Invoice Management System (IMS) is a new functionality developed on the GST portal which allows taxpayers to manage their invoices more efficiently. The new system shall facilitate taxpayers in matching their records/invoices vis a vis issued by their suppliers for availing the correct Input Tax Credit (ITC).

| 54th GST Council Meeting Update The GST Council is enhancing the existing GST return architecture by introducing three new features -Reverse Charge Mechanism (RCM) ledger, Input Tax Credit Reclaim ledger, and Invoice Management System (IMS). Taxpayers will be allowed to declare the opening balances for these new ledgers, ensuring a smooth transition. |

Effective Date

Invoice Management System facility is available to taxpayer from 14th October onwards on the GST portal.

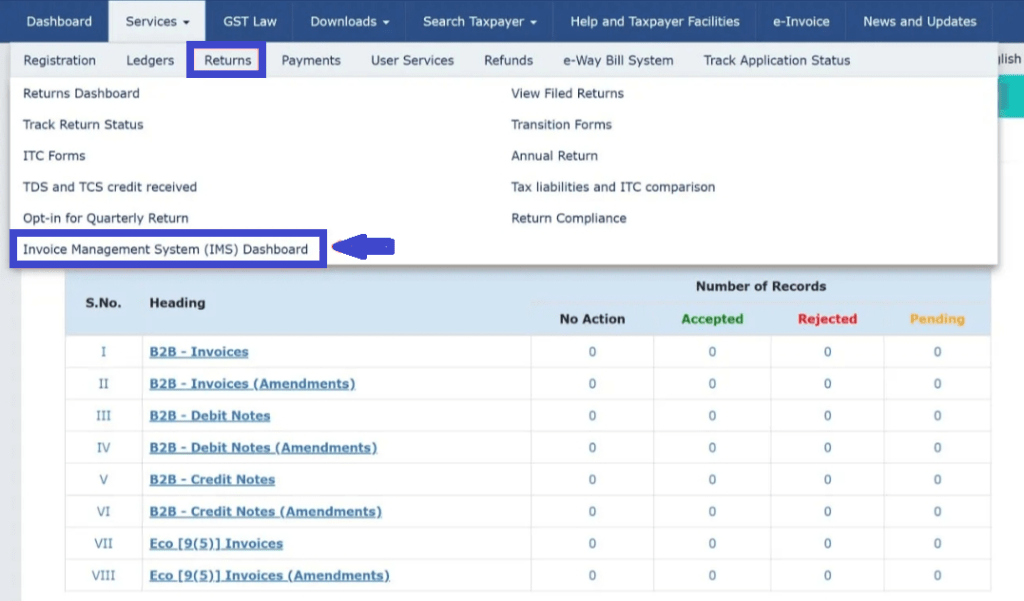

Easy to Manage Invoices Directly from IMS Dashboard

Taxpayers can accept, reject, or keep invoices pending through the IMS dashboard. If no action is taken, invoices are automatically deemed accepted and added to GSTR-2B.

In Detail

The said functionality would be a major enhancement in the ITC ecosystem of GST. Now, only the accepted invoices by the recipients would become part of their GSTR-2B as their eligible ITC.

Therefore Invoice Management System will provide the taxpayers an opportunity to review the genuineness and authenticity of the received invoices. Once the suppliers save any invoice in GSTR 1 / IFF / 1A /the same invoice would be reflected in the IMS dashboard of the recipient.

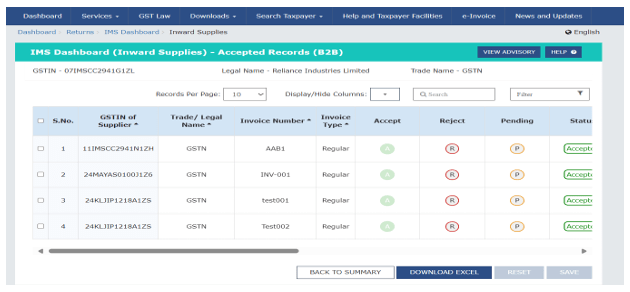

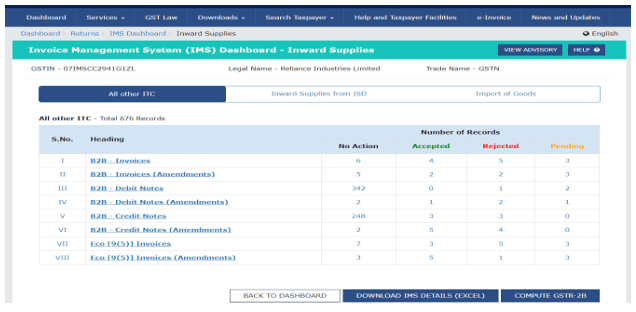

A sample screenshot of the same is provided below.

