| Income Tax Department has notified a new form via Notification No. 49/2025 dated 19th May 2025 which has now been extended to 4 years. Applicable Years To File Returns Now, returns can be filed for Assessment Year 2021-22 to 2024-25, i.e., from FY 2020-21 onward. |

Budget 2025 Update

Time Limit

The time-limit for filing updated returns has been extended:

- Current Limit:

Taxpayers can file an updated return within 24 months from the end of the relevant assessment year.

- Proposed Limit:

The time-limit is being extended to 48 months from the end of the relevant assessment year. This gives taxpayers more time to correct their returns.

Additional Tax Payable

The updated return will attract additional tax on the additional income reported. The tax rate will depend on the time-frame in which the updated return is filed:

| Filed Within | Additional Tax |

| 12 months from the end of the relevant AY | 25% of the aggregate of the tax and interest payable on the additional income |

| 12 to 24 months from the end of the relevant AY | 50% of the aggregate of the tax and interest payable on the additional income |

| 24 to 36 months from the end of the relevant AY | 60% of the aggregate of the tax and interest payable on the additional income |

| 36 to 48 months from the end of the relevant AY | 70% of the aggregate of the tax and interest payable on the additional income |

What is Updated Income Tax Return?

ITR-U or Updated Income Tax Return is a provision that enables taxpayers in India to rectify errors or omissions in their previously submitted income tax returns (ITRs).

In the union budget 2022, the government has introduced a new scheme that permits all taxpayers to file an “updated return” within 24 months from the end of the relevant assessment year.

This provision allows the taxpayers to update/file their ITRs on payment of additional taxes, in case of errors or omissions. The provisions of updated return is available in Section 139(8A) read with section 140B of the Income Tax Act.

Section 139(8A) of the Income Tax Act

- As per section 139(8A) of the Income Tax Act, 1961, “Where the return under sub-section (1) or sub-section (2) or sub-section (4) for an assessment year is furnished after the specified date or is not furnished, then the assessee shall be liable to pay simple interest at fifteen per cent per annum, reckoned from the day immediately following the specified date to the date of the furnishing of the return or, where no return has been furnished, the date of completion of the assessment under section 144, on the amount of the tax payable on the total income as determined on regular assessment, as reduced by the advance tax, if any, paid, and any tax deducted at source.”

Section 140B of the Income Tax Act

- As per section 140B of the Income Tax Act, 1961, “the additional income-tax payable at the time of furnishing the return under 139(8A) shall be equal to twenty-five per cent of the aggregate of tax and interest payable if such return is furnished after the expiry of the time available under 139(5)/139(4) and before completion of the period of twelve months from the end of the relevant assessment year which is 31st March.”

This scheme of updated returns is introduced to provide an opportunity for taxpayers to comply voluntarily, rectify errors/omissions, and reduce litigation.

Who can file an updated ITR?

Any person can file an updated return within 24 months from the end of the relevant assessment year, whether or not an original, revised or belated return has been furnished under section 139 for such AY. It can be filed in the following cases:

- If the return was previously not filed or

- If the return was filed but

- Income was not reported correctly

- Wrong heads of income were chosen

- To reduce carried forward losses

- To reduce unabsorbed depreciation

- To reduce tax credit u/s 115JB/115JC

- Rate of tax was not correct

Who cannot file an updated ITR?

Updated return can’t be filed if such return:

- Is a Nil return or a return of loss or

- Has the effect of decreasing the total tax liability determined on the basis of the return furnished for the relevant AY or

- Results in a refund or increases in the refund due on the basis of return furnished for the relevant assessment year and

- Taxpayer cannot file an updated return in case of search and seizure or in case where any prosecution proceedings have been initiated

