unregistered person to a registered person

In case of an unregistered person is selling goods or providing any services to the registered person,

- then the liability to pay tax shifts on the registered person i.e., the recipient of goods or services,

- where such supply is of taxable supplies.

No reverse charge mechanism in case of exempted supplies.

Government has given an exemption of Rs 5000 per day.

Provision for Reverse Charge Mechanism Under GST

The recipient of goods or services must be registered under GST irrespective of threshold limit.

Non eligibility for composition scheme.

- Supplies under RCM are not included in aggregate turnover of the assessee.

- ITC on RCM tax amount can be claimed only by recipients of goods or services if they are used to conduct business or will be used for business purposes.

- RCM tax can be paid in cash only through electronic cash ledger not by initializing ITC i.e., through electronic credit ledger.

- Whenever reverse charge applies, the supplies must clearly mention on the invoice that the tax payable through reverse charge mechanism.

- Person liable under RCM must issue a tax invoice by mentioning the supply is received under RCM.

Time of Supply

The time of supply under RCM shall be the earliest of the following dates:

- the date of receipt of goods or date of payment

- the date immediately following 30 days in case of goods and 60 days in case of services from the date of issue of invoice.

FAQs

The recipient cannot claim ITC for the unpaid tax which can lead to higher tax liability.

Interest at 18% p.a will be charged from the due date until payment is made.

Non-payment can also result in penalties up to 100% of the due tax under the GST Act.

The taxpayer who is liable to pay tax under RCM must issue an invoice for the goods or services received, stating that the tax is paid under RCM.

If discrepancy found, the taxpayer must review and correct their GSTR-3B filing, ensuring that both the RCM liability and ITC claimed are accurately reported.