The recipient can accept or reject an invoice or can simply keep it pending in the system.

These actions can be taken from the time of saving the records in GSTR 1 / IFF / 1A by the supplier taxpayer till the recipient taxpayer files his/her corresponding GSTR-3B.

If recipient doesn’t take any action on an invoice in IMS then it will be deemed accepted and will move to GSTR-2B as an accepted invoice.

In case, the supplier amends the details of a saved invoices in the GSTR-1 before filling the GSTR-1, in such cases the amended invoice will replace the original invoice in IMS, irrespective of the action taken by the recipient on the original invoice.

Impact of Supplier Amendments on IMS and ITC

If a supplier amends an invoice after filing GSTR-1, the changes will replace the original in IMS.

In Detail

In case supplier has amended any invoice filed in GSTR-1 through GSTR-1A then same will also flow to IMS, however, ITC corresponding to the same will flow in GSTR-2B of the recipient, generated for the subsequent month only.

The invoices which would be kept pending can be availed by taxpayers at any future point of time but not later than the limits prescribed by Section 16(4) of the CGST Act, 2017.

All the invoices/ records reported or saved by the supplier taxpayer in their GSTR-1 or IFF or GST-5 or GSTR-6 will be available in the IMS dashboard of the recipient taxpayer for taking the actions.

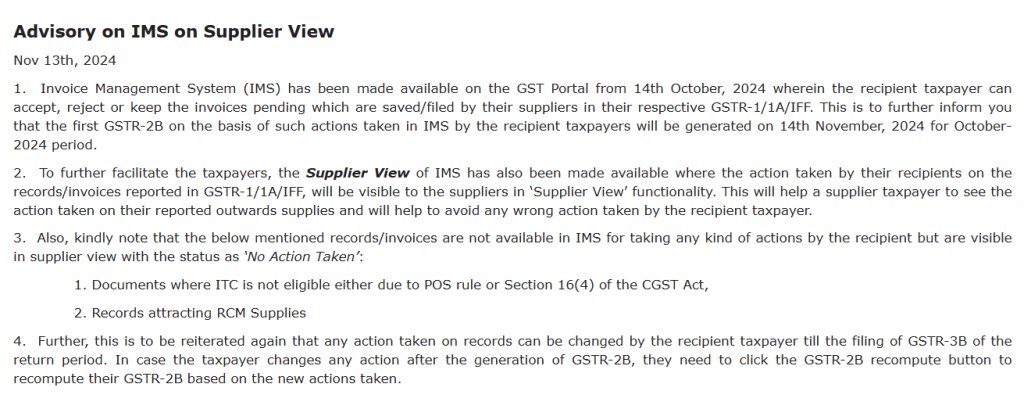

Supplier will also be able to see, what action his recipient has taken on invoices in IMS.

Advisory on IMS on Supplier View

GSTR-2B Generation and Actions on Invoices

Only filed invoices will be considered for ITC calculation in GSTR-2B.

Explanation

At the time of generation of GSTR-2B only the filed invoices/records by the supplier, will be considered for the computation of ITC.

Based on the current cut-off dates and action taken by the recipient, a draft GSTR-2B will be made available to recipient on 14th of the subsequent month as currently being generated.

However, the recipient will be free to take actions of accept/reject or keep pending even after generation of GSTR-2B till the filing of GSTR-3B.

If recipient taxpayers have taken an action on any invoice after 14th of the month, then he would be required to recompute their GSTR-2B. However, they will not be able to take any action after filing of GSTR-3B for the same month.

It may be noted that taxpayers can take action on invoices until they file GSTR-3B, after which no changes can be made. If you can’t see your GSTR2B or there is a difference between 2A and 2B, then compute your new GSTR2B from IMS dashboard after taking any action on the existing records.

Advisory regarding IMS during initial phase of its implementation

Impact on QRMP Taxpayers

The records/invoices saved or filed through IFF by a QRMP taxpayer will flow to IMS for the recipient, and will become part of GSTR-2B, as per action taken by the recipient in IMS on the same.

