Marginal Relief under the Income Tax Act is a mechanism that aims to prevent individuals or entities from facing excessively high tax burdens when their income surpasses the limit of a higher tax bracket. Its primary purpose is to offer taxpayers some financial relief, ensuring that the extra tax owed does not exceed the amount by which their income exceeds the threshold.

Finance Minister Nirmala Sitharaman’s Budget 2025 introduces notable changes to income tax with the addition of marginal relief measures.

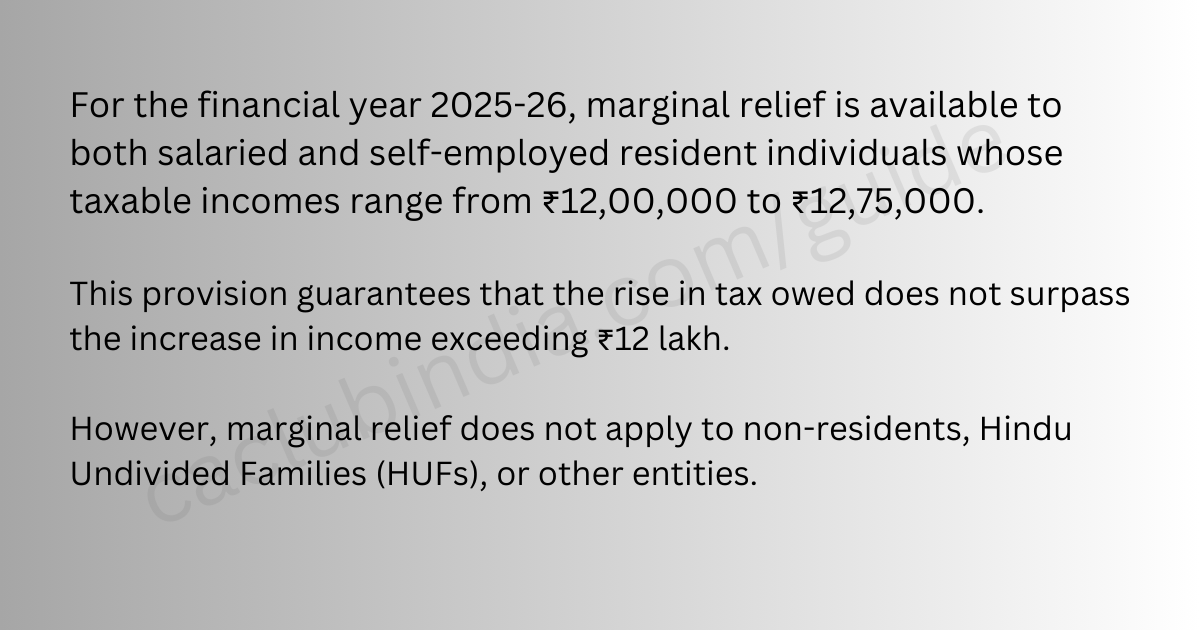

The new tax regime allows for tax exemption on incomes up to ₹12 lakh (₹12.75 lakh for salaried individuals with a standard deduction).

The provision for marginal relief under Section 87A guarantees that the tax on income surpassing ₹12 lakh will not exceed the incremental amount up to ₹12.75 lakh.

Applicability

Marginal Relief is applicable when a taxpayer’s income exceeds the limit of a higher tax bracket, leading to an increased tax obligation.

It guarantees that the rise in tax liability does not exceed the increase in income that surpasses the threshold.

Calculation

Marginal Relief is determined by the difference between:

The tax owed on the total income (which includes any amount over the threshold), and the tax that would have been owed if the income were at the threshold level.

This relief ensures that the additional tax does not surpass the increase in income exceeding the threshold.

Formula for Marginal Relief

The formula to determine Marginal Relief is as follows:

| Marginal Relief = (Tax on Higher Income + Surcharge)−(Tax on Threshold Income + Amount by which Income Exceeds Threshold) |

If the result is positive, Marginal Relief is granted to reduce the tax liability.

Benefits of Marginal Relief

- Ensures that small increases in income do not lead to significantly higher taxes.

- Taxpayers can accept higher earnings without fearing excessive taxation.