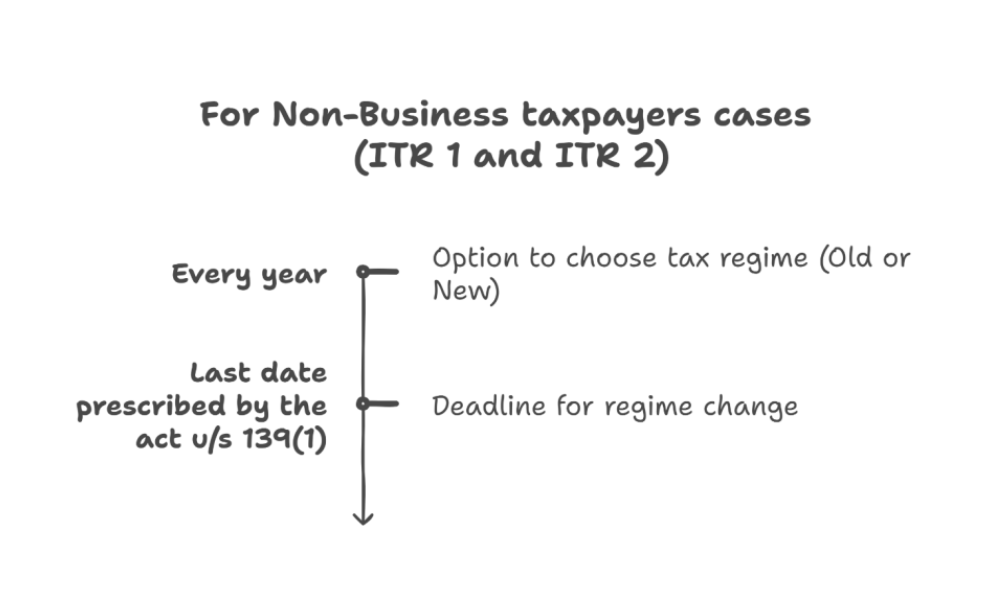

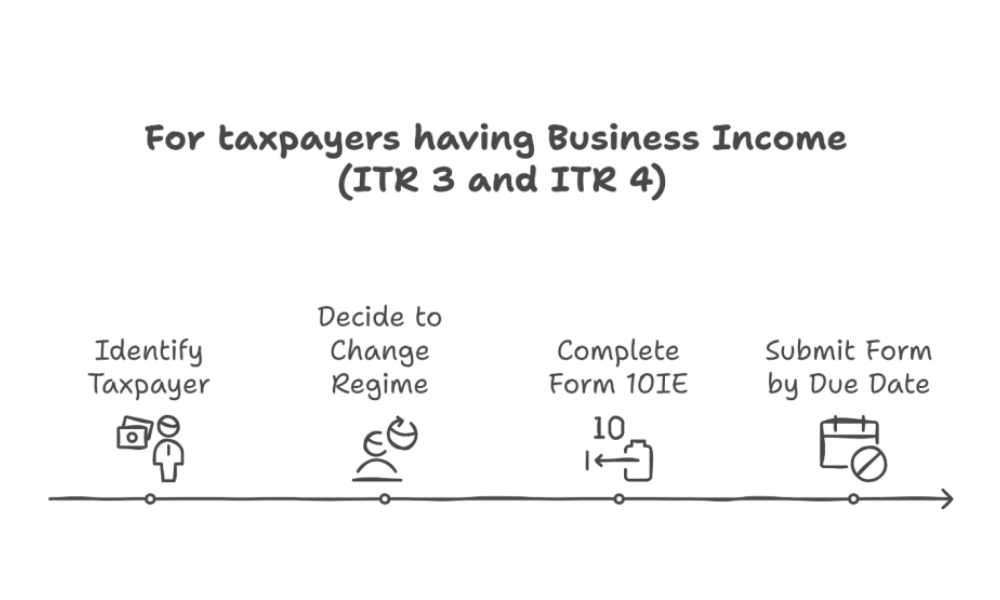

ITR-U and Tax Regime: Is Switching Allowed?

A taxpayer has to choose the tax regime within the due date prescribed as per section 139(1) of the Income Tax Act. Once chosen within the due date the taxpayer cannot change the regime after the due date.

Steps for filing ITR-U (Updated return)

