The 55th GST Council Meeting, held on December 21, 2024, introduced significant changes to the Goods and Services Tax (GST) structure concerning vehicle sales in India.

Key Highlights from the GST Council Meeting

Standardized GST on Used Vehicles

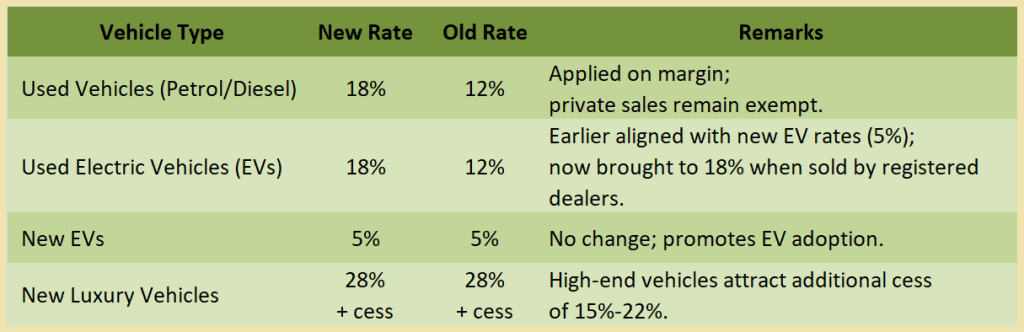

- The GST rate on all used vehicles, including electric vehicles (EVs), has been increased to 18% from the earlier 12%.

- This rate applies to transactions by registered dealers, specifically calculated on the margin scheme:

- The GST is applied to the difference between the selling price and the purchase price of the vehicle.

- If the margin is negative (i.e., the vehicle is sold at a loss), no GST is levied.

- Private sales (i.e., between unregistered individuals) remain exempt from GST.

Clarifications on Luxury and SUVs

The definition of SUVs for GST purposes was revisited, with GST on luxury vehicles already being at 28%, along with a compensation cess ranging from 15%-22%, depending on the vehicle type.

Streamlining of EV Taxation

While new EVs are taxed at 5% GST, the used EVs will now attract the same 18% GST rate as other vehicles when sold by registered dealers.

Implications for Stakeholders

For Vehicle Dealers

Registered Dealers

- The increased GST rate on used vehicles from 12% to 18% will directly affect profit margins, as customers might push back on price increases.

- Dealers may have to restructure pricing to remain competitive while maintaining compliance.

Inventory Impact

- Dealers with a large inventory of used vehicles may experience slower sales due to the higher cost for end consumers.

For Individual Sellers

No GST on Direct Sales

- Private individuals selling their used cars to other individuals will not attract GST, making such transactions relatively cheaper than purchasing from dealers.

- This could shift demand toward peer-to-peer transactions, reducing the market share of registered dealers.

For Consumers

Used Vehicle Prices Likely to Rise

- An 18% GST will likely be factored into the final price of used vehicles sold by registered dealers, increasing costs for buyers.

- Buyers may opt for direct individual transactions to avoid GST.

EV Buyers

- Although the GST rate for used EVs is now the same as other vehicles (18%), new EVs still attract a lower GST of 5%, making new EVs more appealing in certain scenarios.

Precedents and Government’s Intent

- The GST Council’s decision to increase tax rates aligns with the government’s intent to streamline the taxation process and reduce classification disputes, particularly for used and luxury vehicles.

- However, this move could inadvertently impact the affordability of used vehicles, which form a significant part of the Indian auto market.

Comparative Tax Rates

Industry Reactions and Criticism

- Auto Dealers’ Concerns: Industry bodies like FADA (Federation of Automobile Dealers Associations) have raised concerns about the increased tax burden on used vehicles, potentially impacting affordability.

- Push for Clarity: Stakeholders seek clarity on whether hybrid vehicles and specific SUV classifications would attract additional compensation cess or fall under the standard rate.

Strategic Insights

- Consumers: Buyers looking for affordable options may increasingly prefer direct sales or explore financing for new EVs, given their lower GST rates.

- Dealers: To mitigate losses, dealers might focus on offering value-added services (e.g., warranties or free maintenance) to make the higher prices more palatable.