Finance Minister Nirmala Sitharaman has revised the income tax slabs in the new tax regime as part of the Union Budget for 2025. These updated income tax slabs will be implemented starting April 1, 2025, for the financial year 2025-26. The new tax regime introduces a complete overhaul of the income tax slabs.

The income tax brackets for the Financial Year (FY) 2024-25 in India depend on the tax regime selected by the taxpayer. There are two options: the Old Tax Regime and the New Tax Regime. Here are the income tax slabs for FY 2024-25 (Assessment Year 2025-26):

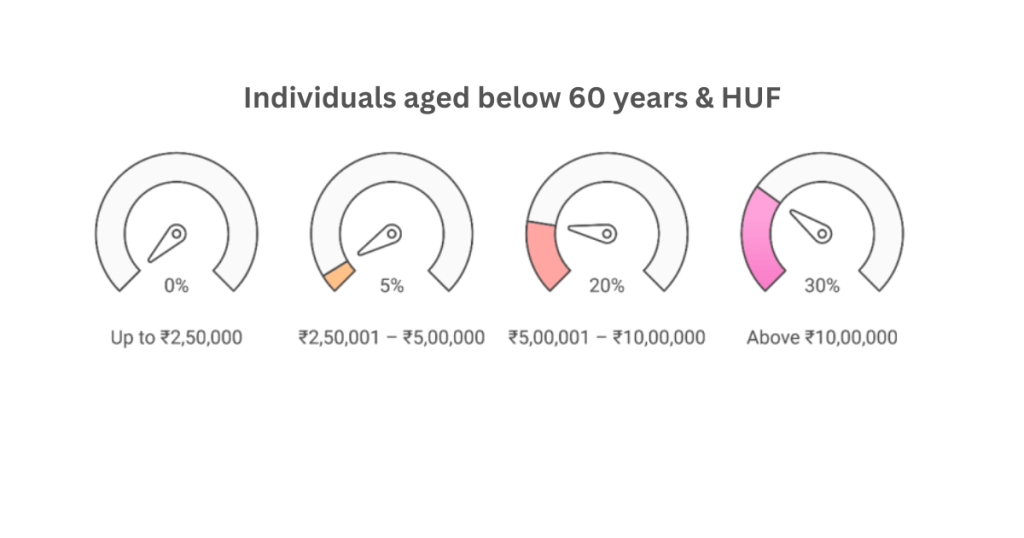

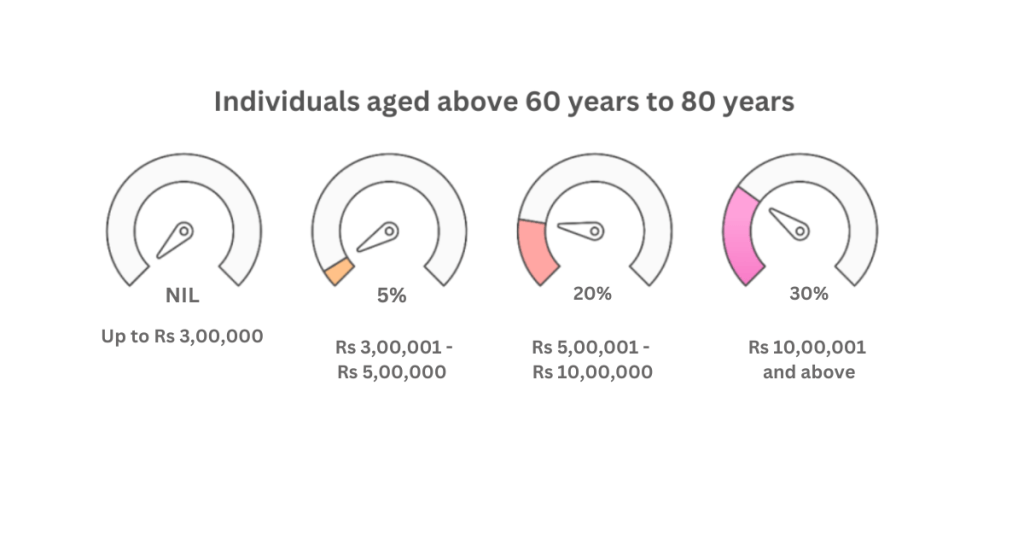

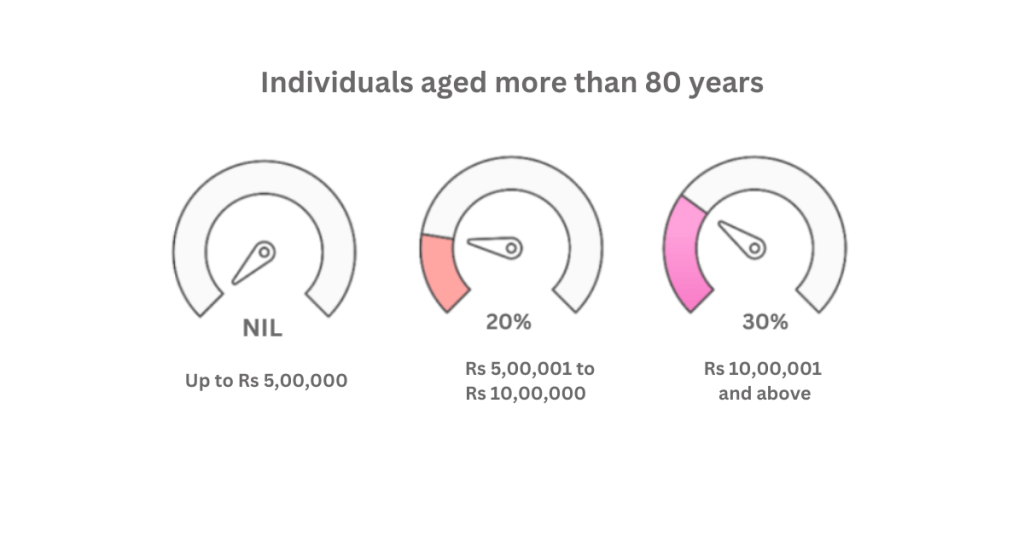

Old Tax Regime For FY 2024-25

The old tax regime allows various deductions and exemptions but has higher tax rates.

Standard Deduction

- Amount: ₹50,000

- Applicability: Available to salaried individuals and pensioners.

- Purpose: Replaces the earlier transport allowance (₹19,200) and medical reimbursement (₹15,000).

Rebate Under Section 87A

- Eligibility: Individuals with total taxable income up to ₹5,00,000.

- Rebate Amount: Up to ₹12,500.

- Effect: Reduces tax liability to zero if income is below ₹5,00,000.

Surcharge

A surcharge is an additional tax levied on high-income earners. The rates are as follows:

| Income Range | Surcharge Rate |

| ₹50 lakh – ₹1 crore | 10% |

| ₹1 crore – ₹2 crore | 15% |

| ₹2 crore – ₹5 crore | 25% |

| Above ₹5 crore | 37% |

Health and Education Cess

- Rate: 4% of the total tax (including surcharge, if applicable).

- Purpose: Funds health and education initiatives.

Example

Let’s assume a taxpayer has a taxable income of ₹60,00,000 under the Old Tax Regime:

Tax Calculation:

- Up to ₹2,50,000: 0%

- ₹2,50,001 – ₹5,00,000: 5% of ₹2,50,000 = ₹12,500

- ₹5,00,001 – ₹10,00,000: 20% of ₹5,00,000 = ₹1,00,000

- Above ₹10,00,000: 30% of ₹50,00,000 = ₹15,00,000

- Total Tax: ₹12,500 + ₹1,00,000 + ₹15,00,000 = ₹16,12,500

Surcharge:

- Income is ₹60,00,000 (falls in ₹50 lakh – ₹1 crore slab).

- Surcharge = 10% of ₹16,12,500 = ₹1,61,250

Health and Education Cess:

- Cess = 4% of (₹16,12,500 + ₹1,61,250) = ₹70,950

Total Tax Liability:

- ₹16,12,500 + ₹1,61,250 + ₹70,950 = ₹18,44,700

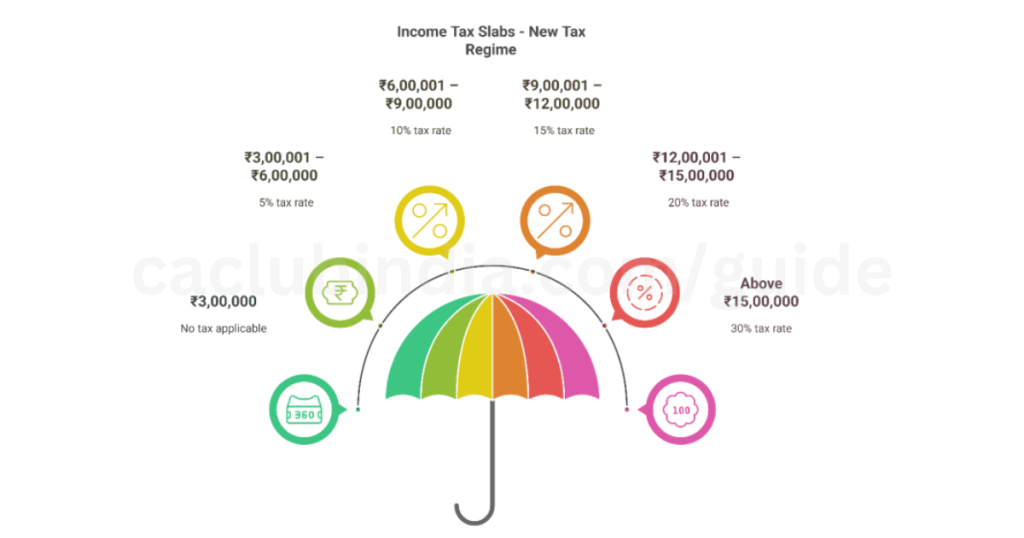

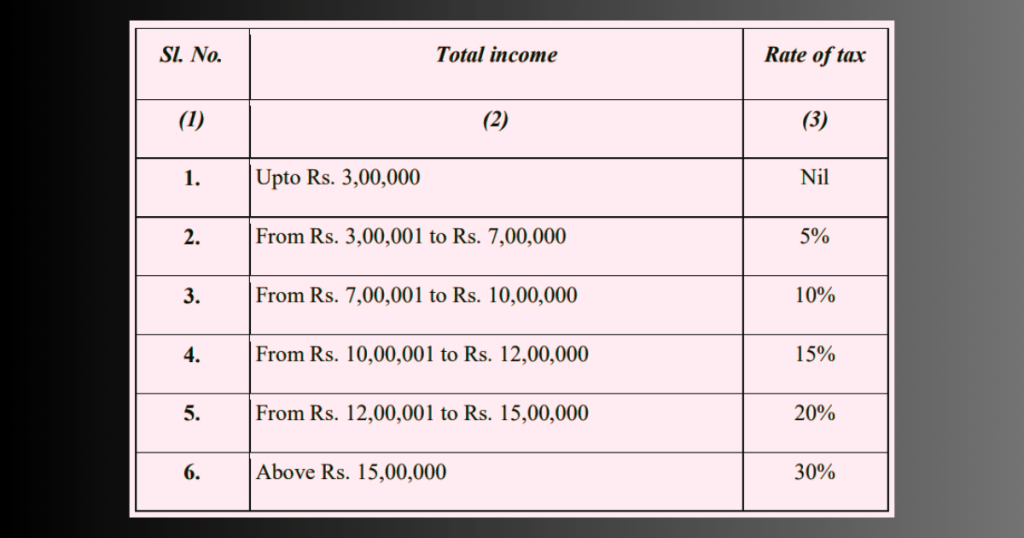

New Tax Regime For FY 2024-25

The new tax system features reduced tax rates, but it does not permit the majority of deductions and exemptions

Default Regime From FY 2023-24

For FY 2024-25

As per the provisions of sub-section (1A) of section 115BAC of the Act, an individual or Hindu undivided family or association of persons [other than a co-operative society], or body of individuals, whether incorporated or not, or an artificial juridical person referred to in sub-clause (vii) of clause (31) of section 2, has to pay tax in respect of the total income at following rates:

Standard Deduction

- Amount: ₹50,000

- Applicability: Available to salaried individuals and pensioners.

- Purpose: Reduces taxable income by ₹50,000.

Rebate Under Section 87A

- Eligibility: Individuals with total taxable income up to ₹7,00,000.

- Rebate Amount: Up to ₹25,000.

- Effect: Reduces tax liability to zero if income is below ₹7,00,000.

Surcharge

A surcharge is an additional tax levied on high-income earners. The rates are as follows:

| Income Range | Surcharge Rate |

| ₹50 lakh – ₹1 crore | 10% |

| ₹1 crore – ₹2 crore | 15% |

| ₹2 crore – ₹5 crore | 25% |

| Above ₹5 crore | 37% |

Health and Education Cess

- Rate: 4% of the total tax (including surcharge, if applicable).

- Purpose: Funds health and education initiatives.

Example

Let’s assume a taxpayer has a taxable income of ₹60,00,000 under the New Tax Regime:

Tax Calculation:

- Up to ₹3,00,000= 0%

- ₹3,00,001 – ₹6,00,000: 5% of ₹3,00,000 = ₹15,000

- ₹6,00,001 – ₹9,00,000: 10% of ₹3,00,000 = ₹30,000

- ₹9,00,001 – ₹12,00,000: 15% of ₹3,00,000 = ₹45,000

- ₹12,00,001 – ₹15,00,000: 20% of ₹3,00,000 = ₹60,000

- Above ₹15,00,000: 30% of ₹45,00,000 = ₹13,50,000

- Total Tax: ₹15,000 + ₹30,000 + ₹45,000 + ₹60,000 + ₹13,50,000 = ₹15,00,000

Surcharge:

- Income is ₹60,00,000 (falls in ₹50 lakh – ₹1 crore slab).

- Surcharge = 10% of ₹15,00,000 = ₹1,50,000

Health and Education Cess:

- Cess = 4% of (₹15,00,000 + ₹1,50,000) = ₹66,000

Total Tax Liability:

- ₹15,00,000 + ₹1,50,000 + ₹66,000 = ₹17,16,000

Corporate Tax Rates (FY 2024-25)

For Domestic Companies

Base Tax Rate:

- 25% (if turnover or gross receipts in the previous year (FY 2022-23) do not exceed ₹400 crore)

- 30% (for other domestic companies)

Reduced Tax Rate (Section 115BAA):

- 22% (if the company opts for this concessional rate and forgoes certain deductions/exemptions)

Surcharge:

- 7% (if taxable income exceeds ₹1 crore but is less than ₹10 crore).

- 12% (if taxable income exceeds ₹10 crore)

Health and Education Cess:

- 4% (on the total of income tax and surcharge)

For Foreign Companies

Base Tax Rate:

- 40% (on income earned in India)

Surcharge:

- 2% (if taxable income exceeds ₹1 crore but is less than ₹10 crore).

- 5% (if taxable income exceeds ₹10 crore)

Health and Education Cess:

- 4% (on the total of income tax and surcharge)

Minimum Alternate Tax (MAT)

MAT is imposed at a rate of 15% (along with an additional surcharge and cess) on book profits for companies that take advantage of specific exemptions or deductions, leading to a reduced tax obligation.

Cooperative Societies (FY 2024-25)

The tax rates for cooperative societies are different from those for individuals and companies.

| Income Slab | Tax Rate |

| Up to ₹10,000 | 10% |

| ₹10,001 to ₹20,000 | 20% |

| Above ₹20,000 | 30% |

Surcharge

- 7% of the tax amount if the total income exceeds ₹1 crore but is less than ₹10 crore.

- 12% of the tax amount if the total income exceeds ₹10 crore.

Health and Education Cess

- 4% of the total tax (including surcharge, if applicable)

Other Points

- Cooperative societies are eligible for certain deductions under Section 80P of the Income Tax Act, which allows exemptions on income from specific activities like providing credit facilities, cottage industries, marketing of agricultural produce, etc.

- Cooperative societies must file their income tax returns using ITR-5.

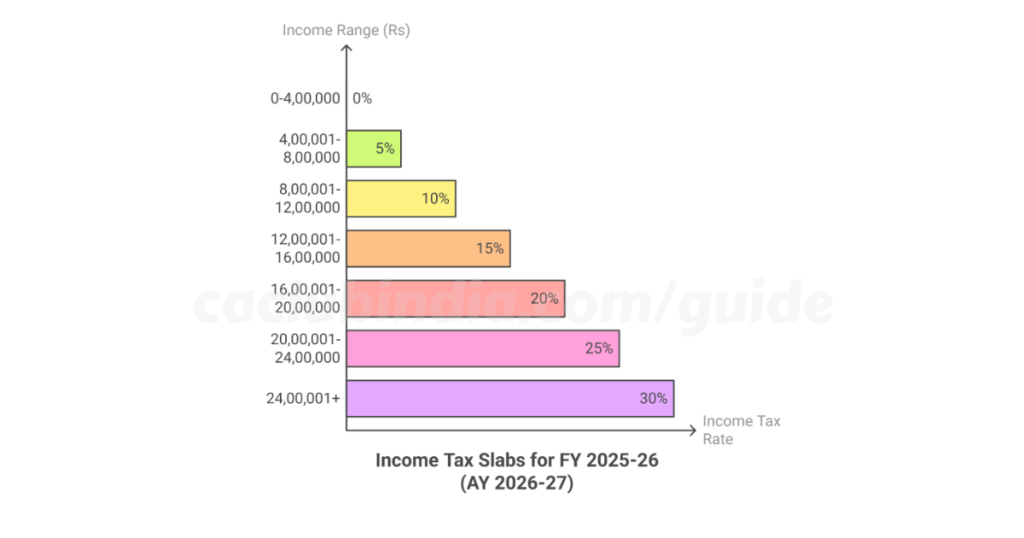

Income Tax Slabs for FY 2025-26 (AY 2026-27)

The finance minister has announced important modifications to the income tax slabs within the new tax regime in the Union Budget for 2025. These updated slabs will take effect from April 1, 2025. The modified slabs under the new tax regime are as follows:

FAQs

To choose between the old and new tax regimes it totally depends on individual circumstances.

The old regime offers more deductions and exemptions.

The new regime offers lower tax rates with fewer deductions.

Yes, a standard deduction of Rs. 50,000 under the new tax regime can be claim similar to the old regime.

The main disadvantage of the new tax regime is the absence of tax deductions, which can be negatively impact individuals for those who have investments in tax-saving instruments like ELSS funds or tax-saving insurance plans.