The GSTR2B of the recipient will be generated monthly, unless the recipient is a QRMP taxpayer.

It may be noted that GSTR-2B will not be generated for Month M-1 and M-2 for QRMP taxpayer. GSTR-2B for a QRMP taxpayer will be generated on Quarterly basis only.

Flow of IMS

All the outward supplies reported in the GSTR 1 / IFF / 1A shall populate in the IMS of recipients for taking the actions.

No Action Taken

These are the invoices/records where no action has been taken by the recipient these will be treated as deemed accepted at the time of GSTR-2B generation

Accept

Accepted records will become part of ‘ITC Available’ section of respective GSTR 2B. GST on accepted records will auto-populate in GSTR 3B as eligible ITC.

Reject

Rejected records will become part of ‘ITC Rejected’ section of respective GSTR 2B. ITC of rejected records will not auto-populate in GSTR 3B.

Pending

Pending records will not become part of GSTR 2B and GSTR 3B. Such records will remain on IMS dashboard till the time same is accepted or rejected. ‘Pending’ action shall not be allowed in following scenarios:

- Original Credit note

- Upward amendment of the credit note irrespective of the action taken by recipient on the original credit note

- Downward amendment of the credit-note if original credit note was rejected by recipient,

- Downward amendment of Invoice/ Debit note where original Invoice/ Debit note was accepted by recipient and respective GSTR 3B has also been filed.

Below is a screenshot of IMS dashboard showing summary of all inwards records and action taken thereon:

Reasons For Non-Generation of GSTR-2B

The two primary scenarios under the IMS are:

QRMP Scheme Taxpayers

For QRMP taxpayers, GSTR-2B is only generated for the third month of the quarter.

Example: For the October–December 2024 quarter, GSTR-2B will be generated for December 2024. No GSTR-2B will be generated for October 2024 or November 2024.

Pending GSTR-3B Filing

GSTR-2B generation will be blocked if previous GSTR-3B is pending.

It will be generated only after pending GSTR-3B return. After filing, use the “Compute GSTR-2B” button on the IMS dashboard to generate the missing GSTR-2B.

Key Points to Note

At the time of GSTR 2B generation, a record will be considered as ‘Deemed Accepted’ if no action is taken on that record in IMS.

It is mandatory to recompute GSTR 2B from IMS dashboard in case of any change in action already taken on concerned records or any action is taken after 14th of the month i.e. date of generation of Draft GSTR-2B.

- Following supplies will not go to IMS and will be directly populated in the GSTR 3B –

- Inward RCM supplies where supplier has reported in the Table 4B of IFF / GSTR 1 or GSTR 1A and

- supplies where ITC is not eligible due to section 16(4) of CGST Act or on account of POS rule.

- Records will flow to IMS dashboard at the time of saving of record by supplier in respective form and recipient can take action on such record in IMS. However, such records will be populated in the GSTR 2B after filling of return in GSTR-1/IFF/1A by the supplier.

- All the accepted/ deemed accepted/ rejected records will move out of IMS dashboard after filing of respective GSTR 3B.

- Pending records will remain on IMS dashboard and these records can be accepted or rejected in future months.

- It is mandatory to take action on original record and file the respective GSTR 3B before taking action on amended record (amended through GSTR-1A/GSTR-1) when original and amended record belongs to 2 different GSTR 2B return period. If both the records belong to same period’s 2B, only amended record will be considered for ITC calculation of GSTR 2B.

- Any change made in a record/invoice before filing GSTR-1/1A/IFF by the supplier will reset the record’s status on recipient’s IMS dashboard.

- GSTR 2B will be sequential now. i.e. system will generate GSTR 2B of a return period only if GSTR 3B of previous return period is filed.

- The liability of supplier will be increased in GSTR 3B for the subsequent tax period, for the invoices/records which have been rejected by the recipient in the IMS for the following transactions

- Original Credit note rejected by the recipient

- Upward amendment of the credit note rejected by the recipient irrespective of the action taken by recipient on the original credit note

- Downward amendment of the credit note rejected by the recipient if original credit note was rejected by him,

- Downward amendment of Invoice/ Debit note rejected by the recipient where original Invoice/ Debit note was accepted by him and respective GSTR 3B has also been filed.