GSTR-5 is a document or statement that has to be filed by every registered non-resident taxable person for the period during which they carry out business transaction in India.

The document must contain the details of all outward supplies and inward supplies.

Pre-requisites for filling GSTR-5

In order to file the GSTR-5:

- You have to be a non-resident foreign taxpayer who does not have a business establishment in India.

- You need a temporary registration under GST for the period during which you will carry out business in India.

Who is a Non Resident Taxable Persons?

Non-resident foreign taxpayers are the suppliers who does not have a business establishment in India and operate in India for a short duration to make taxable supplies.

Such taxpayers must register under GST and file GSTR-5, a return specifically designed for them.

Due Date to file GSTR-5

From July 2017 to September 2022

Due date was the 20th of the following month or within 7 days of business closure, whichever is earlier.

From October 2022 Onwards

GSTR-5 must be filed by the 13th of the following month or within 7 days of business closure, whichever is earlier.

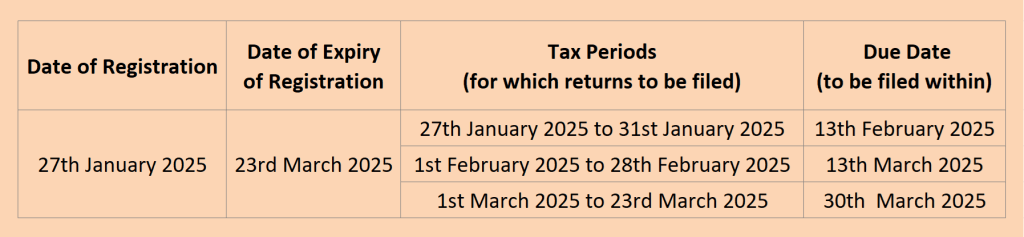

Example

From where Form GSTR-5 can be Filed?

Form GSTR-5 can be accessed on the GST Portal.

The path is Services > Returns > Returns Dashboard.

Consequences of Not Filing or Delaying GSTR-5

Non-Filing of GSTR-5

- The next month’s return cannot be filed until the pending return is submitted.

- This leads to a cascading effect, resulting in fines and penalties.

Late Filing of GSTR-5

Interest

18% per annum on the amount of outstanding tax to be paid, calculated from the next day of filing to the date of payment.

Late Fee

- ₹50 per day (₹25 CGST + ₹25 SGST).

- ₹20 per day (₹10 CGST + ₹10 SGST) for Nil returns.

- Maximum late fee: ₹5,000.

Non-resident foreign taxpayers must file GSTR-5 on time to ensure GST compliance. Timely filing prevents penalties and ensures smooth business operations in India.