ITR-1 also known as the SAHAJ form applies to those taxpayers that do not have total income exceeding ₹ 50 lakh in the financial year.

Let us explore the various facets of ITR 1:

Who is eligible to file ITR-1?

ITR-1 can be filed by a Resident Individual whose:

Total Income does not exceed ₹ 50 lakh during the financial year

Income is only from:

- Salary

- ONE House Property

- Family Pension

- Agricultural income (up to ₹ 5,000)

- Other Source Income like – Interest from savings accounts, deposits, Income Tax Refund, interest on enhanced compensation received, any other Interest Income.

- The income of a spouse or minor is combined if it falls within specified limits.

Who is not eligible to file ITR for AY 2025-26?

The ITR-1 cannot be filed by an individual who:

- Has Resident Not Ordinarily Resident (RNOR) or Non-Resident (NR) status

- Has Total income exceeding ₹ 50 lakh

- Has Agricultural income exceeding ₹ 5,000

- Has income from lottery, racehorses, legal gambling etc

- Has taxable long-term or short-term capital gains

- Has invested in any unlisted equity shares

- Has income from business or profession

- Has gains from Virtual Digital Assets (Cryptocurrency transactions)

- Is a Director of a company

- Has tax deduction under Section 194N (for cash withdrawal exceeding limits) of the Income Tax Act

- Owns and has income from more than the one house property

- Has deferred income tax on Employee Stock Options (ESOP) received from an eligible start-up employer

- A resident who has assets (including financial interest in any entity) outside India

- Is an individual claiming double taxation relief for foreign tax paid or payable under Section 90/90A/91

- Is not covered under eligibility conditions of the ITR-1

Types of income that shall not form part of ITR-1

The following incomes shall not form part of the ITR 1 form:

- Profits and gains from business and professions

- Capital Gains

- Income from more than one house property

- Income from other sources of the following nature:

- Winnings from lottery

- Income from the activity of owning and maintaining racehorses

- Income taxable at special rates under section 115BBDA or section 115BBE

- Income to be apportioned in accordance with provisions of Section 5A

Major changes made to ITR-1 Form in AY 2025-26

The most important changes are:

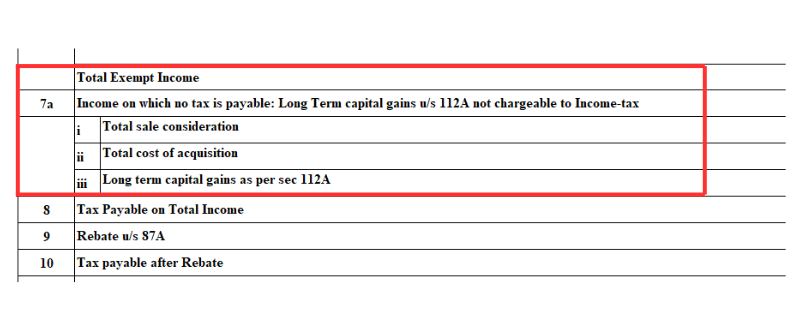

Capital Gains Reporting

You can now report LTCG u/s 112A in ITR-1, but only if:

- It is exempt – total LTCG under 112A is up to ₹1.25 lakh.

- A new option has been added under “Exempt Income” for this: “Income on which no tax is payable: Long Term capital gains u/s 112A not chargeable to Income-tax”.

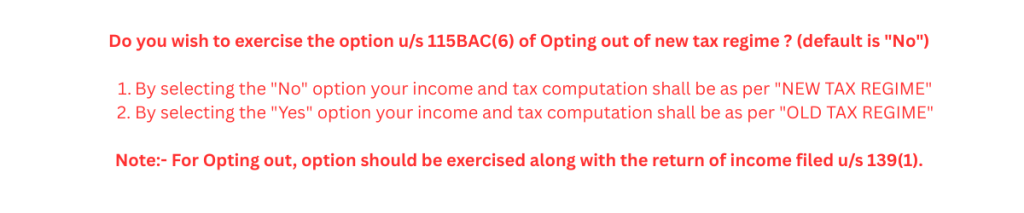

Old Tax Regime Option Enabled

Taxpayers can will be able to opt for the old tax regime within ITR 1.

Changes made in old tax regime are:

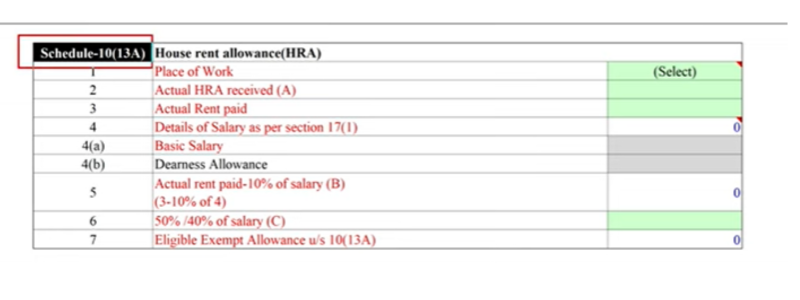

HRA Exemption Calculation

- HRA exemption can be claimed but not directly from Form 16.

