Important Update

GST Portal provides a pre-filled GSTR-3B, where the tax liability gets auto-populated based on the outward supplies declared in GSTR-1/ GSTR-1A/ IFF. As of now taxpayers can edit such auto populated values in form GSTR 3B itself.

What’s changing?

From the July 2025 tax period (to be filed in August 2025), the auto-populated tax liability in GSTR-3B will become non editable.

What’s the solution?

Taxpayers must use the new GSTR-1A form to amend their incorrectly declared outward supplies in GSTR-1/IFF.

Advisory on 16th May 2025: Reporting Values in Table 3.2 of GSTR-3B

GSTR-1A allows amendments in outward supplies before filing GSTR-3B for the same period.

Table 3.2 of Form GSTR-3B captures inter-State supplies which are made to:

- Unregistered persons

- Composition taxpayers

- UIN (Unique Identification Number) holders

The values in Table 3.2 of GSTR-3B auto-populates from corresponding inter-state supplies declared in GSTR-1, GSTR-1A, and IFF in requisite tables.

But from April-2025 tax period, inter-state supplies auto-populated in Table 3.2 of GSTR-3B will be made non-editable. The GSTR-3B shall be filed with the auto-populated values as generated by the system only.

Amendments Can Only Be Done Through GSTR-1, GSTR-1A or IFF

- In case any modification/amendment is required in auto-populated values of Table 3.2 of GSTR-3B, same can be done only by amending the corresponding values in respective tables of GSTR-1A or through Form GSTR-1/IFF filed for subsequent tax periods.

Importance of Accurate Reporting in GSTR-1

To ensure that GSTR-3B is filed accurately with the correct values of inter-state supplies, it is advised to report the correct values in GSTR-1, GSTR-1A, or IFF.

This will ensure the auto-populated values in Table 3.2 of GSTR-3B are accurate and compliant with GST regulations.

What is GSTR-3B?

GSTR-3B is a summary of supplies made during the month along with GST to be paid.

It discloses summary of input tax credit claimed, purchases on which reverse charge is applicable, etc.

Who are Eligible?

All GST-registered persons including casual taxable persons and those liable for reverse charge except specific categories are required to file GSTR-3B.

This filling includes regular taxpayers and those under the Quarterly Returns with Monthly Payments (QRMP) Scheme.

Filing is mandatory even if there are no transactions (nil return) during the tax period.

Exemptions

The following are exempted:

- Taxpayers under the GST Composition Scheme (who file CMP-08 and GSTR-4).

- Non-resident taxable persons (who file GSTR-5).

- Input Service Distributors (who file GSTR-6).

- Non-resident Suppliers of OIDAR Services

Important Update

| Taxpayers can directly report negative sale values in GSTR-3B which ensures accurate tax reporting and avoids unnecessary carry-forwards. |

| Taxpayers will not be able to modify values auto-populated in GSTR-3B from GSTR-1/1A/IFF or GSTR-2B as it will automatically derived from supplies declared in GSTR-1, GSTR-1A, or IFF. |

| FORM GSTR-3B will be frozen soon, as it changes the previous process where GSTR-3B could be filed even if GSTR-2B wasn’t available. Now, GSTR-3B can be filed only after FORM GSTR-2B of the said tax period is made available on the portal. |

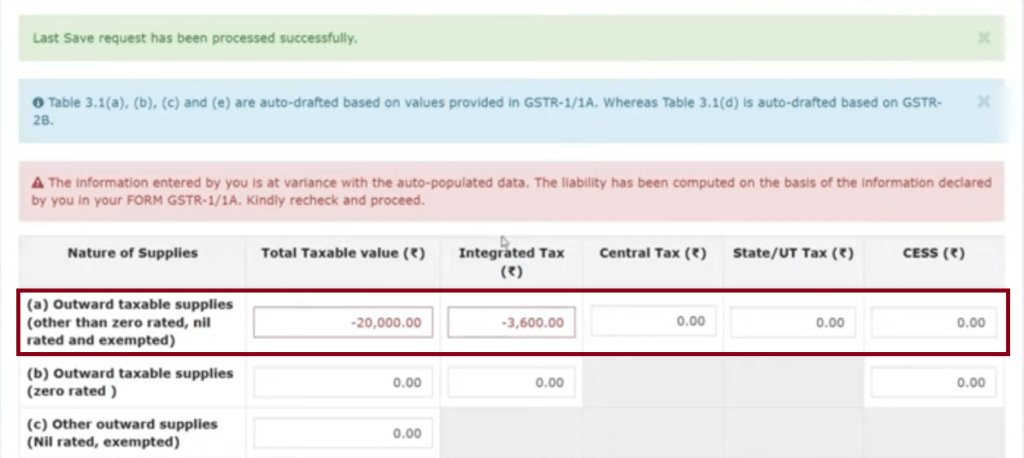

Reporting Negative Sales in GSTR-3B

Earlier Reporting Method

Negative values were not allowed in GSTR-3B. Taxpayers had to:

- Report zero in Table 3.1(a) of GSTR-3B.

- Carry forward the negative values to the next month.

- And need to adjust these values against future sales in the next month’s GSTR-3B.

New Reporting Method

Now, negative values can be directly reported in Table 3.1(a) of GSTR-3B.

Example

Mr. Anand, a taxpayer whose turnover for the month of December 2024:

Sales: Rs. 1,00,000, GST: Rs. 18,000

Sales Return: Rs. 1,20,000, GST: Rs. 21,600

Calculation of Net Sales & GST

Net Sales = Rs. 1,00,000 – Rs. 1,20,000 = Rs. (-20,000)

Net GST = Rs. 18,000 – Rs. 21,600 = Rs. (-3,600)

Taxpayers now can directly report negative sales and GST amount in GSTR-3B without waiting for adjustment in future periods.

