The government in Union Budget 2025 has introduced a simplified New Tax Regime, offering zero tax liability up to Rs. 12 lakh (i.e. average income of Rs.1 lakh per month other than special rate income such as capital gains)

Now, the new limit will be Rs.12.75 lakh for salaried tax payers, due to standard deduction amounting Rs. 75,000.

Income Tax Slabs Under New Regime

| Income Tax Slab | Income Tax Rate |

| 0-4 lakh | Nil |

| 4-8 lakh | 5% |

| 8-12 lakh | 10% |

| 12-16 lakh | 15% |

| 16-20 lakh | 20% |

| 20- 24 lakh | 25% |

| Above 24 lakh | 30% |

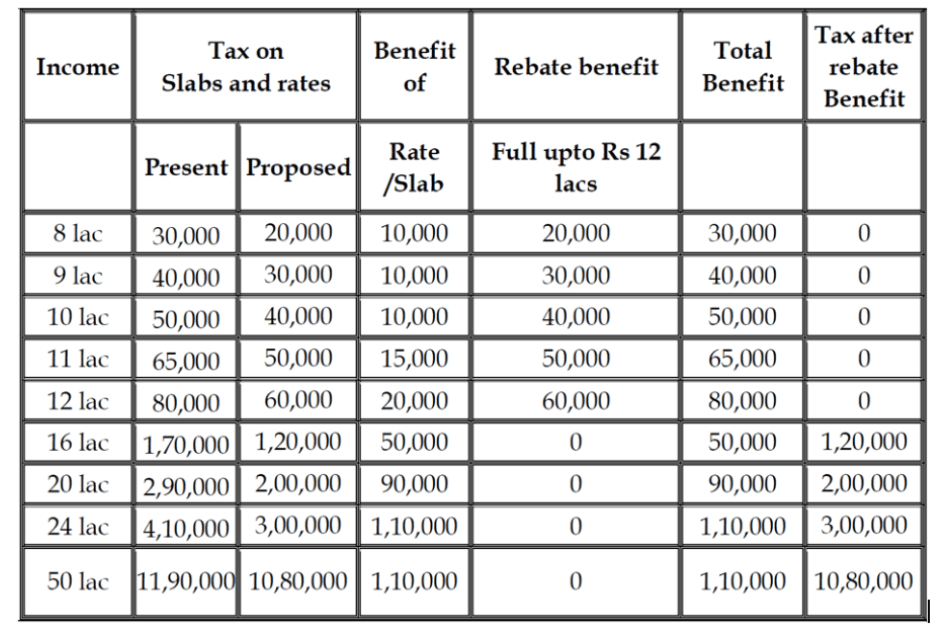

The total tax benefit of slab rate changes and rebate at different income levels can be illustrated in the table below:

By reducing taxes, the government aims to leave more disposable income in the hands of taxpayers, which can boost household consumption, savings, and investments, thereby contributing to economic growth.