GST returns which are filed are soon going to be removed from the GST portal. Taxpayers won’t be able to access their return data after specified years.

Important Update

Advisory on 29th Sep 2024

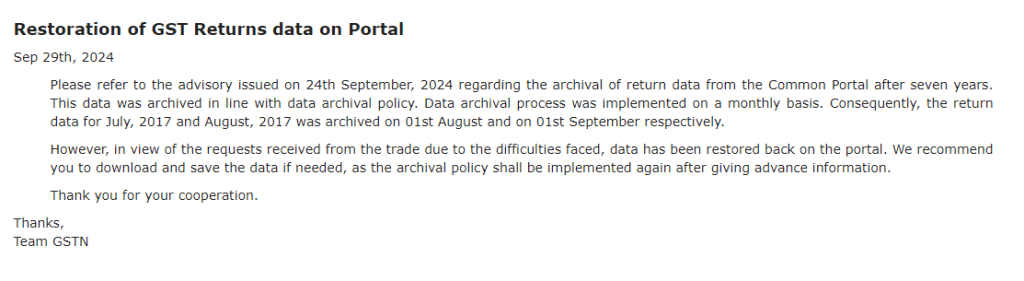

An opportunity for taxpayers to download and securely save the important data as the data has been restored on the portal.

An advisory was issued on 29th September 2024 regarding “Restoration of Archived GST Return Data“.

Advisory on 24th Sep 2024

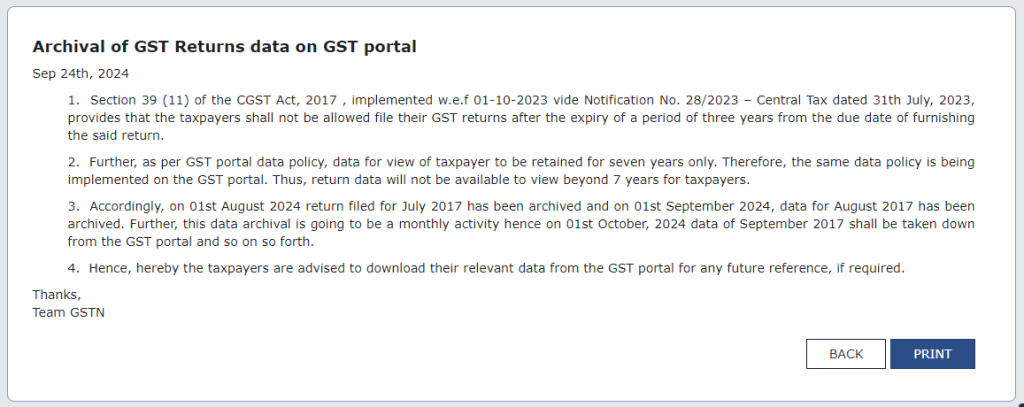

An advisory has been issued where two most important points are:

- Taxpayers will not be able to file their GST returns, if three years have passed from the original due date of the return.

- Old data will be removed from the portal which means taxpayers can view return data for seven years only. After this period, the data will not be available for viewing.

Monthly Archival of GST Return Data Beyond Seven Years Started

GST return data which are older than seven years is being archived monthly starting from August 1, 2024.

For Example

July 2017 data was archived on August 1, 2024, and August 2017 data on September 1, 2024. This process will continue each month.

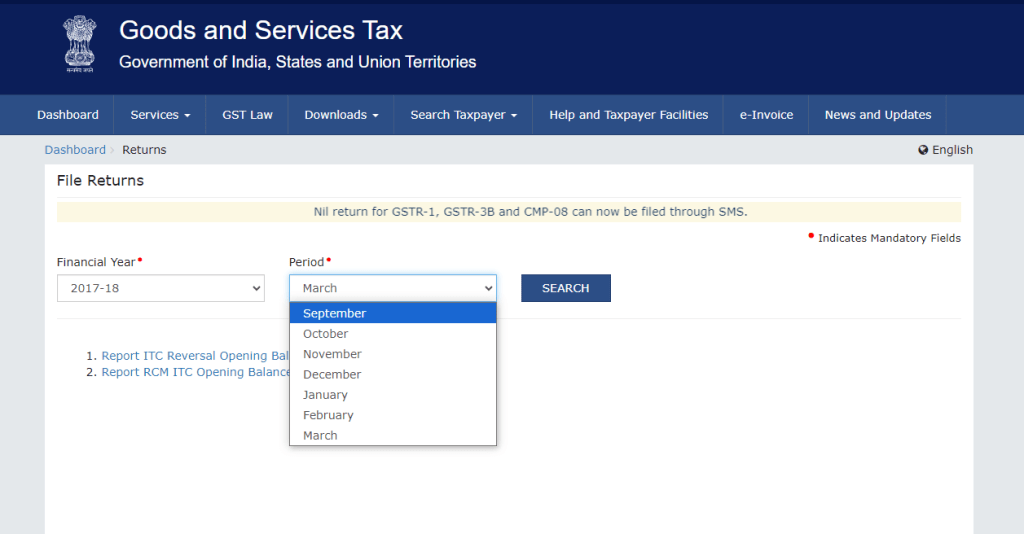

You can see in your portal that return data has already been achieved.

It means portal issued advisory after removing two months data from the portal.

Save Your GST Filing Data Now Before It’s Archived

Download return data now: Download all the return data now and secure it for future use.

Data Removal Alert: Returns filed are already being archived from 2017-18. If you have cases related to 2017-18, download the data now. Some data has already been removed, and more will be archived soon.

More Data Will Be Removed: Future returns will also be taken down.

Act Before It’s Too Late: Ensure you have all records saved.

Avoid Future Issues: If you won’t download it now and you will have no filling records, missing data could lead to complications in case of disputes and resolving such cases will be the taxpayer’s responsibility.