The “time of supply” is a fundamental concept in GST that dictates the point at which a tax obligation arises. It signifies the precise instance when goods or services are deemed delivered, which fixes the due date for remitting GST to the government. This framework is critical for regulatory compliance and for applying the accurate tax rate, particularly when rates are revised. Separate criteria exist for identifying the taxable event for goods versus services, primarily based on the earlier of key events, such as the issuance of an invoice or receipt of payment.

The applicable GST rate is determined based on whether the time of supply occurred prior to or following the enactment of the rate change.

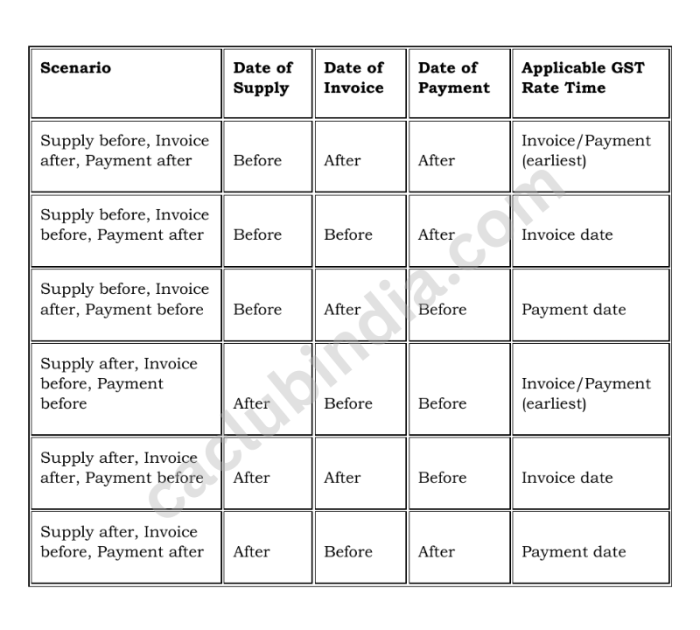

Scenario 1: Supply is made BEFORE the GST rate change

Invoice and payment both occur AFTER the change: The new rate applies. The supply date is the earlier of the invoice or payment date.

Invoice issued BEFORE, payment received AFTER: The old rate applies. The supply date is the invoice date.

Payment received BEFORE, invoice issued AFTER: The old rate applies. The supply date is the payment date.

Scenario 2: Supply is made AFTER the GST rate change

Invoice and Payment Before Change: The old rate applies. The time of supply is the earlier of the invoice date or the payment date.

Invoice After Change, Payment Before: The old rate applies. The time of supply is the invoice date.

Invoice Before Change, Payment After: The new rate applies. The time of supply is the payment date.

General Principle

The applicable tax rate is determined by the timing of key events relative to the rate change date. The rule is:

- If two or more of the three events (supply, invoice, payment) happen before the change, the old rate applies.

- If two or more of the events happen after the change, the new rate applies.

Updated GST Rate Slabs (from 22 September 2025)

- Standard rate: 18%

- Merit rate: 5%

- Demerit rate (sin/luxury goods): 40%

Applicable to most goods/services, while select essential and luxury items are specified separately

Click Here For Frequently Asked Questions (FAQs) on the decisions of the 56th GST Council.

FAQs

The time of supply is the earliest of the following for goods or services involved in a rate change:

1. Date of issuance of invoice.

2. Date of receipt of payment (earliest of book entry date or bank credit date).

3. Date of actual supply of goods/services.

Input tax credit (ITC) must be reversed immediately for any goods or services that become exempt, or where ITC is disallowed, after a GST rate change. Specifically, if the supply is made on or after the effective date of the rate change (for example, 22nd September 2025), ITC availed earlier for those goods/services must be reversed in accordance with the provisions of the CGST Act.

Advances received before 22 September 2025 are taxed at the GST rate prevailing on the date of receipt of payment, as per time of supply rules under Section 14 of the CGST Act. For future supply, the applicable GST on such advances is the old rate, even if the actual supply is made after 22 September.

The notification that lists the revised GST rates and their effective dates, including the changes effective from 22 September 2025, is the CGST Rate Notification issued by the Central Board of Indirect Taxes and Customs (CBIC). This notification details the updated GST slabs and the corresponding dates when these rates become applicable.