- Reducing tax burdens on slight income increases allows more disposable income for taxpayers.

Example of Marginal Relief Calculation

The relief guarantees that the extra tax owed will not surpass the increase in income above ₹12 lakh.

For example, if a taxpayer earns ₹12.1 lakh, their additional tax obligation without this relief could be much greater than the actual rise in income. However, with marginal relief, the tax owed is limited to the amount of the income increase.

Income: ₹12,10,000

- Tax Without Relief: ₹61,500

- Incremental Income Over ₹12 Lakh: ₹10,000

- Tax Payable with Marginal Relief: ₹10,000 (as the tax does not exceed the incremental income)

Income: ₹12,50,000

- Tax Without Relief: ₹67,500

- Tax Payable with Marginal Relief: ₹50,000

Income: ₹12,70,000

- Tax Without Relief: ₹70,500

- Tax Payable with Marginal Relief: ₹70,000

Marginal Relief for Surcharge

Marginal Relief is also applicable when a surcharge is levied on higher income levels.

- If income exceeds ₹50 lakh, a 10% surcharge is applicable.

- If income exceeds ₹1 crore, a 15% surcharge is applicable.

- If income exceeds ₹2 crore, a 25% surcharge is applicable.

- If income exceeds ₹5 crore, a 37% surcharge is applicable.

In summary, marginal relief for FY 2025-26 is a crucial provision that helps individuals whose income exceeds ₹12 lakh by preventing a disproportionate tax burden resulting from small increases in earnings.

This measure ensures fairness in the tax system, allowing individuals to retain a larger portion of their income despite being just above the taxable threshold, thereby promoting financial stability and encouraging further income growth.

FAQs

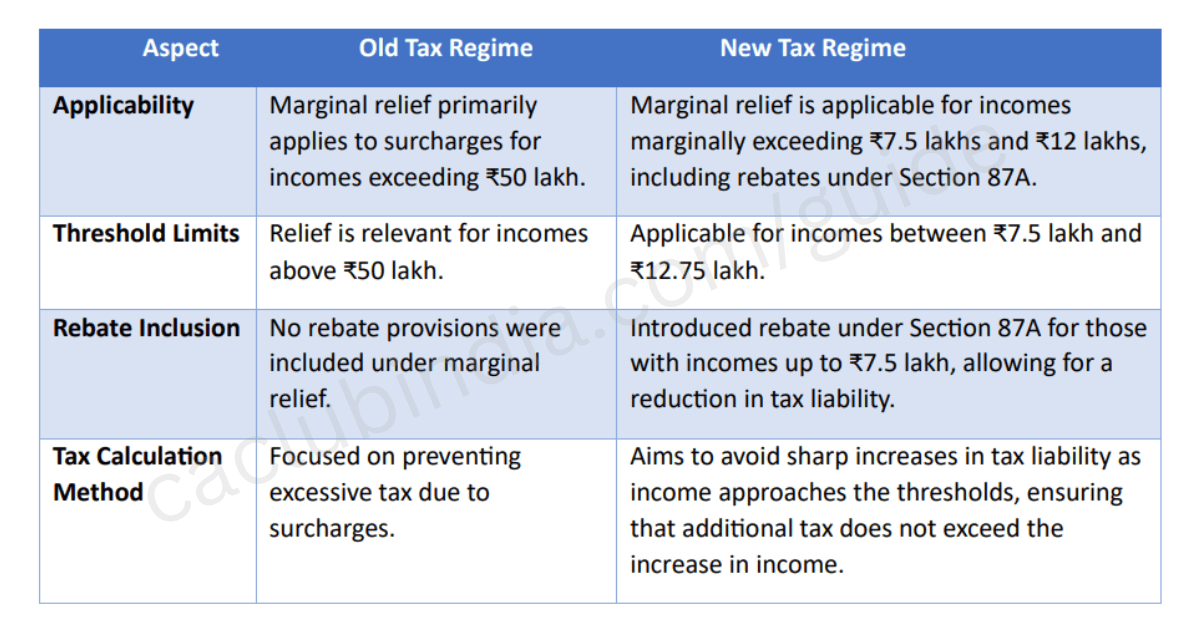

The key differences between marginal relief in the old and new tax regimes are as follows: