When filing their income tax return (ITR) forms in India, taxpayers often make several common errors. Timely and accurate income tax payments are crucial to avoid penalties and interest charges from the Income Tax Department.

Here are some of the errors:

Incorrect personal details

Taxpayers may make mistakes when entering their personal information, such as name, address, PAN (Permanent Account Number), or bank account details. It is crucial to provide accurate information to avoid any potential issues.

Incorrect form selection

Choosing the right ITR form based on tax liability and type of income is also important.

Incorrect Assessment Year

Selecting the appropriate financial year is essential to ensure accurate tax payments.

Report all sources of income

It is crucial to report all sources of income to avoid issues, and compliance with tax regulations is strongly advised.

Delay in filing/ Non-filing

Failing to file returns on time may incur penalties and legal consequences. It is recommended that the returns be submitted by the deadline.

Not keeping any record of documents

Many taxpayers fail to preserve facts about income tax payments, leading to disputes with the income tax department if discrepancies arise. It is better to keep track of documents for proof purposes.

Mismatch of Income and Tax Deduction with Form 26AS and Form 16

If you are a salaried employee, Form 16 is imperative to be produced to you by your employer before you file your taxes. Before filing your taxes, it is imperative to put together your income earned that reflects in for the Forms. Do check for any discrepancies before you input the data.

Neglecting Advance Tax Responsibilities

When advance tax payments are not made on time, taxpayers may incur interest charges on the outstanding amount. Additionally, tax authorities often impose penalties for non-compliance, which can significantly increase the total amount owed.

Misunderstanding Deductions and Credits

Failing to understand which deductions and credits you qualify for can lead to incorrect payment amounts.

Failing to Review Tax Statements

After payment, always review any statements or notifications from the tax authority to ensure your payment was processed correctly.

By being aware of these common pitfalls and taking proactive steps to mitigate them, you can help ensure a smoother income tax payment process and avoid unnecessary complications. Timely payment of advance tax is crucial to avoid unnecessary financial burdens.

By understanding the rules and regulations and taking proactive steps, you can ensure compliance and minimize the risk of penalties.

Income Tax Online Payment: Steps

Post-Login

- Log in to income tax e-Filing portal with your User ID and Password.

- Click on e-File on the Dashboard, then click on e-Pay Tax. You will be navigated to the e-Pay Tax.

- On the e-Pay Tax page, click the New Payment option to initiate the online tax payment and then click Proceed.

- After selecting the applicable Tax Payment tile, select Assessment Year, Minor head, other details (as applicable) and click Continue.

- Add the breakup of total amount of tax payment on the Add Tax Breakup Details page and click Continue.

- In the Select Payment Mode page, select Payment Gateway mode and click Continue.

- In the Preview and Make Payment page, verify the details and tax break up details and click Pay Now.

- Carefully read and select the terms and conditions and click Submit to Bank.

- After successful payment, you will receive a confirmation e-Mail and an SMS on the e-Mail ID and Mobile number registered with the e-Filing portal.

- Once the payment is successful, details of payment and Challan Receipt are available under Payment History Tab on the e-Pay Tax page.

Pre-Login

- Go to the e-Filing portal and click e-Pay Tax.

- On the e-Pay Tax page, fill the required details (PAN/TAN with mobile number) and click Continue.

- Enter the 6-digit OTP received on the mobile number.

- Once OTP verified, a success message will be displayed with your PAN/TAN and masked name. Click Continue to proceed.

- Click Proceed on a tax payment category that applies to you.

- Select Assessment Year, Minor head, other details (as applicable) after selecting the applicable Tax Payment tile and click Continue.

- On the Add Tax Breakup Details page, add the breakup of total amount of tax payment and click Continue.

- In the Select Payment Mode page, select Payment Gateway mode and click Continue.

- In the Preview and Make Payment page, verify the details and tax break up details and click Pay Now.

- Read and select the terms and conditions and click Submit to Bank.

- After successful payment, you will receive a confirmation e-Mail and an SMS.

- Once the payment is successful, Challan Receipt may be downloaded for future references.

- The details of payment and Challan Receipt are also available under Payment History tab on the e-Pay Tax page post-login.

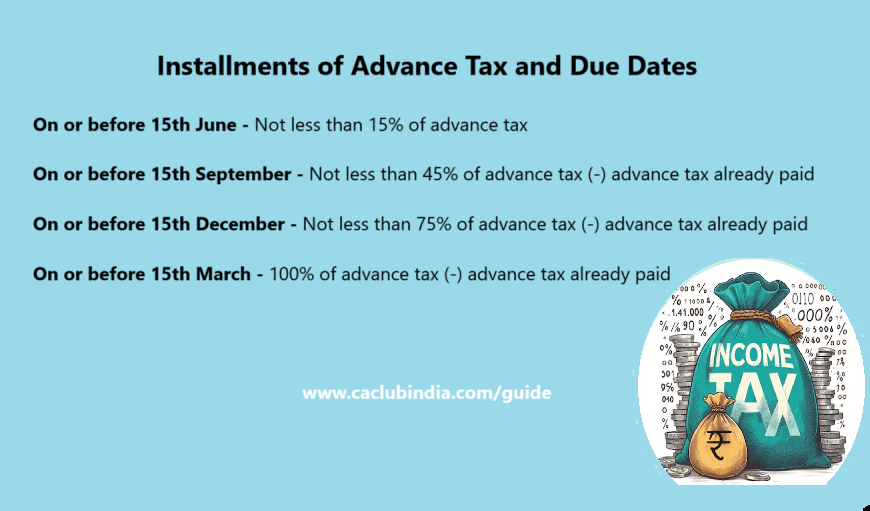

Advance Income Tax Payment: Due Dates

Click Here To Know More About