- Taxpayers are now have to calculate HRA exemption manually using a formula u/s 10(13A).

- Details required like place of work (metro or non-metro), actual HRA received (from payslips), actual rent paid (from bank statements or rent receipts).

- The exemption amount must match the calculation and Form 16 to avoid discrepancies.

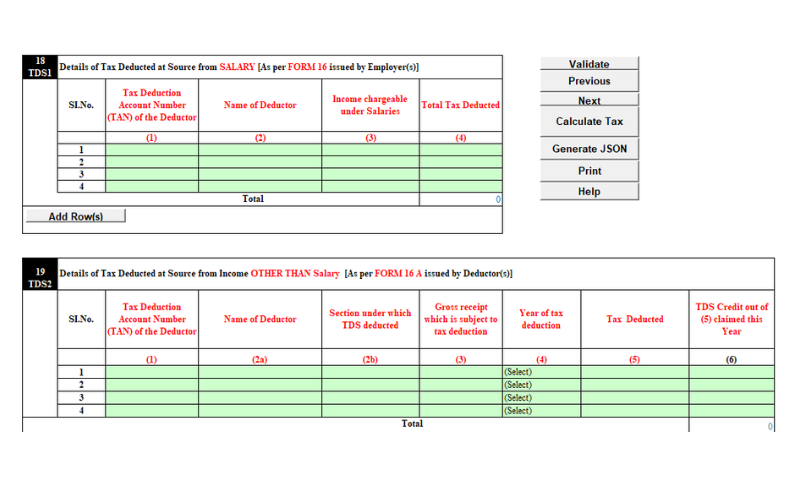

Changes in TDS Schedule

- Now, taxpayers must mention the specific section under which TDS was deducted.

- Refer to Form 26AS to identify the relevant section code for TDS deductions.

Detailed Deductions Reporting in Old Regime

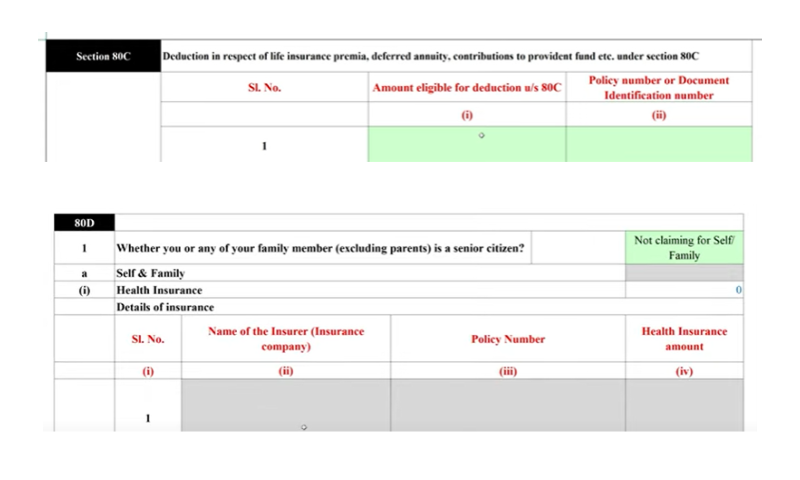

- Deductions u/s 80C cannot be claimed directly from Form 16 as before. Taxpayers must provide bifurcation of components like LIC, PF, and other investments with corresponding policy/account numbers.

- For Section 80D (health insurance), detailed information required like insurer name and policy number is required.

- Donations u/s 80G require donor details, address, PAN, and donation amount.

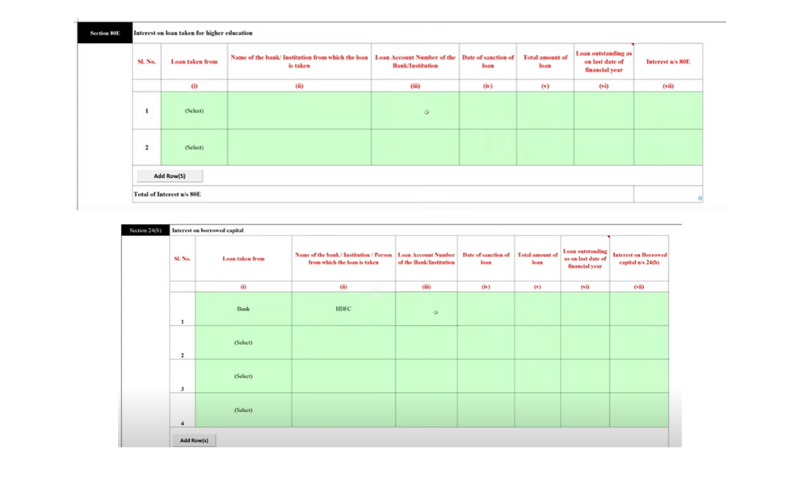

- Home loan interest deduction u/s 24(b) requires detailed loan information such as lender name, loan account number, sanction date, outstanding amount, and interest paid (max ₹2 lakh).