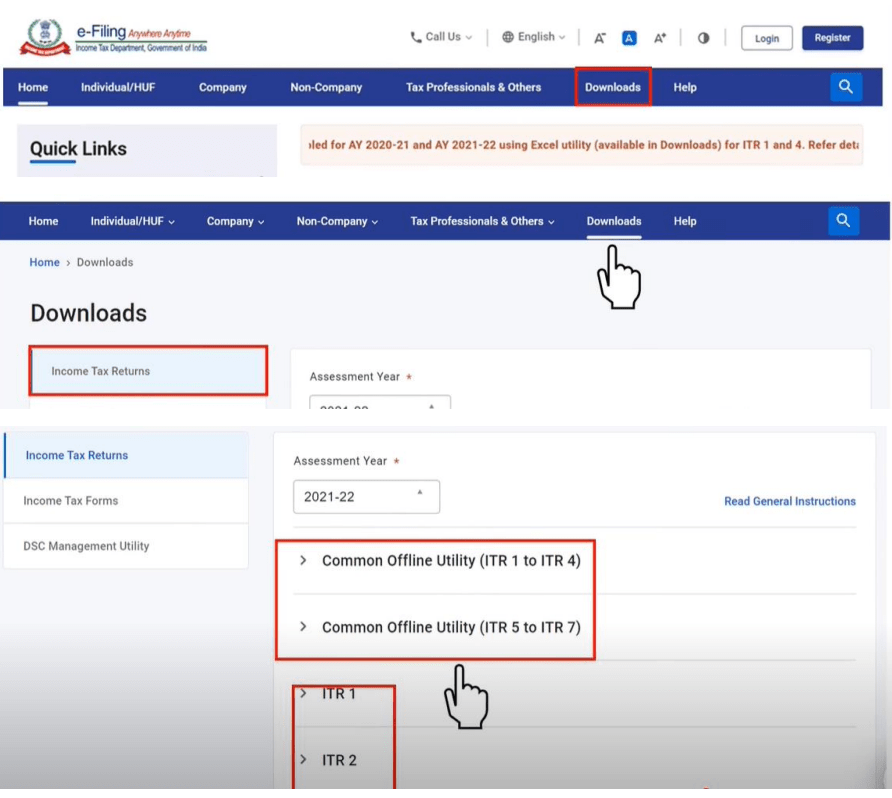

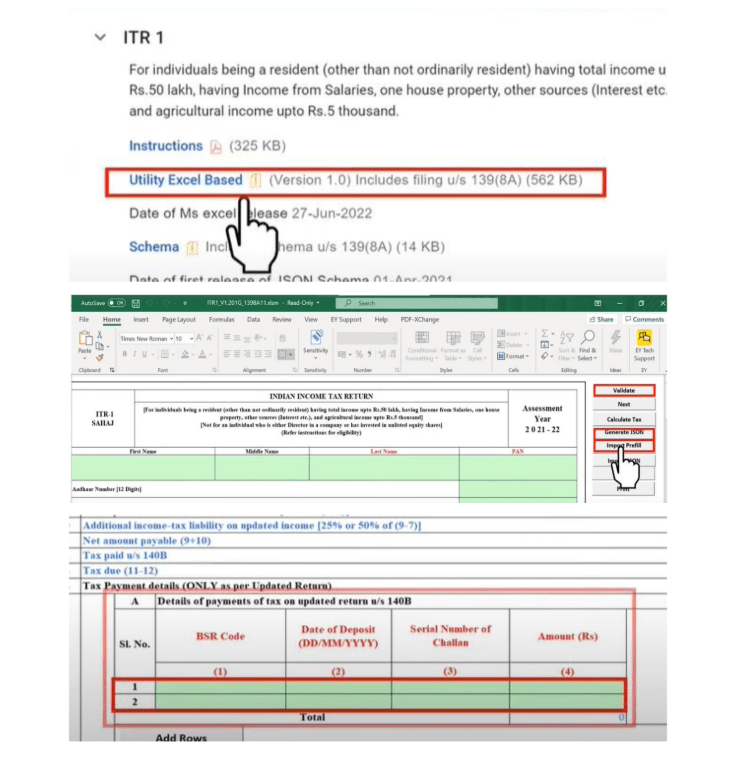

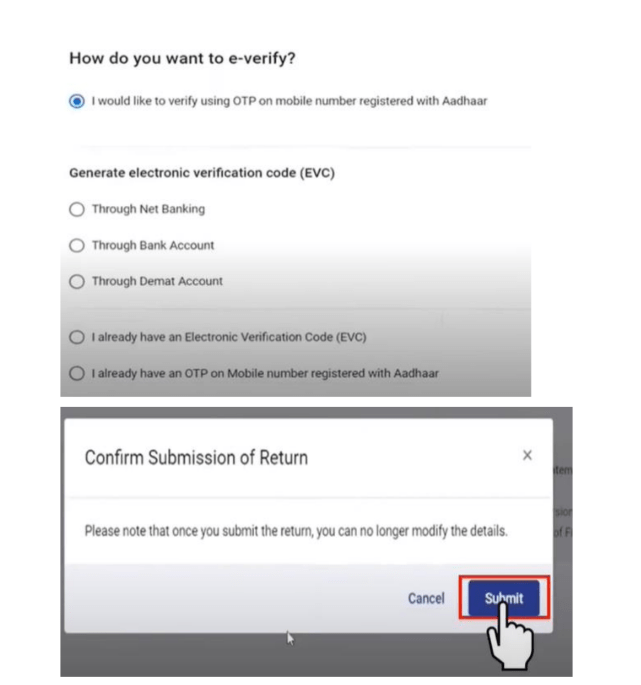

Step – 1: Download the ITR-U Excel utility and enter the relevant details and generate the JSON file.

