MSME refers to Micro, Small, and Medium Enterprises, which are classified according to size, investment, and revenue. These businesses are vital in driving economic growth, creating jobs, and fostering innovation.

Under the MSMED (Micro, Small, and Medium Enterprises Development) Act, 2006, MSMEs are classified into two main categories: Manufacturing Enterprises and Service Enterprises.

- Manufacturing Enterprises: These are defined as enterprises that engage in the production of goods and have a manufacturing process. The classification is based on the investment in plant and machinery. The specific thresholds for categorizing enterprises into micro, small, and medium depend on the amount invested, which is subject to change based on amendments to the act or government notifications.

- Service Enterprises: These are defined as enterprises that provide services rather than manufacture goods. Just like manufacturing enterprises, these are also classified based on the investment in equipment.

MSMEs are regarded as the foundation of global economies, playing a crucial role in GDP, job creation, and fostering innovation.

Benefits of MSME Registration

- Access to government schemes and incentives.

- Easier access to credit and loans.

- Tax benefits under various provisions.

Budget 2025-26: Key Expectations for MSMEs

The Union Budget 2025-26 is likely to focus on:

- Easier credit access (higher loan guarantees, lower interest rates).

- Tax relief (extended 25% corporate tax, higher presumptive income limits).

- Digital & green MSME push (subsidies for tech adoption, eco-friendly manufacturing).

- Stricter payment rules (45-day compliance, faster dispute resolution).

- Export & skill boost (higher incentives, training programs).

- Infrastructure upgrades (new industrial parks, cluster development).

Entities Categorized as MSMEs in India (Udyam Registration)

Under the Micro, Small & Medium Enterprises Development (MSMED) Act, 2006, businesses are classified as MSMEs based on their investment in plant & machinery/equipment and annual turnover.

This categorization is part of the Udyam Registration process, which was introduced to streamline the registration of MSMEs and to facilitate access to various government schemes.

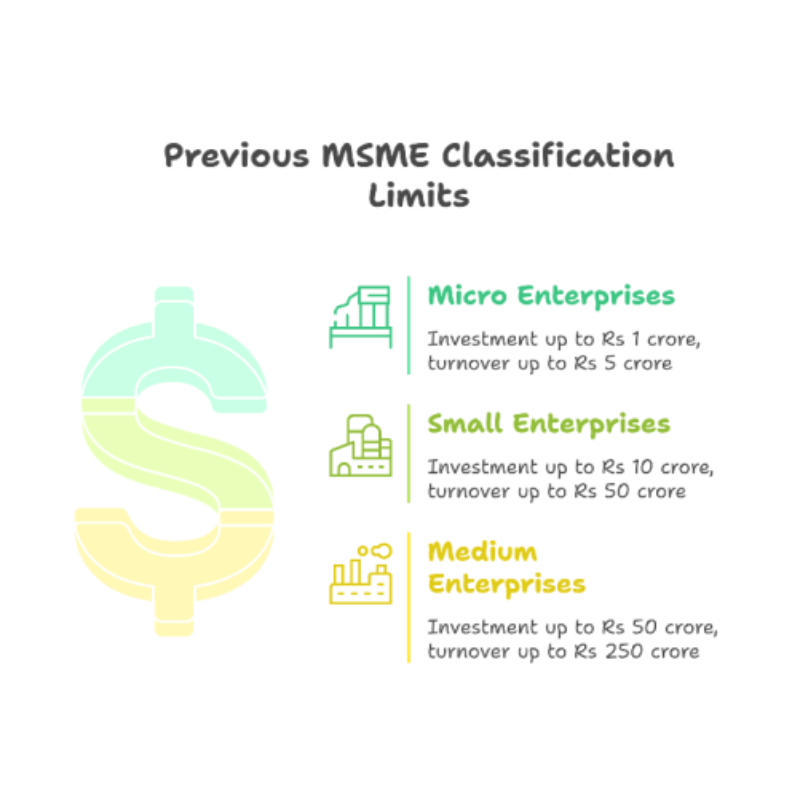

Previous MSME Classification Limits

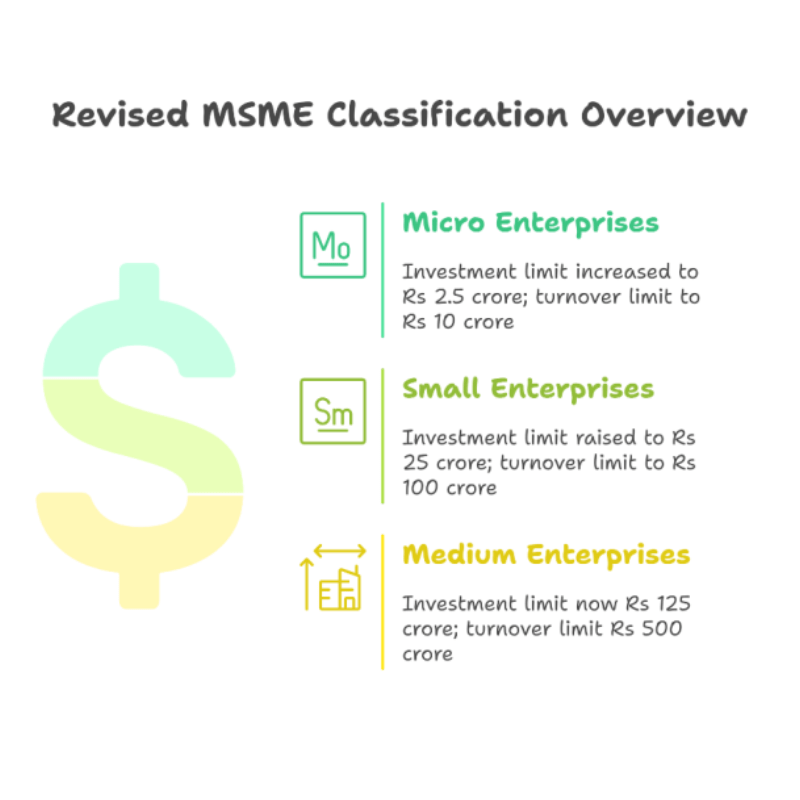

Revised MSME Classification Limits

Section 43B(h) of the Income Tax Act

According to Section 43B(h) of the Income Tax Act, any payments owed to registered MSMEs must be made within 45 days from the acceptance date of their goods or services. If this deadline is not met, the expense will not be deductible for that financial year and can only be claimed in the year when the payment is made. This regulation, which comes into effect from AY 2024-25, is designed to promote prompt payments to MSMEs by making any unpaid dues taxable income for buyers.

Businesses are required to check the Udyam registration status of their suppliers and must strictly adhere to the 45-day payment requirement to avoid increased tax liabilities and compliance challenges.

The 45-day MSME payment rule

- The 45-day MSME payment rule requires businesses to pay registered MSME suppliers within 45 days of receiving goods or completing services, as outlined in the MSMED Act 2006 and Income Tax Section 43B(h).

- Non-compliance results in triple-interest penalties (approximately 18% annual interest based on RBI rates) and tax disallowances, where outstanding amounts are added back to taxable income. This rule applies exclusively to transactions with Udyam-registered MSMEs, necessitating that buyers verify supplier credentials and diligently track payments.

- While businesses can define payment terms in written contracts, these cannot supersede the 45-day timeframe. To avoid financial penalties and foster strong supplier relationships within India’s MSME landscape, businesses should adopt systematic invoice processing and prioritize payments to MSMEs.

Payment Deadlines in Summary

| Scenario | Deadline |

| No written agreement | 15 days |

| Written agreement exists | 45 days |

Benefits for MSMEs

- Improved cash flow: Prompt payments improve the liquidity of MSMEs, enabling them to meet operational costs and invest in growth.

- Reduced Working Capital Pressure: Since MSMEs are often reliant on external financing, timely payments alleviate the need for borrowing, thereby reducing interest costs.

- Strengthened Business Relationships: The 45-day rule fosters good relationships between MSMEs and their buyers, ensuring that larger companies maintain ethical payment practices.

FAQs

Businesses must pay Micro and Small Enterprises (MSMEs) within 45 days of receiving goods or services. If there is no written agreement, payment is due within 15 days. The final deadline for outstanding payments is March 31, 2025.

Under Section 43B(h), deductions for payments to MSMEs can only be claimed in the year those payments are made. This means timely payments are essential to avoid increased taxable income.

Clear Contracts: Define payment terms clearly in agreements.

Invoice Management: Maintain organized records of invoices and payment deadlines.

Automated Reminders: Set reminders for upcoming payment due dates.

Regular Follow-ups: Actively follow up on overdue payments.

Document Everything: Keep thorough records of all transactions and communications.