GSTR-3B due date for the month of December 2024 have been extended as the GST portal has experienced scheduled downtime starting from 9th January 2025 (12 AM) to 10th January 2025 (6 PM).

Reason for Extension of GSTR-3B Deadlines

The downtime affected the filing of GSTR-1 returns for which taxpayers has short time limit for GSTR-3B filing, so the deadline has been extended accordingly.

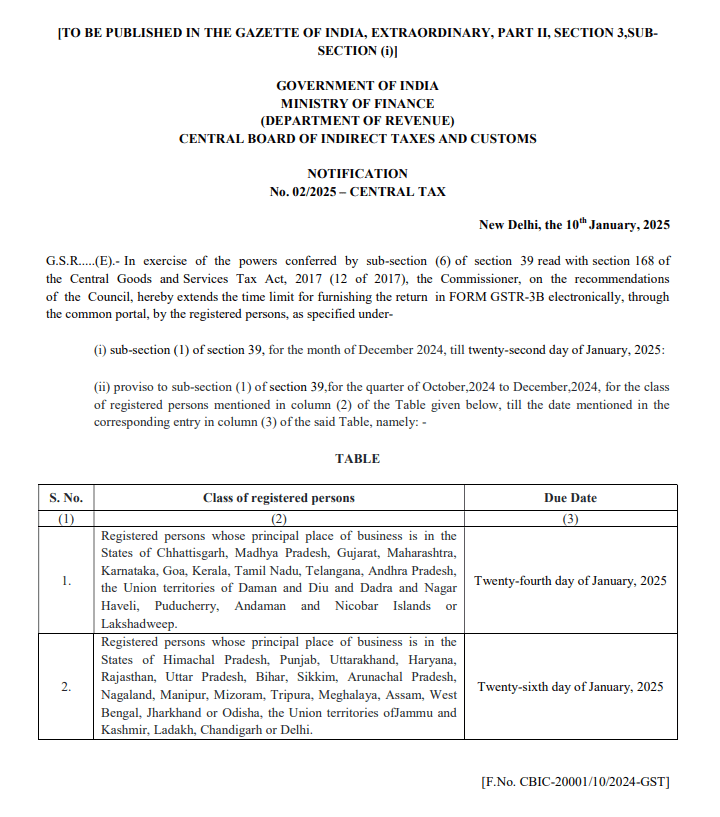

For monthly filers

The GSTR-3B filing deadline is extended to 22nd January 2025.

For quarterly filers (October-December 2024)

States/UTs in Group 1

- Registered persons whose principal place of business is in the States of Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands or Lakshadweep.

- New Deadline: 24th January 2025

States/UTs in Group 2:

- Registered persons whose principal place of business is in the States of Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh or Delhi.

- New Deadline: 26th January 2025

The original due date for Form GSTR-3B was the 20th of every month, but due to the extended GSTR-1 deadline, the GSTR-3B due date has also been extended.