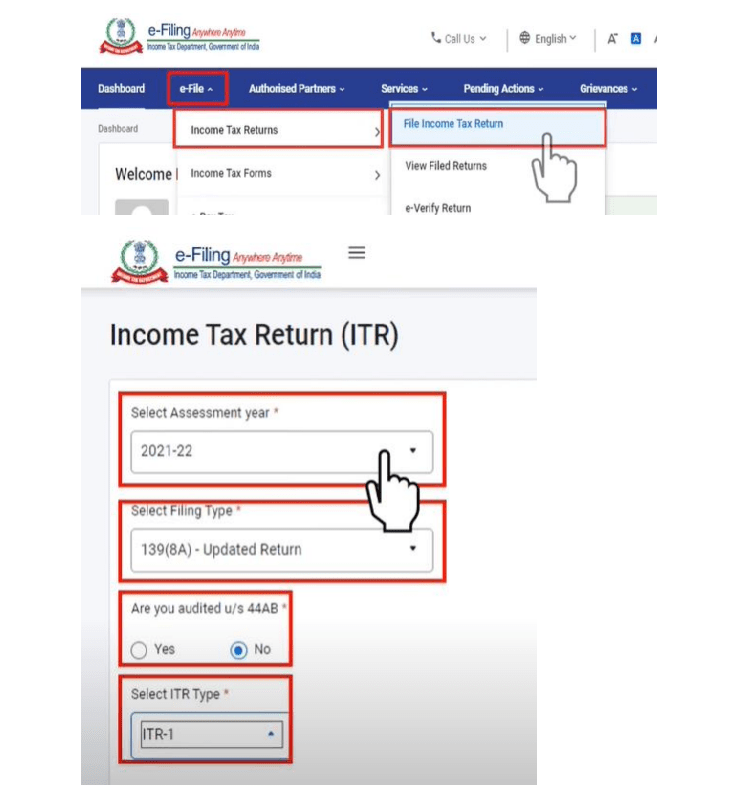

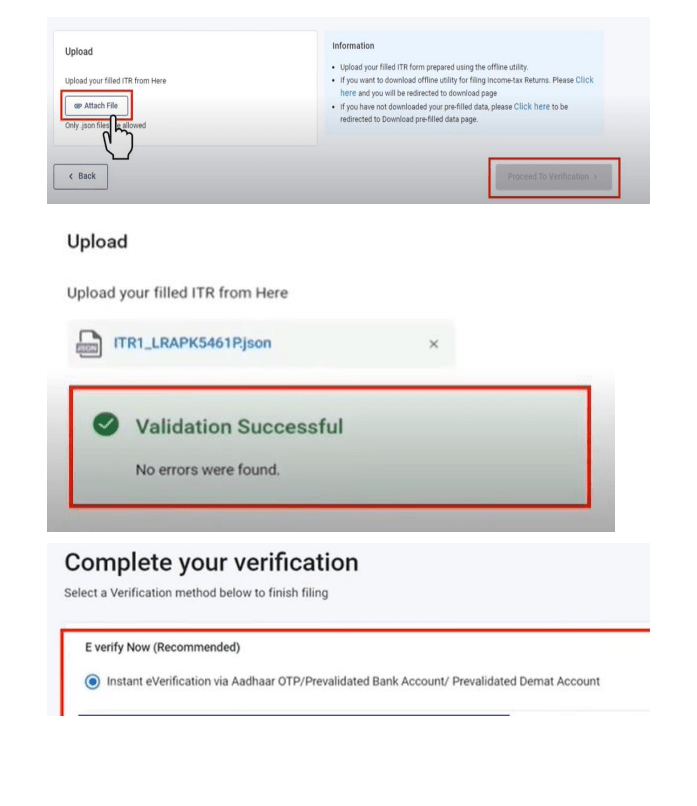

Step – 2: Upload the JSON file on e-filing portal and do verification.

FAQs

The e-filing portal will not allow to file ITR u/s 139(8A) more than one time.

No, if the total tax is adjusted with TDS credit and you do not have any additional tax liability, you cannot file an Updated ITR.

One can file the updated return but will be liable for late filing fees. The same must be paid, and the payment details must be updated under the “Taxes paid under 140B” head.