Income Tax Clearance Certificate (ITCC) is a document which states that an individual has no outstanding pending tax liabilities or has made acceptable arrangements to address them.

When it is mandatory to get income tax clearance certificate?

There are situations when it is mandatory to get income tax clearance certificate.

When one leaves India permanently India

When a non resident who want to return back to his home country after completing business or who was under employment in India.

How to get Income Tax Clearance Certificate?

The process of getting income tax clearance certificate is regulated by section 230 of Income Tax Act.

For Resident

If you are an Indian and want to leave the country, then you need to submit Form 30C to the jurisdictional tax officer.

Once the application is approved certificate will be granted in Form 33.

For Non Resident

If you are a person who is not domiciled in India, who has come to India in connection with business, profession or employment or who has income derived from any source in India.

Then, you need to submit Form 31 to the employer from whom you have received income.

On the basis of this information, employer or the person will submit details in Form 30A to Chief Commissioner of Income Tax.

Once the application is approved, income tax officer issue a certificate in Form 30B.

Who has the power to issue Income Tax Clearance Certificate?

The state government’s revenue department issues the Income Tax Clearance Certificate (ITCC) in the name of the individual concerned.

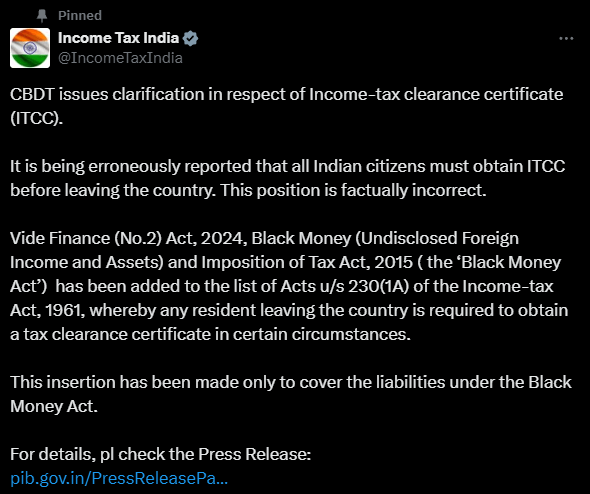

CBDT’s recent clarification in respect of Income-tax clearance certificate

The Ministry of Finance has clarified that the need for an Income-Tax Clearance Certificate (ITCC) is specific and not broadly applicable to all citizens.

Misinterpretation

Only certain individuals with specific circumstances need to obtain an ITCC before leaving India.

It is incorrectly reported that all Indian citizens must obtain an ITCC before leaving the country. This is not true.

Amendment to Section 230(1A)

The recent amendment to Section 230(1A) includes liabilities under the Black Money Act alongside existing tax liabilities.

When ITCC is required?

An ITCC is required only in specific situations:

- Those who are involved in serious financial irregularities under the IT Act or Wealth-tax Act.

- Those having direct tax arrears over Rs. 10 lakh not stayed by any authority.

Note: A person can only be asked to obtain ITCC after reasons are recorded and approval from the Principal Chief Commissioner or Chief Commissioner of Income-tax.

Rare Cases Requiring an ITCC

The requirement for an ITCC is rare and it is applicable only in exceptional cases, like significant financial misconduct or large unpaid tax liabilities.

194R TDS: Tax Implications on Business Perks Click Here

FAQs

Domiciled in India refers to an individual,s permanent home in India.

No, ITCC is not necessary for all citizens.

It requires only for those meeting specific criteria like significant tax liabilities or involvement in financial irregularities.

No, the requirement for an ITCC can only be imposed after recording specific reasons and obtaining approval from the Principal Chief Commissioner or Chief Commissioner of Income-tax.