- Education loan interest u/s 80E and disability deductions u/s 80U also require detailed information and documents.

Documents required to file the ITR-1

- Form 16- which is issued by your employers during the given financial year.

- Form 26AS and AIS- to be downloaded from the income tax portal itself. These provide details about the various transactions entered into by the taxpayer that have been reported, including TDS, interest earned, dividends, capital gains etc. The taxpayer needs to match the details in Form 16 with Form 26AS.

- House Rent receipts.

- Bank Investment Certificates- Interest from bank account details, either from savings accounts or deposits.

- Proofs of deductions, exemptions and allowances being claimed like House Rent Allowance, investment payment receipts and insurance premium receipts to claim the deductions under Section 80C, 80D etc. While there is no need to attach these supporting documents to the ITR on submission, it is essential to have these documents in handy in case the taxpayer is required to produce them before tax authorities on assessments, inquiries etc.

- PAN card and Aadhaar card- it is mandatory for taxpayers to link PAN card and Aadhaar card on the income tax website.

Structure of the ITR 1 Form

The ITR 1 Sahaj form has 5 parts and 2 schedules with the final step being the verification process.

A – General Information: encompasses the personal information

- First name, last name and if applicable middle name

- PAN details

- Age

- Gender and Date of birth, all information aligning with the PAN details

- Ward details and assessing officer’s details if known

- Communication address

- Contact number

- City and State

- Filing date

- Aadhaar details

- Nature of Employment: it is mandatory to define the nature of employment while filing the return:

- Central Government Employee

- State government Employee

- Employee of Public Sector Enterprise (whether Central or State Government)

- Pensioners (CG/SG/PSU/OTHER)

- Employee of Private concern

- Not applicable (if family pension)

B – Gross Total Income: all the details of income under the 5 heads of income are entered in this section.

C – Deductions and taxable total income: all the deductions under the Chapter VIA of the Income Tax Act are to be entered here.

D – Computation of tax payable

E – Other Information: details of Bank Account like account number, IFSC code, account type etc to be entered.

Schedule IT – Details of advance tax and self-assessment tax payments

Schedule TDS – Details of TDS and TCS

Verification

How to File ITR 1 (SAHAJ) on the IT Portal?

- Go to the income tax e-filing website.

- Log in to your account or register an account.

- Click on the ‘e-File’ tab, then the ‘Income Tax Returns’ and then select ‘File Income Tax Return’.

- Select the Assessment Year from the dropdown menu, the current assessment year is 2024-25 applicable for the financial year 2023-24.

- Select the ‘Online’ mode of filing and click on ‘Continue’

- Click on the ‘Start New Filing’ option.

- Select the status applicable to you out of, ‘Individual’, ‘HUF’ and ‘Others’.

- Select ITR-1 and click on proceed.

- Choose the option applicable to you:

- Whether filing ITR because income exceeds the basic exemption limit.

- Filing a return to comply with provisions of Section 139 of the Income Tax Act.

- Others.

- The details of AIS/Form 26AS have to be verified with the pre-filled information. The details have to be carefully reviewed by the taxpayer. Any changes if necessary, have to be made.

- The taxpayer has to e-verify the return once it has been submitted. It is important to remember the validation of your bank account for the smooth receipt of refunds and filing of the return is being done on or before the applicable due date. There can be repercussions for not filing within the due date like late fees, losses not getting carried forward etc.

Filing a return does involve a lot of things for a taxpayer to keep in their mind and it can take a bit of time. Therefore it is best to seek professional help if required.

FAQs

A resident individual can file ITR-1 if their total income is up to ₹50 lakh which comes from salary, one house property, family pension, agricultural income (up to ₹5000), and other sources like savings account interest etc.

Do not file ITR 1 if you have capital gains income. File ITR-2.

Form ITR-1 can be used by an Ordinary Resident (ROR) Individual with a total income of up to Rs. 50 lakh.

ITR-1 is for individuals with income from salaries and a total income below ₹50 lakh.

ITR-2 is for individuals with capital gains or more than one house property.