Upcoming Important Changes

Auto-Populated Data In GSTR-3B Form

- Taxpayers will no longer be able to modify values auto-populated in GSTR-3B from GSTR-1/1A/IFF or GSTR-2B.

- It will automatically derived from supplies declared in GSTR-1, GSTR-1A, or IFF.

Previous Plan:

- From January 2025, GST Portal was planned to restrict editing auto-populated liability in GSTR-3B based on GSTR-1/1A/IFF to enhance accuracy.

Current Status:

- From April 2025 onwards Table 3.2 of GSTR-3B, inter-state supplies will auto-populate and become non-editable. Any corrections must be made through amendments in GSTR-1A or IFF.

- Other changes will be introduced soon, and taxpayers will be notified in advance.

Suggested Actions for Taxpayers

For outward Supplies

- Taxpayers can correct errors in outward supplies reported in GSTR-1 or IFF via GSTR-1A.

- This ensures accurate liability is reflected before filing GSTR-3B.

For Inward Supplies

- Taxpayers can manage ITC claims by taking informed actions on inward supplies available in IMS.

- Options include accept, reject, or pending invoices, ensuring correct ITC claims in GSTR-3B.

Key Amendments

The GST Council has recommended significant amendments in the CGST Act, 2017 and CGST Rules, 2017 to strengthen the functionality of the Invoice Management System (IMS). Here are the key amendments:

Amendment to Section 38 of CGST Act, 2017 and rule 60 of CGST Rules, 2017

Purpose

- To establish a legal framework for generating FORM GSTR-2B.

- To improved accuracy in input tax credit (ITC) reconciliation.

In Detail

FORM GSTR-2B will now be generated based on the actions taken by taxpayers on the IMS. This will ensures that ITC details are aligned with suppliers invoices uploaded in IMS.

Amendment to Section 34(2) of CGST Act, 2017

Purpose

- To mandate ITC reversal for credit notes issued by suppliers.

In Detail

When a credit note is issued by a supplier, the recipient must reverse the corresponding ITC. This will allow the supplier to reduce their output tax liability and align between ITC claimed and credit adjustments.

Insertion of Rule 67B in CGST Rules, 2017

Purpose

- To prescribe the procedure for supplier’s output tax adjustment.

In Detail

Rule 67B will provide a manner in which the output tax liability of the supplier shall be adjusted against the credit note issued by him.

Amendment to Section n 39 (1) of CGST Act, 2017 and rule 61 of CGST Rules, 2017

Purpose

- To link the filing of FORM GSTR-3B with the availability of FORM GSTR-2B.

In Detail

FORM GSTR-3B of a tax period shall be allowed to be filed only after FORM GSTR-2B of the said tax period is made available on the portal.

Example

Earlier, if your GSTR-1 for November 2024 is filed on 2nd December 2024, GSTR-3B reflects on the same day. But from now you can file GSTR-3B only after FORM GSTR-2B of the said tax period is made available on the portal.

Note: GSTR-3B can only be filed after GSTR-2B is generated, ensuring ITC reflects accurately.

Due Dates To File GSTR-3B Return

Monthly

Taxpayers having total sales over Rs. 5 crore must file GSTR-3B by the 20th of the following month.

Quarterly (QRMP)

Taxpayers with total sales up to Rs. 5 crore can opt for the QRMP scheme and can file GSTR-3B quarterly

The due date 22nd or 24th are applicable to the month following each quarter, based on the principal place of business.

- 22nd of every month: Includes states like Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Lakshadweep, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, and Union Territories like Daman and Diu, Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands.

- 24th of every month: Covers states such as Jammu and Kashmir, Ladakh, Himachal Pradesh, Punjab, Chandigarh, Uttarakhand, Haryana, Delhi, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand, and Odisha.

How To File GSTR-3B?

GSTR-3B can be filed online via the GST Portal:

- Log in to the GST Portal (https://services.gst.gov.in/services/login)

- Click on “Returns Dashboard” under “Services.”

- Choose the financial year, month or quarter for filing return.

- Answer a questionnaire to enable relevant tables, then enter summary data for outward supplies, ITC and tax payments.

- Verify the system-generated details from GSTR-1 and GSTR-2B, edit if necessary.

- Once payment done offset liabilities using ITC or cash via the electronic cash ledger.

- Submit using an Electronic Verification Code (EVC) or Digital Signature Certificate (DSC).

For nil returns, taxpayers can select “Yes” to the first questionnaire prompt and file directly, skipping detailed entries.

Late Fees and Penalties

If GSTR-3B is late filed, it incurs penalties:

- Rs. 50 per day of delay (Rs. 25 each under CGST and SGST/UTGST Acts).

- Rs. 20 per day for nil returns.

- If GST dues are not paid within the due date, interest @ 18% per annum is charged on the outstanding tax amount.

Conclusion

The new provisions will shorten the time available for filing GSTR-3B, aligning it with the availability of GSTR-2B. But this change aims to improve the compliance, ITC claims are based on up-to-date, and enhance the accuracy of tax filings.

FAQs

The auto-population feature automatically fills sales liability and turnover details in GSTR 3B based on data from GSTR 1 and IFF.

No, the sale figures in GSTR 3B will be frozen and it cannot be edited after auto-population.

Taxpayers need to make any necessary adjustments using GSTR 1A before filing GSTR 3B.

GSTR 1A is the mechanism for making adjustments or corrections to data before it is reflected in GSTR 3B.