GST Registration is a process by which a business obtains a unique GSTIN (Goods and Services Tax Identification Number) to collect and remit GST.

Major revisions to India’s Goods and Services Tax (GST) system are scheduled to be implemented in 2025 to improve compliance, security, and efficiency.

The CBIC, through Notification No. 07/2025-Central Tax dated January 23, 2025, has amended the Central Goods and Services Tax (CGST) Rules, 2017.

This amendment brings forth several important provisions designed to improve compliance for composition dealers and create a system for Temporary Identification Numbers (TIN).

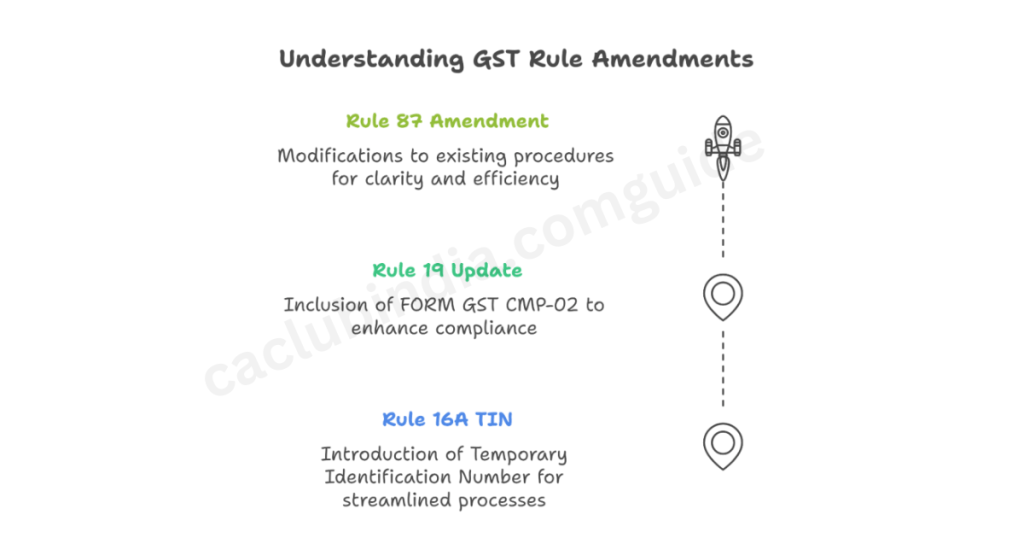

Key Amendments

Introduction of Rule 16A – Temporary Identification Number (TIN)

A new Rule 16A has been introduced to facilitate the issuance of a temporary identification number for individuals who do not need to register under the CGST Act but still wish to make payments as required.

This TIN will be granted by the proper officer through an order in Part B of FORM GST REG-12.

The aim of this provision is to enhance compliance by ensuring that all payments made by unregistered individuals are accurately monitored.

The implementation of Rule 16A is designed to simplify compliance for non-registered entities involved in taxable activities.

By offering a way for these individuals or organizations to acquire a TIN, the CBIC seeks to improve tracking and ensure accurate recording of tax payments, thereby alleviating the compliance burdens for those who do not frequently participate in taxable transactions.

Amendment in Rule 19 – Inclusion of FORM GST CMP-02

The amendment broadens Rule 19(1) to incorporate information from FORM GST CMP-02, utilized by composition taxpayers to enrol in the Composition Scheme.

Consequently, any notifications submitted by composition taxpayers concerning their registration can now lead to adjustments in their GST registration.

The amendments will take effect on a date to be announced by the government. This update demonstrates the government’s dedication to simplifying GST processes and improving compliance for composition dealers, enabling them to efficiently handle their tax responsibilities while participating in the Composition Scheme.

Amendment in Rule 87

The amendment connects Rule 87(4) with the newly introduced Rule 16A, enabling individuals with a temporary TIN to create payment challans through the common portal.

The amendment facilitates the generation of payment challans for individuals with a TIN, thereby streamlining the GST payment process. This is especially advantageous for those who may not hold formal GST registration yet still have tax obligations to fulfil.

The provisions of this amendment will take effect on a date to be announced by the government. This change is part of the CBIC’s continued efforts to improve compliance and streamline processes for taxpayers, ensuring that all required payments are accurately recorded within the GST framework.

The provision will come into force from a date to be notified by the government. The Notification can be accessed here.